Are you a seasoned Branch Banker seeking a new career path? Discover our professionally built Branch Banker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

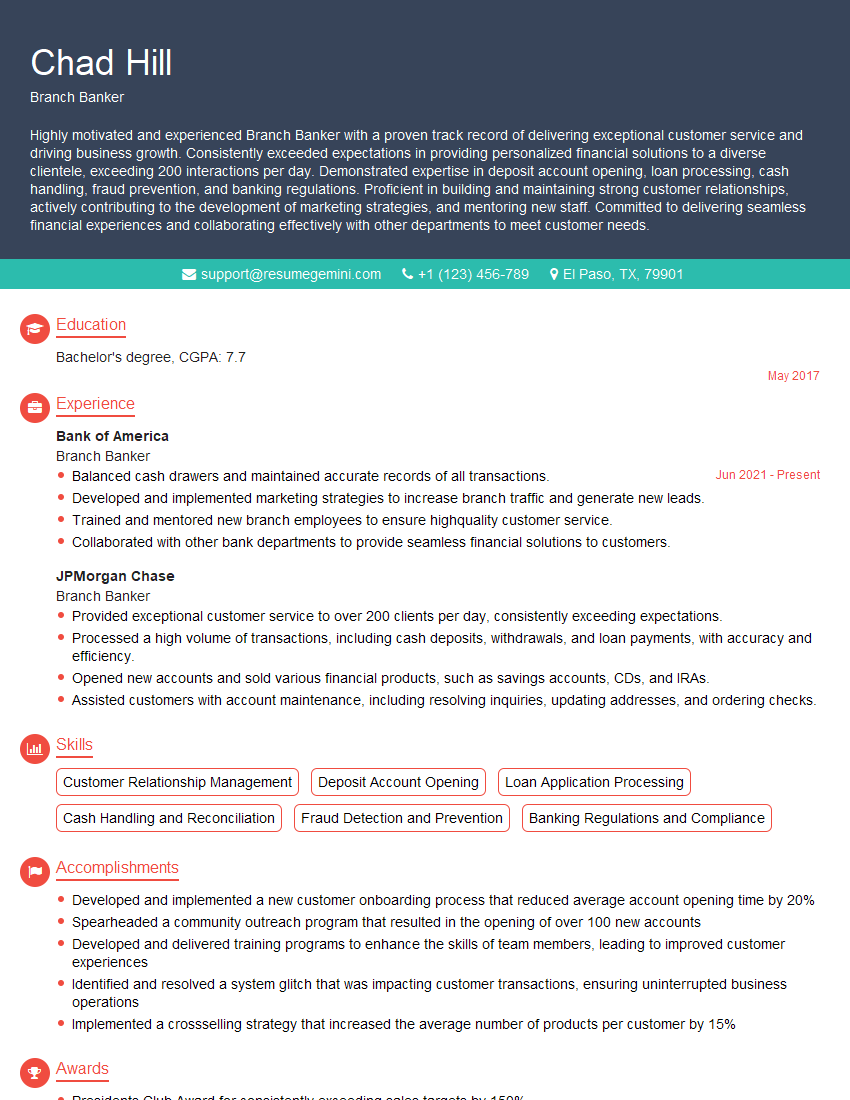

Chad Hill

Branch Banker

Summary

Highly motivated and experienced Branch Banker with a proven track record of delivering exceptional customer service and driving business growth. Consistently exceeded expectations in providing personalized financial solutions to a diverse clientele, exceeding 200 interactions per day. Demonstrated expertise in deposit account opening, loan processing, cash handling, fraud prevention, and banking regulations. Proficient in building and maintaining strong customer relationships, actively contributing to the development of marketing strategies, and mentoring new staff. Committed to delivering seamless financial experiences and collaborating effectively with other departments to meet customer needs.

Education

Bachelor’s degree

May 2017

Skills

- Customer Relationship Management

- Deposit Account Opening

- Loan Application Processing

- Cash Handling and Reconciliation

- Fraud Detection and Prevention

- Banking Regulations and Compliance

Work Experience

Branch Banker

- Balanced cash drawers and maintained accurate records of all transactions.

- Developed and implemented marketing strategies to increase branch traffic and generate new leads.

- Trained and mentored new branch employees to ensure highquality customer service.

- Collaborated with other bank departments to provide seamless financial solutions to customers.

Branch Banker

- Provided exceptional customer service to over 200 clients per day, consistently exceeding expectations.

- Processed a high volume of transactions, including cash deposits, withdrawals, and loan payments, with accuracy and efficiency.

- Opened new accounts and sold various financial products, such as savings accounts, CDs, and IRAs.

- Assisted customers with account maintenance, including resolving inquiries, updating addresses, and ordering checks.

Accomplishments

- Developed and implemented a new customer onboarding process that reduced average account opening time by 20%

- Spearheaded a community outreach program that resulted in the opening of over 100 new accounts

- Developed and delivered training programs to enhance the skills of team members, leading to improved customer experiences

- Identified and resolved a system glitch that was impacting customer transactions, ensuring uninterrupted business operations

- Implemented a crossselling strategy that increased the average number of products per customer by 15%

Awards

- Presidents Club Award for consistently exceeding sales targets by 150%

- Banker of the Month for outstanding customer service and sales performance

- Top Performer Award for consistently achieving top sales and customer satisfaction ratings

- Excellence in Service Award for exceptional customer service and resolving customer issues effectively

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Consultant (ChFC)

- Certified Financial Analyst (CFA)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Branch Banker

- Highlight your customer-centric approach and ability to build lasting relationships.

- Quantify your accomplishments with specific metrics to showcase your impact on business growth.

- Demonstrate your proficiency in banking products, services, and regulations.

- Emphasize your teamwork and collaboration skills, as well as your ability to mentor and train others.

Essential Experience Highlights for a Strong Branch Banker Resume

- Provided exceptional customer service, consistently exceeding expectations, to over 200 clients per day

- Processed a high volume of transactions, including cash deposits, withdrawals, and loan payments, with accuracy and efficiency

- Opened new accounts and sold various financial products, such as savings accounts, CDs, and IRAs

- Assisted customers with account maintenance, including resolving inquiries, updating addresses, and ordering checks

- Balanced cash drawers and maintained accurate records of all transactions

- Developed and implemented marketing strategies to increase branch traffic and generate new leads

- Trained and mentored new branch employees to ensure high-quality customer service

Frequently Asked Questions (FAQ’s) For Branch Banker

What are the key skills and qualifications required to be a successful Branch Banker?

To excel as a Branch Banker, you should possess a strong foundation in customer relationship management, deposit account opening, loan application processing, cash handling and reconciliation, fraud detection and prevention, and banking regulations and compliance.

What are the primary responsibilities of a Branch Banker?

As a Branch Banker, your key responsibilities include providing exceptional customer service, processing transactions accurately and efficiently, opening new accounts and selling financial products, assisting customers with account maintenance, balancing cash drawers, developing marketing strategies, and training new employees.

What are the career advancement opportunities for Branch Bankers?

With experience and strong performance, Branch Bankers can advance to roles such as Branch Manager, Assistant Branch Manager, or other management positions within the banking industry.

What is the work environment like for Branch Bankers?

Branch Bankers typically work in a fast-paced, customer-oriented environment. They interact with a wide range of individuals, and the job requires a high level of attention to detail and accuracy.

What is the salary range for Branch Bankers?

The salary range for Branch Bankers varies depending on experience, location, and the size of the financial institution. According to the U.S. Bureau of Labor Statistics, the median annual salary for Bank Tellers and Customer Service Representatives, which includes Branch Bankers, was $36,920 in May 2021.

What are the educational requirements to become a Branch Banker?

While a high school diploma or equivalent is typically the minimum educational requirement for Branch Bankers, many employers prefer candidates with a Bachelor’s degree in Business, Finance, or a related field.