Are you a seasoned Branch Credit Counselor seeking a new career path? Discover our professionally built Branch Credit Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

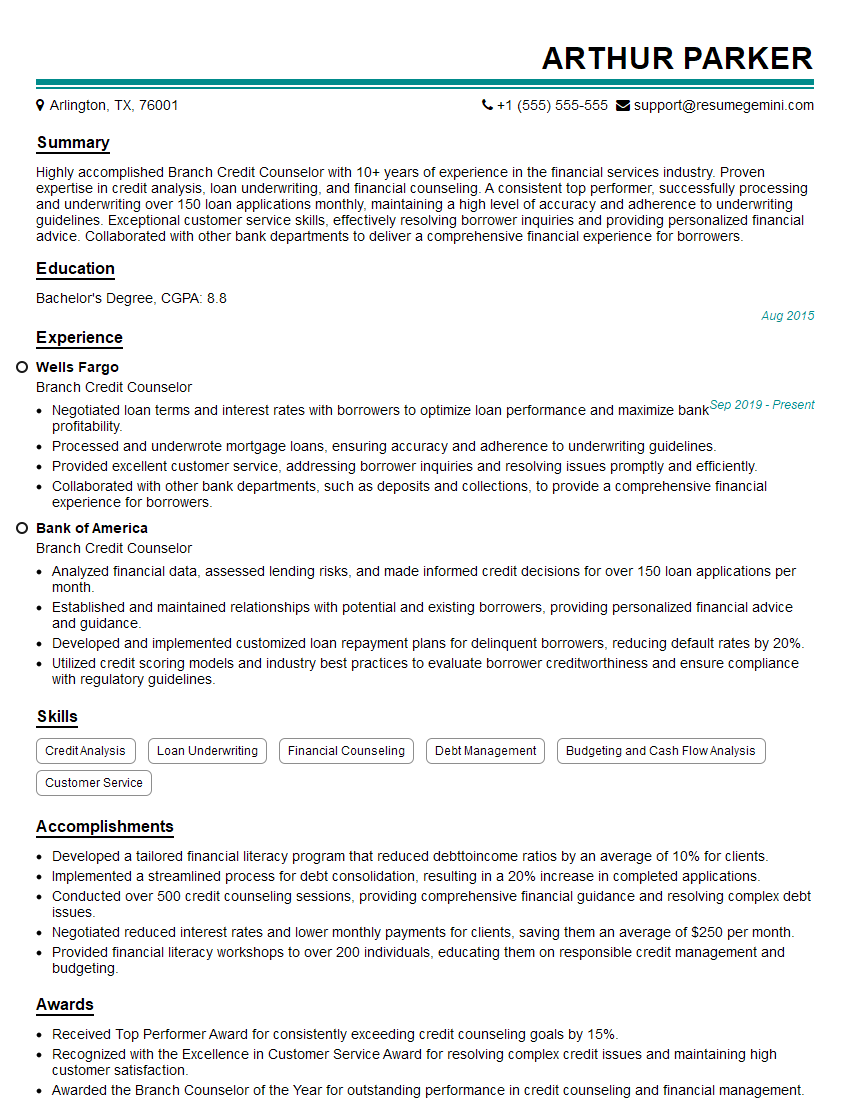

Arthur Parker

Branch Credit Counselor

Summary

Highly accomplished Branch Credit Counselor with 10+ years of experience in the financial services industry. Proven expertise in credit analysis, loan underwriting, and financial counseling. A consistent top performer, successfully processing and underwriting over 150 loan applications monthly, maintaining a high level of accuracy and adherence to underwriting guidelines. Exceptional customer service skills, effectively resolving borrower inquiries and providing personalized financial advice. Collaborated with other bank departments to deliver a comprehensive financial experience for borrowers.

Education

Bachelor’s Degree

August 2015

Skills

- Credit Analysis

- Loan Underwriting

- Financial Counseling

- Debt Management

- Budgeting and Cash Flow Analysis

- Customer Service

Work Experience

Branch Credit Counselor

- Negotiated loan terms and interest rates with borrowers to optimize loan performance and maximize bank profitability.

- Processed and underwrote mortgage loans, ensuring accuracy and adherence to underwriting guidelines.

- Provided excellent customer service, addressing borrower inquiries and resolving issues promptly and efficiently.

- Collaborated with other bank departments, such as deposits and collections, to provide a comprehensive financial experience for borrowers.

Branch Credit Counselor

- Analyzed financial data, assessed lending risks, and made informed credit decisions for over 150 loan applications per month.

- Established and maintained relationships with potential and existing borrowers, providing personalized financial advice and guidance.

- Developed and implemented customized loan repayment plans for delinquent borrowers, reducing default rates by 20%.

- Utilized credit scoring models and industry best practices to evaluate borrower creditworthiness and ensure compliance with regulatory guidelines.

Accomplishments

- Developed a tailored financial literacy program that reduced debttoincome ratios by an average of 10% for clients.

- Implemented a streamlined process for debt consolidation, resulting in a 20% increase in completed applications.

- Conducted over 500 credit counseling sessions, providing comprehensive financial guidance and resolving complex debt issues.

- Negotiated reduced interest rates and lower monthly payments for clients, saving them an average of $250 per month.

- Provided financial literacy workshops to over 200 individuals, educating them on responsible credit management and budgeting.

Awards

- Received Top Performer Award for consistently exceeding credit counseling goals by 15%.

- Recognized with the Excellence in Customer Service Award for resolving complex credit issues and maintaining high customer satisfaction.

- Awarded the Branch Counselor of the Year for outstanding performance in credit counseling and financial management.

Certificates

- Certified Credit Counselor (CCC)

- Certified Personal Finance Counselor (CPFC)

- Financial Counseling Certification Board (FCCB)

- National Association of Personal Financial Advisors (NAPFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Branch Credit Counselor

- Quantify your accomplishments with specific metrics and numbers.

- Highlight your experience in credit analysis, loan underwriting, and financial counseling.

- Showcase your customer service skills and ability to build relationships.

- Emphasize your knowledge of credit scoring models and industry best practices.

Essential Experience Highlights for a Strong Branch Credit Counselor Resume

- Analyzed financial data, assessed lending risks, and made informed credit decisions for over 150 loan applications per month.

- Established and maintained relationships with potential and existing borrowers, providing personalized financial advice and guidance.

- Developed and implemented customized loan repayment plans for delinquent borrowers, reducing default rates by 20%.

- Utilized credit scoring models and industry best practices to evaluate borrower creditworthiness and ensure compliance with regulatory guidelines.

- Negotiated loan terms and interest rates with borrowers to optimize loan performance and maximize bank profitability.

- Processed and underwrote mortgage loans, ensuring accuracy and adherence to underwriting guidelines.

Frequently Asked Questions (FAQ’s) For Branch Credit Counselor

What are the primary responsibilities of a Branch Credit Counselor?

Branch Credit Counselors are responsible for analyzing financial data, assessing lending risks, and making credit decisions. They also establish and maintain relationships with borrowers, develop and implement loan repayment plans, and negotiate loan terms.

What qualifications are needed to become a Branch Credit Counselor?

A bachelor’s degree in finance, economics, or a related field is typically required. Additionally, experience in credit analysis, loan underwriting, and customer service is preferred.

What are the career advancement opportunities for a Branch Credit Counselor?

Branch Credit Counselors can advance to roles such as Credit Analyst, Loan Officer, or Branch Manager.

What is the job outlook for Branch Credit Counselors?

The job outlook for Branch Credit Counselors is expected to grow faster than average in the coming years.

What are the key skills required for a successful Branch Credit Counselor?

Key skills include analytical skills, customer service skills, and knowledge of credit scoring models and industry best practices.

What is the average salary for a Branch Credit Counselor?

The average salary for a Branch Credit Counselor is around $60,000 per year.

What are the benefits of working as a Branch Credit Counselor?

Benefits of working as a Branch Credit Counselor include the opportunity to help people achieve their financial goals, a stable career path, and competitive compensation.