Are you a seasoned Business Taxes Specialist seeking a new career path? Discover our professionally built Business Taxes Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

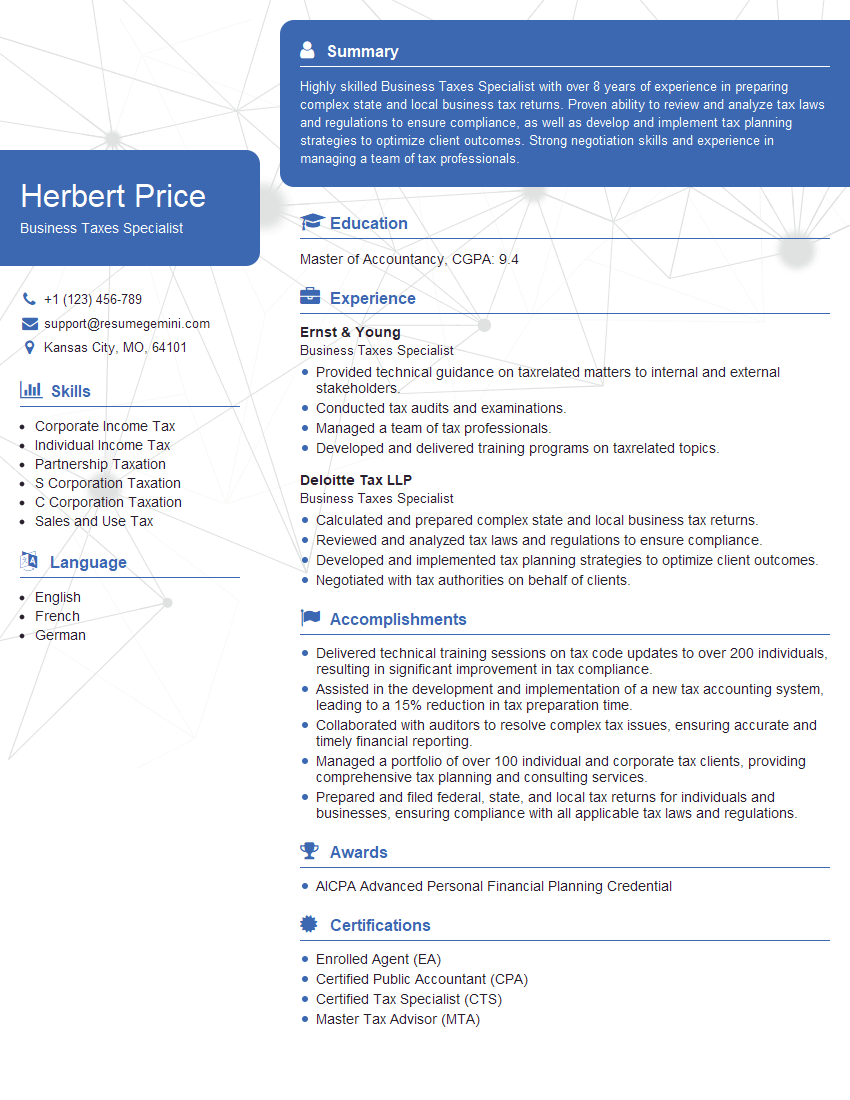

Herbert Price

Business Taxes Specialist

Summary

Highly skilled Business Taxes Specialist with over 8 years of experience in preparing complex state and local business tax returns. Proven ability to review and analyze tax laws and regulations to ensure compliance, as well as develop and implement tax planning strategies to optimize client outcomes. Strong negotiation skills and experience in managing a team of tax professionals.

Education

Master of Accountancy

October 2016

Skills

- Corporate Income Tax

- Individual Income Tax

- Partnership Taxation

- S Corporation Taxation

- C Corporation Taxation

- Sales and Use Tax

Work Experience

Business Taxes Specialist

- Provided technical guidance on taxrelated matters to internal and external stakeholders.

- Conducted tax audits and examinations.

- Managed a team of tax professionals.

- Developed and delivered training programs on taxrelated topics.

Business Taxes Specialist

- Calculated and prepared complex state and local business tax returns.

- Reviewed and analyzed tax laws and regulations to ensure compliance.

- Developed and implemented tax planning strategies to optimize client outcomes.

- Negotiated with tax authorities on behalf of clients.

Accomplishments

- Delivered technical training sessions on tax code updates to over 200 individuals, resulting in significant improvement in tax compliance.

- Assisted in the development and implementation of a new tax accounting system, leading to a 15% reduction in tax preparation time.

- Collaborated with auditors to resolve complex tax issues, ensuring accurate and timely financial reporting.

- Managed a portfolio of over 100 individual and corporate tax clients, providing comprehensive tax planning and consulting services.

- Prepared and filed federal, state, and local tax returns for individuals and businesses, ensuring compliance with all applicable tax laws and regulations.

Awards

- AICPA Advanced Personal Financial Planning Credential

Certificates

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Certified Tax Specialist (CTS)

- Master Tax Advisor (MTA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Business Taxes Specialist

- Quantify your accomplishments and use specific metrics to demonstrate your impact.

- Highlight your knowledge of tax laws and regulations, as well as your ability to interpret and apply them.

- Showcase your experience in tax planning and optimization, and provide examples of how you have helped clients achieve their financial goals.

- Emphasize your negotiation skills and experience in working with tax authorities.

- Demonstrate your leadership and management skills, and provide examples of how you have successfully managed a team of tax professionals.

Essential Experience Highlights for a Strong Business Taxes Specialist Resume

- Calculated and prepared complex state and local business tax returns.

- Reviewed and analyzed tax laws and regulations to ensure compliance.

- Developed and implemented tax planning strategies to optimize client outcomes.

- Negotiated with tax authorities on behalf of clients.

- Provided technical guidance on tax-related matters to internal and external stakeholders.

- Conducted tax audits and examinations.

- Managed a team of tax professionals.

Frequently Asked Questions (FAQ’s) For Business Taxes Specialist

What are the key skills required for a Business Taxes Specialist?

Key skills for a Business Taxes Specialist include strong analytical skills, attention to detail, and knowledge of tax laws and regulations. Other skills that are beneficial include experience in tax planning and optimization, negotiation skills, and leadership skills.

What are the career prospects for a Business Taxes Specialist?

Business Taxes Specialists are in high demand due to the increasing complexity of tax laws and regulations. With experience, Business Taxes Specialists can advance to management positions, such as Tax Manager or Tax Director.

What is the average salary for a Business Taxes Specialist?

The average salary for a Business Taxes Specialist varies depending on experience, location, and company size. According to the U.S. Bureau of Labor Statistics, the median annual salary for tax preparers was $56,370 in May 2021.

What are the educational requirements for a Business Taxes Specialist?

Most Business Taxes Specialists have a bachelor’s degree in accounting or a related field. Some employers may also require a master’s degree in taxation or a related field.

What are the certifications that are beneficial for a Business Taxes Specialist?

Certifications that are beneficial for a Business Taxes Specialist include the Enrolled Agent (EA) certification, the Certified Public Accountant (CPA) certification, and the Certified Tax Specialist (CTS) certification.

What are the professional organizations that are available for Business Taxes Specialists?

Professional organizations that are available for Business Taxes Specialists include the National Association of Tax Professionals (NATP) and the American Institute of Certified Public Accountants (AICPA).