Are you a seasoned Bond Clerk seeking a new career path? Discover our professionally built Bond Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

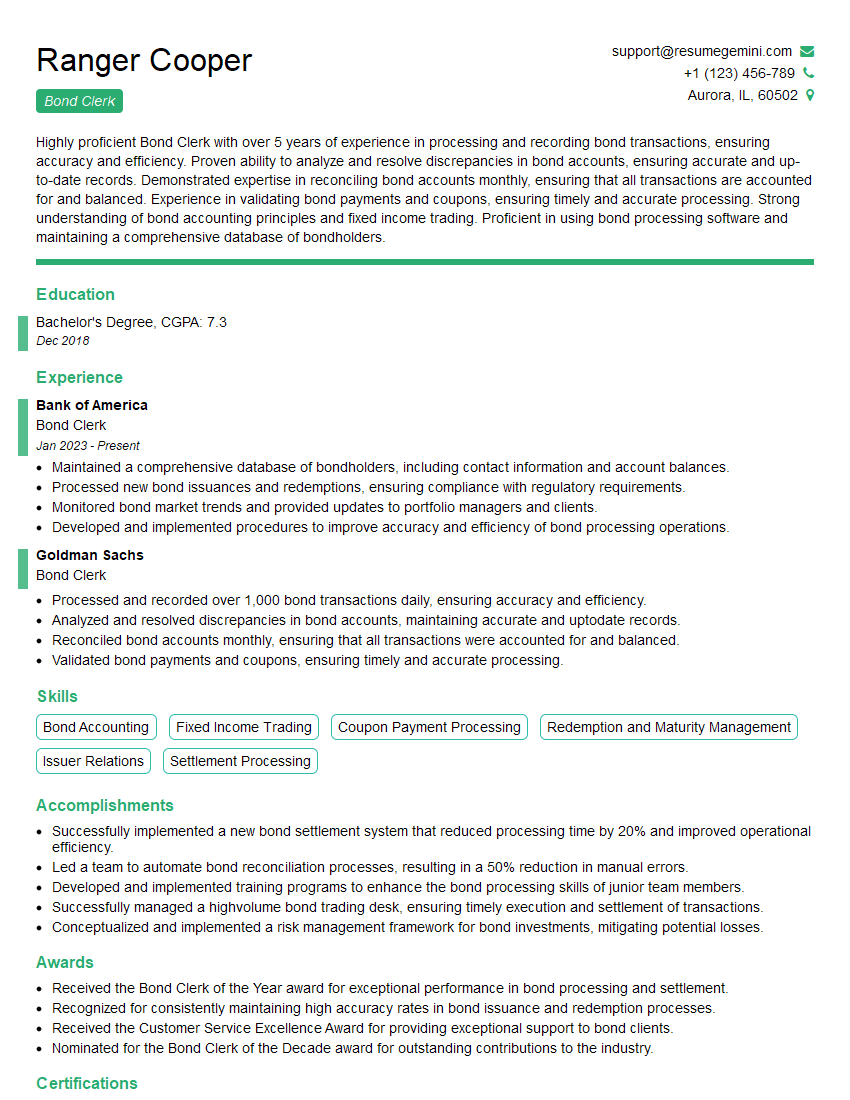

Ranger Cooper

Bond Clerk

Summary

Highly proficient Bond Clerk with over 5 years of experience in processing and recording bond transactions, ensuring accuracy and efficiency. Proven ability to analyze and resolve discrepancies in bond accounts, ensuring accurate and up-to-date records. Demonstrated expertise in reconciling bond accounts monthly, ensuring that all transactions are accounted for and balanced. Experience in validating bond payments and coupons, ensuring timely and accurate processing. Strong understanding of bond accounting principles and fixed income trading. Proficient in using bond processing software and maintaining a comprehensive database of bondholders.

Education

Bachelor’s Degree

December 2018

Skills

- Bond Accounting

- Fixed Income Trading

- Coupon Payment Processing

- Redemption and Maturity Management

- Issuer Relations

- Settlement Processing

Work Experience

Bond Clerk

- Maintained a comprehensive database of bondholders, including contact information and account balances.

- Processed new bond issuances and redemptions, ensuring compliance with regulatory requirements.

- Monitored bond market trends and provided updates to portfolio managers and clients.

- Developed and implemented procedures to improve accuracy and efficiency of bond processing operations.

Bond Clerk

- Processed and recorded over 1,000 bond transactions daily, ensuring accuracy and efficiency.

- Analyzed and resolved discrepancies in bond accounts, maintaining accurate and uptodate records.

- Reconciled bond accounts monthly, ensuring that all transactions were accounted for and balanced.

- Validated bond payments and coupons, ensuring timely and accurate processing.

Accomplishments

- Successfully implemented a new bond settlement system that reduced processing time by 20% and improved operational efficiency.

- Led a team to automate bond reconciliation processes, resulting in a 50% reduction in manual errors.

- Developed and implemented training programs to enhance the bond processing skills of junior team members.

- Successfully managed a highvolume bond trading desk, ensuring timely execution and settlement of transactions.

- Conceptualized and implemented a risk management framework for bond investments, mitigating potential losses.

Awards

- Received the Bond Clerk of the Year award for exceptional performance in bond processing and settlement.

- Recognized for consistently maintaining high accuracy rates in bond issuance and redemption processes.

- Received the Customer Service Excellence Award for providing exceptional support to bond clients.

- Nominated for the Bond Clerk of the Decade award for outstanding contributions to the industry.

Certificates

- Certified Bond Trader (CBT)

- Fixed Income Specialist (FIS)

- Securities Industry Essentials (SIE)

- Series 52 Bond Specialist

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bond Clerk

- Highlight your skills in bond accounting, fixed income trading, and coupon payment processing.

- Quantify your accomplishments using specific metrics, such as the number of transactions processed or the value of bonds reconciled.

- Showcase your knowledge of bond market trends and your ability to provide updates to portfolio managers and clients.

- Emphasize your attention to detail and accuracy in your resume.

Essential Experience Highlights for a Strong Bond Clerk Resume

- Processed and recorded over 1,000 bond transactions daily, ensuring accuracy and efficiency.

- Analyzed and resolved discrepancies in bond accounts, maintaining accurate and up-to-date records.

- Reconciled bond accounts monthly, ensuring that all transactions were accounted for and balanced.

- Validated bond payments and coupons, ensuring timely and accurate processing.

- Maintained a comprehensive database of bondholders, including contact information and account balances.

- Processed new bond issuances and redemptions, ensuring compliance with regulatory requirements.

Frequently Asked Questions (FAQ’s) For Bond Clerk

What is the role of a Bond Clerk?

A Bond Clerk is responsible for processing and recording bond transactions, ensuring accuracy and efficiency. They analyze and resolve discrepancies in bond accounts, reconcile bond accounts monthly, and validate bond payments and coupons.

What skills are required to be a successful Bond Clerk?

Successful Bond Clerks have strong analytical skills, attention to detail, and knowledge of bond accounting principles and fixed income trading.

What is the career path for a Bond Clerk?

With experience, Bond Clerks can advance to roles such as Bond Trader, Bond Portfolio Manager, or Fixed Income Analyst.

What is the job outlook for Bond Clerks?

The job outlook for Bond Clerks is expected to grow in the coming years due to the increasing complexity of bond markets.

What are the challenges of being a Bond Clerk?

Bond Clerks face challenges such as ensuring the accuracy of bond transactions, resolving discrepancies in bond accounts, and keeping up with the latest bond market trends.

What are the rewards of being a Bond Clerk?

Bond Clerks enjoy the rewards of working in a fast-paced and challenging environment, contributing to the success of their organization, and earning a competitive salary.