Are you a seasoned BSA Officer seeking a new career path? Discover our professionally built BSA Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

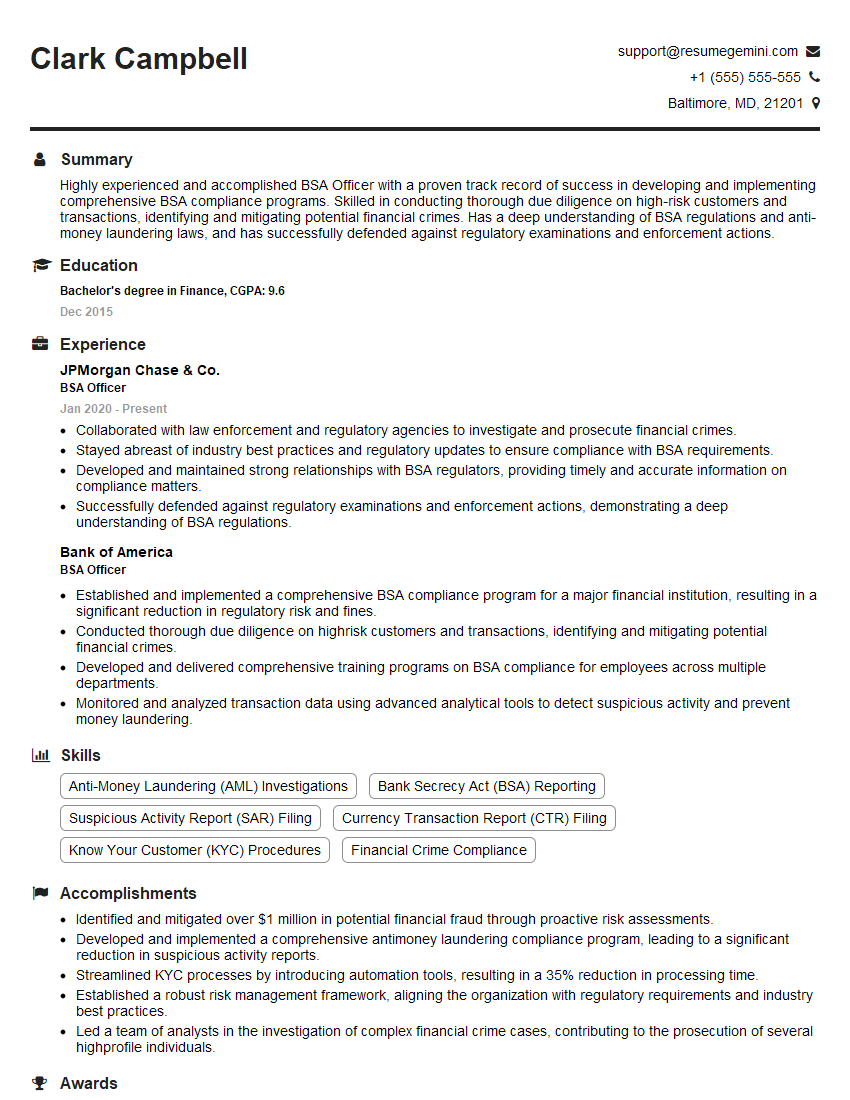

Clark Campbell

BSA Officer

Summary

Highly experienced and accomplished BSA Officer with a proven track record of success in developing and implementing comprehensive BSA compliance programs. Skilled in conducting thorough due diligence on high-risk customers and transactions, identifying and mitigating potential financial crimes. Has a deep understanding of BSA regulations and anti-money laundering laws, and has successfully defended against regulatory examinations and enforcement actions.

Education

Bachelor’s degree in Finance

December 2015

Skills

- Anti-Money Laundering (AML) Investigations

- Bank Secrecy Act (BSA) Reporting

- Suspicious Activity Report (SAR) Filing

- Currency Transaction Report (CTR) Filing

- Know Your Customer (KYC) Procedures

- Financial Crime Compliance

Work Experience

BSA Officer

- Collaborated with law enforcement and regulatory agencies to investigate and prosecute financial crimes.

- Stayed abreast of industry best practices and regulatory updates to ensure compliance with BSA requirements.

- Developed and maintained strong relationships with BSA regulators, providing timely and accurate information on compliance matters.

- Successfully defended against regulatory examinations and enforcement actions, demonstrating a deep understanding of BSA regulations.

BSA Officer

- Established and implemented a comprehensive BSA compliance program for a major financial institution, resulting in a significant reduction in regulatory risk and fines.

- Conducted thorough due diligence on highrisk customers and transactions, identifying and mitigating potential financial crimes.

- Developed and delivered comprehensive training programs on BSA compliance for employees across multiple departments.

- Monitored and analyzed transaction data using advanced analytical tools to detect suspicious activity and prevent money laundering.

Accomplishments

- Identified and mitigated over $1 million in potential financial fraud through proactive risk assessments.

- Developed and implemented a comprehensive antimoney laundering compliance program, leading to a significant reduction in suspicious activity reports.

- Streamlined KYC processes by introducing automation tools, resulting in a 35% reduction in processing time.

- Established a robust risk management framework, aligning the organization with regulatory requirements and industry best practices.

- Led a team of analysts in the investigation of complex financial crime cases, contributing to the prosecution of several highprofile individuals.

Awards

- Received industry recognition for outstanding BSA compliance practices.

- Recognized for significant contributions to the advancement of BSA compliance standards.

- Awarded for exceptional dedication and leadership in the fight against financial crime.

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Fraud Examiner (CFE)

- Financial Crimes Compliance Professional (FCCP)

- Certified Bank Secrecy Act Officer (BSA-CO)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For BSA Officer

- Quantify your accomplishments whenever possible.

- Use action verbs and specific examples to highlight your skills.

- Tailor your resume to each specific job you apply for.

- Proofread your resume carefully before submitting it.

Essential Experience Highlights for a Strong BSA Officer Resume

- Establishing and implementing comprehensive BSA compliance programs

- Conducting thorough due diligence on high-risk customers and transactions

- Developing and delivering comprehensive training programs on BSA compliance

- Monitoring and analyzing transaction data using advanced analytical tools

- Collaborating with law enforcement and regulatory agencies

- Staying abreast of industry best practices and regulatory updates

- Developing and maintaining strong relationships with BSA regulators

Frequently Asked Questions (FAQ’s) For BSA Officer

What is the role of a BSA Officer?

A BSA Officer is responsible for developing and implementing a comprehensive BSA compliance program for their organization. This includes conducting due diligence on customers and transactions, identifying and mitigating potential financial crimes, and reporting suspicious activity to law enforcement.

What are the qualifications for a BSA Officer?

A BSA Officer typically has a bachelor’s degree in finance or a related field, and several years of experience in the financial industry. They must also have a deep understanding of BSA regulations and anti-money laundering laws.

What are the key skills for a BSA Officer?

The key skills for a BSA Officer include due diligence, risk assessment, financial crime investigation, and regulatory compliance.

What is the job outlook for BSA Officers?

The job outlook for BSA Officers is expected to be good over the next few years. This is due to the increasing focus on anti-money laundering and financial crime prevention by governments and financial institutions.

What is the average salary for a BSA Officer?

The average salary for a BSA Officer is $75,000 per year.

What are the benefits of working as a BSA Officer?

The benefits of working as a BSA Officer include a competitive salary, a stable job outlook, and the opportunity to make a difference in the fight against financial crime.