Are you a seasoned BSA/AML Compliance Officer seeking a new career path? Discover our professionally built BSA/AML Compliance Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

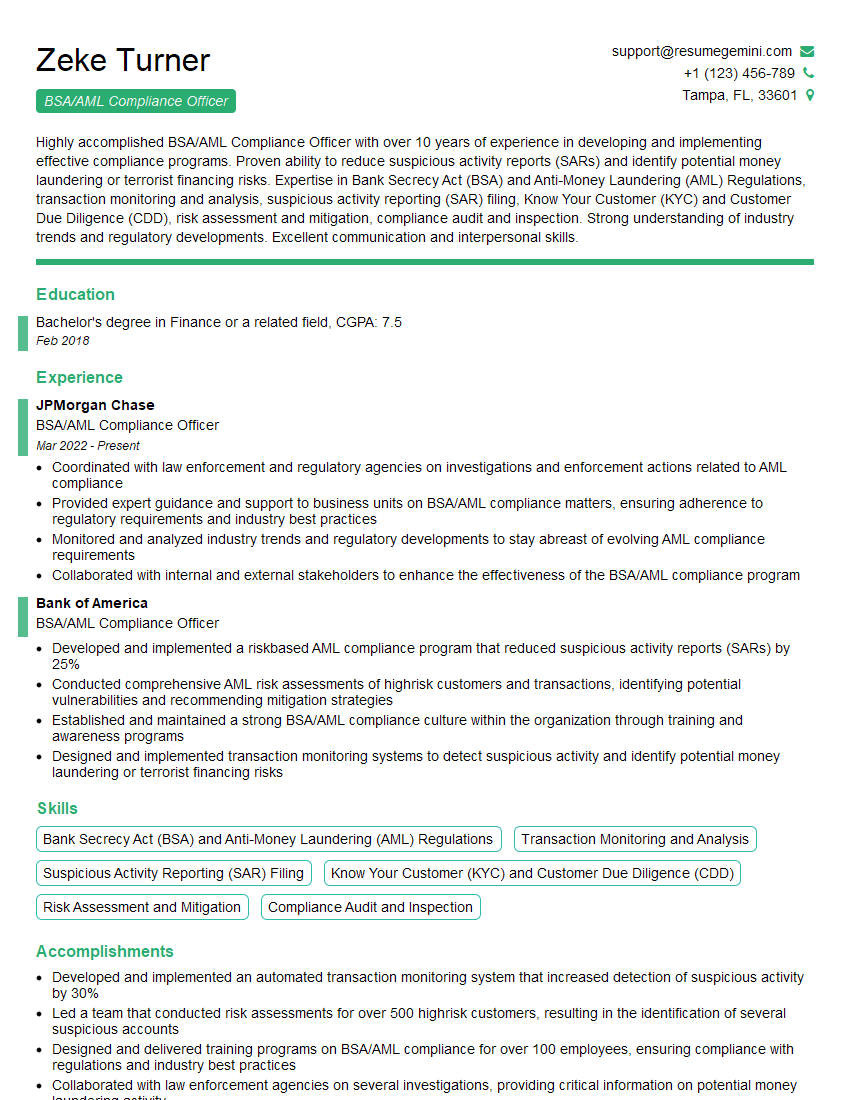

Zeke Turner

BSA/AML Compliance Officer

Summary

Highly accomplished BSA/AML Compliance Officer with over 10 years of experience in developing and implementing effective compliance programs. Proven ability to reduce suspicious activity reports (SARs) and identify potential money laundering or terrorist financing risks. Expertise in Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) Regulations, transaction monitoring and analysis, suspicious activity reporting (SAR) filing, Know Your Customer (KYC) and Customer Due Diligence (CDD), risk assessment and mitigation, compliance audit and inspection. Strong understanding of industry trends and regulatory developments. Excellent communication and interpersonal skills.

Education

Bachelor’s degree in Finance or a related field

February 2018

Skills

- Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) Regulations

- Transaction Monitoring and Analysis

- Suspicious Activity Reporting (SAR) Filing

- Know Your Customer (KYC) and Customer Due Diligence (CDD)

- Risk Assessment and Mitigation

- Compliance Audit and Inspection

Work Experience

BSA/AML Compliance Officer

- Coordinated with law enforcement and regulatory agencies on investigations and enforcement actions related to AML compliance

- Provided expert guidance and support to business units on BSA/AML compliance matters, ensuring adherence to regulatory requirements and industry best practices

- Monitored and analyzed industry trends and regulatory developments to stay abreast of evolving AML compliance requirements

- Collaborated with internal and external stakeholders to enhance the effectiveness of the BSA/AML compliance program

BSA/AML Compliance Officer

- Developed and implemented a riskbased AML compliance program that reduced suspicious activity reports (SARs) by 25%

- Conducted comprehensive AML risk assessments of highrisk customers and transactions, identifying potential vulnerabilities and recommending mitigation strategies

- Established and maintained a strong BSA/AML compliance culture within the organization through training and awareness programs

- Designed and implemented transaction monitoring systems to detect suspicious activity and identify potential money laundering or terrorist financing risks

Accomplishments

- Developed and implemented an automated transaction monitoring system that increased detection of suspicious activity by 30%

- Led a team that conducted risk assessments for over 500 highrisk customers, resulting in the identification of several suspicious accounts

- Designed and delivered training programs on BSA/AML compliance for over 100 employees, ensuring compliance with regulations and industry best practices

- Collaborated with law enforcement agencies on several investigations, providing critical information on potential money laundering activity

- Identified and reported over 100 suspicious transactions, leading to the seizure of illicit funds and the prosecution of several criminals

Awards

- ACAMS Certified AntiMoney Laundering Specialist (CAMS)

- Certified BSA AML Professional (CBAP)

- Global Certified AntiMoney Laundering Specialist (GCAML)

- Recognition for outstanding performance in BSA/AML compliance monitoring and enforcement

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Fraud Examiner (CFE)

- Anti-Money Laundering Certified Associate (AMLA)

- Certified Know Your Customer Professional (CKYC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For BSA/AML Compliance Officer

- Highlight your experience in developing and implementing BSA/AML compliance programs that have reduced SARs and identified potential money laundering or terrorist financing risks.

- Demonstrate your expertise in BSA/AML Regulations, transaction monitoring and analysis, SAR filing, KYC/CDD, risk assessment and mitigation, and compliance audit and inspection.

- Showcase your ability to stay abreast of industry trends and regulatory developments in AML compliance.

- Provide examples of how you have successfully collaborated with law enforcement and regulatory agencies on AML compliance matters.

Essential Experience Highlights for a Strong BSA/AML Compliance Officer Resume

- Develop and implement BSA/AML compliance programs that meet regulatory requirements and industry best practices.

- Conduct comprehensive AML risk assessments to identify potential vulnerabilities and recommend mitigation strategies.

- Establish and maintain a strong BSA/AML compliance culture within the organization through training and awareness programs.

- Design and implement transaction monitoring systems to detect suspicious activity and identify potential money laundering or terrorist financing risks.

- Coordinate with law enforcement and regulatory agencies on investigations and enforcement actions related to AML compliance.

- Provide expert guidance and support to business units on BSA/AML compliance matters, ensuring adherence to regulatory requirements and industry best practices.

- Monitor and analyze industry trends and regulatory developments to stay abreast of evolving AML compliance requirements.

Frequently Asked Questions (FAQ’s) For BSA/AML Compliance Officer

What are the key responsibilities of a BSA/AML Compliance Officer?

The key responsibilities of a BSA/AML Compliance Officer include developing and implementing BSA/AML compliance programs, conducting AML risk assessments, establishing and maintaining a strong BSA/AML compliance culture, designing and implementing transaction monitoring systems, coordinating with law enforcement and regulatory agencies, providing expert guidance and support to business units, and monitoring and analyzing industry trends and regulatory developments.

What are the qualifications required to become a BSA/AML Compliance Officer?

Typically, a BSA/AML Compliance Officer requires a bachelor’s degree in Finance or a related field, along with several years of experience in BSA/AML compliance or a related field.

What are the career prospects for a BSA/AML Compliance Officer?

BSA/AML Compliance Officers are in high demand due to the increasing focus on anti-money laundering and terrorist financing regulations. With experience and expertise, BSA/AML Compliance Officers can advance to senior management positions within compliance or risk management.

What are the challenges faced by BSA/AML Compliance Officers?

BSA/AML Compliance Officers face several challenges, including the increasing complexity of money laundering and terrorist financing methods, the need to stay abreast of constantly evolving regulations, and the need to balance compliance with business objectives.

What are the key skills required for a BSA/AML Compliance Officer?

BSA/AML Compliance Officers require a strong understanding of BSA/AML Regulations, transaction monitoring and analysis, SAR filing, KYC/CDD, risk assessment and mitigation, and compliance audit and inspection. They also need excellent communication, interpersonal, and analytical skills.

What are the professional development opportunities for BSA/AML Compliance Officers?

BSA/AML Compliance Officers can pursue professional development opportunities through industry conferences, workshops, and online courses. They can also obtain industry certifications, such as the Certified Anti-Money Laundering Specialist (CAMS) certification.

What is the salary range for BSA/AML Compliance Officers?

The salary range for BSA/AML Compliance Officers varies depending on experience, location, and industry. According to Salary.com, the average salary for a BSA/AML Compliance Officer in the United States is around $120,000.