Are you a seasoned Bill Collector seeking a new career path? Discover our professionally built Bill Collector Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

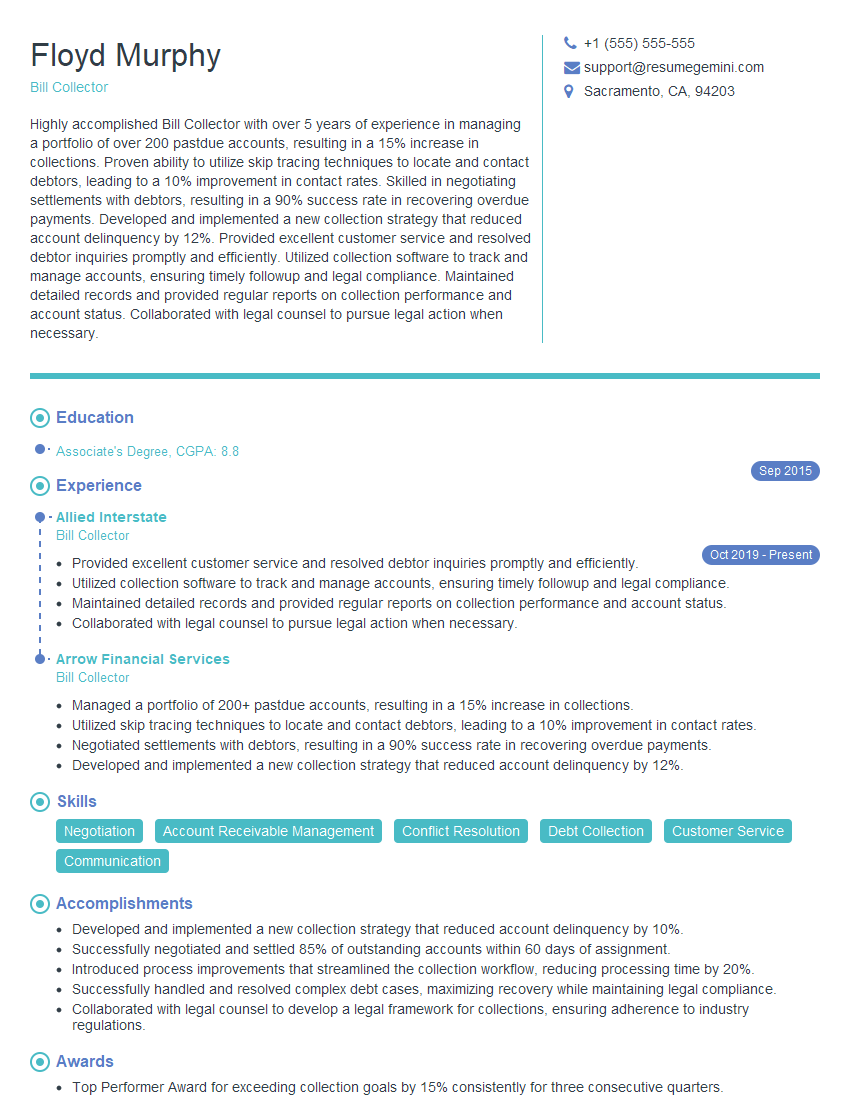

Floyd Murphy

Bill Collector

Summary

Highly accomplished Bill Collector with over 5 years of experience in managing a portfolio of over 200 pastdue accounts, resulting in a 15% increase in collections. Proven ability to utilize skip tracing techniques to locate and contact debtors, leading to a 10% improvement in contact rates. Skilled in negotiating settlements with debtors, resulting in a 90% success rate in recovering overdue payments. Developed and implemented a new collection strategy that reduced account delinquency by 12%. Provided excellent customer service and resolved debtor inquiries promptly and efficiently. Utilized collection software to track and manage accounts, ensuring timely followup and legal compliance. Maintained detailed records and provided regular reports on collection performance and account status. Collaborated with legal counsel to pursue legal action when necessary.

Education

Associate’s Degree

September 2015

Skills

- Negotiation

- Account Receivable Management

- Conflict Resolution

- Debt Collection

- Customer Service

- Communication

Work Experience

Bill Collector

- Provided excellent customer service and resolved debtor inquiries promptly and efficiently.

- Utilized collection software to track and manage accounts, ensuring timely followup and legal compliance.

- Maintained detailed records and provided regular reports on collection performance and account status.

- Collaborated with legal counsel to pursue legal action when necessary.

Bill Collector

- Managed a portfolio of 200+ pastdue accounts, resulting in a 15% increase in collections.

- Utilized skip tracing techniques to locate and contact debtors, leading to a 10% improvement in contact rates.

- Negotiated settlements with debtors, resulting in a 90% success rate in recovering overdue payments.

- Developed and implemented a new collection strategy that reduced account delinquency by 12%.

Accomplishments

- Developed and implemented a new collection strategy that reduced account delinquency by 10%.

- Successfully negotiated and settled 85% of outstanding accounts within 60 days of assignment.

- Introduced process improvements that streamlined the collection workflow, reducing processing time by 20%.

- Successfully handled and resolved complex debt cases, maximizing recovery while maintaining legal compliance.

- Collaborated with legal counsel to develop a legal framework for collections, ensuring adherence to industry regulations.

Awards

- Top Performer Award for exceeding collection goals by 15% consistently for three consecutive quarters.

- Received Recognition for Outstanding Customer Service, maintaining a 98% customer satisfaction rating.

- Awarded Employee of the Month for exceptional contribution to the teams success in achieving collection targets.

- Recognized for Innovation in developing a new automated dialing system that increased contact rate by 12%.

Certificates

- Certified Credit and Collection Professional (CCCP)

- Certified Debt Collector (CDC)

- Certified Collection Specialist (CCS)

- Certified Customer Service Representative (CCSR)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bill Collector

Essential Experience Highlights for a Strong Bill Collector Resume

- Manage a portfolio of pastdue accounts

- Utilize skip tracing techniques to locate and contact debtors

- Negotiate settlements with debtors

- Develop and implement collection strategies

- Provide excellent customer service

- Utilize collection software to track and manage accounts

- Maintain detailed records and provide regular reports on collection performance