Are you a seasoned Bottom Liner seeking a new career path? Discover our professionally built Bottom Liner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

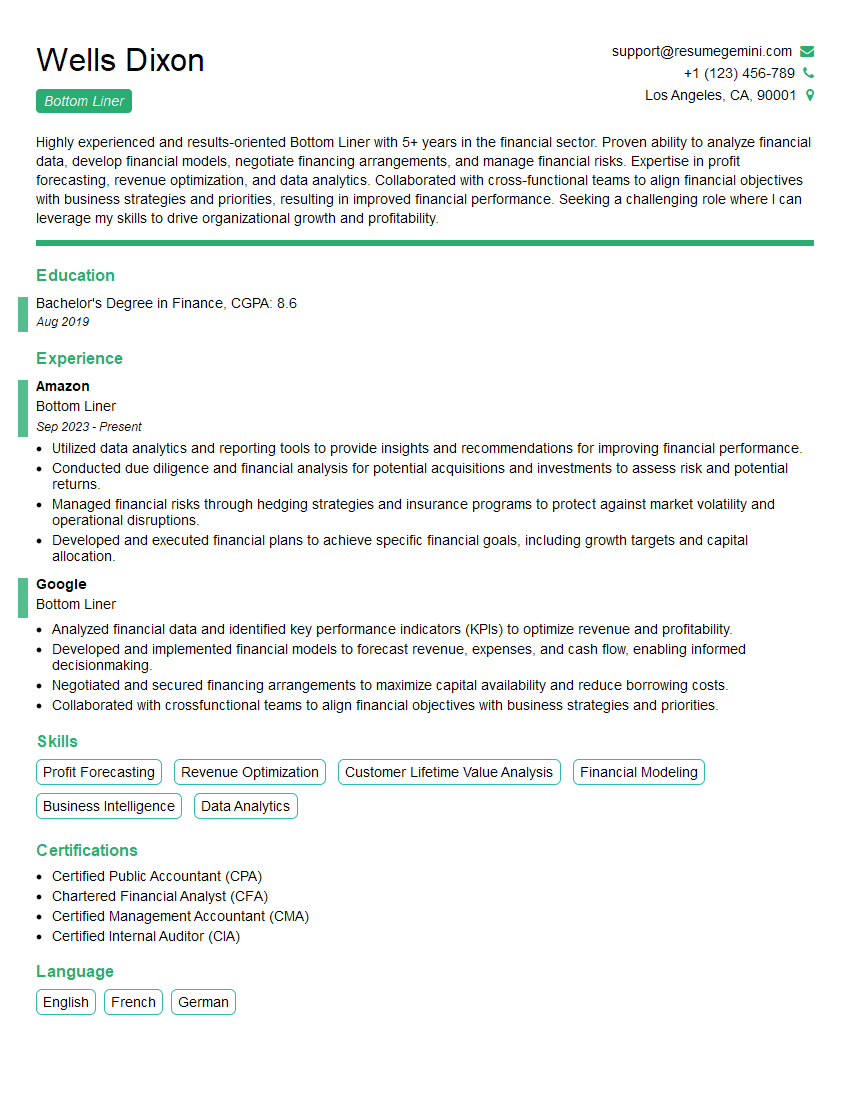

Wells Dixon

Bottom Liner

Summary

Highly experienced and results-oriented Bottom Liner with 5+ years in the financial sector. Proven ability to analyze financial data, develop financial models, negotiate financing arrangements, and manage financial risks. Expertise in profit forecasting, revenue optimization, and data analytics. Collaborated with cross-functional teams to align financial objectives with business strategies and priorities, resulting in improved financial performance. Seeking a challenging role where I can leverage my skills to drive organizational growth and profitability.

Education

Bachelor’s Degree in Finance

August 2019

Skills

- Profit Forecasting

- Revenue Optimization

- Customer Lifetime Value Analysis

- Financial Modeling

- Business Intelligence

- Data Analytics

Work Experience

Bottom Liner

- Utilized data analytics and reporting tools to provide insights and recommendations for improving financial performance.

- Conducted due diligence and financial analysis for potential acquisitions and investments to assess risk and potential returns.

- Managed financial risks through hedging strategies and insurance programs to protect against market volatility and operational disruptions.

- Developed and executed financial plans to achieve specific financial goals, including growth targets and capital allocation.

Bottom Liner

- Analyzed financial data and identified key performance indicators (KPIs) to optimize revenue and profitability.

- Developed and implemented financial models to forecast revenue, expenses, and cash flow, enabling informed decisionmaking.

- Negotiated and secured financing arrangements to maximize capital availability and reduce borrowing costs.

- Collaborated with crossfunctional teams to align financial objectives with business strategies and priorities.

Certificates

- Certified Public Accountant (CPA)

- Chartered Financial Analyst (CFA)

- Certified Management Accountant (CMA)

- Certified Internal Auditor (CIA)

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bottom Liner

- Quantify your accomplishments whenever possible using specific metrics and data.

- Highlight your analytical and problem-solving skills by providing examples of how you have used data to improve financial performance.

- Demonstrate your understanding of financial markets and how they impact business decisions.

- Showcase your ability to communicate effectively with both financial and non-financial professionals.

Essential Experience Highlights for a Strong Bottom Liner Resume

- Analyzed financial data and identified key performance indicators (KPIs) to optimize revenue and profitability.

- Developed and implemented financial models to forecast revenue, expenses, and cash flow, enabling informed decision-making.

- Negotiated and secured financing arrangements to maximize capital availability and reduce borrowing costs.

- Collaborated with cross-functional teams to align financial objectives with business strategies and priorities.

- Utilized data analytics and reporting tools to provide insights and recommendations for improving financial performance.

- Conducted due diligence and financial analysis for potential acquisitions and investments to assess risk and potential returns.

- Managed financial risks through hedging strategies and insurance programs to protect against market volatility and operational disruptions.

Frequently Asked Questions (FAQ’s) For Bottom Liner

What are the key responsibilities of a Bottom Liner?

Bottom Liners are responsible for analyzing financial data, developing financial models, negotiating financing arrangements, managing financial risks, and collaborating with cross-functional teams to align financial objectives with business strategies and priorities.

What skills are required to be successful as a Bottom Liner?

Bottom Liners should have strong analytical and problem-solving skills, be proficient in financial modeling and data analysis, and have a deep understanding of financial markets. They should also be able to communicate effectively with both financial and non-financial professionals.

What are the career prospects for Bottom Liners?

Bottom Liners can advance to senior-level positions such as Chief Financial Officer (CFO), Controller, or Treasurer. They may also move into roles in investment banking, private equity, or consulting.

What is the average salary for a Bottom Liner?

The average salary for a Bottom Liner varies depending on experience, industry, and location. According to Glassdoor, the average salary for a Bottom Liner in the United States is $85,000 per year.

What are the top companies that hire Bottom Liners?

Some of the top companies that hire Bottom Liners include Amazon, Google, Microsoft, Apple, and JPMorgan Chase.

What is the job outlook for Bottom Liners?

The job outlook for Bottom Liners is expected to be good in the coming years. As businesses become increasingly complex and global, the need for professionals who can analyze financial data and make sound financial decisions will continue to grow.