Are you a seasoned Casualty Claims Supervisor seeking a new career path? Discover our professionally built Casualty Claims Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

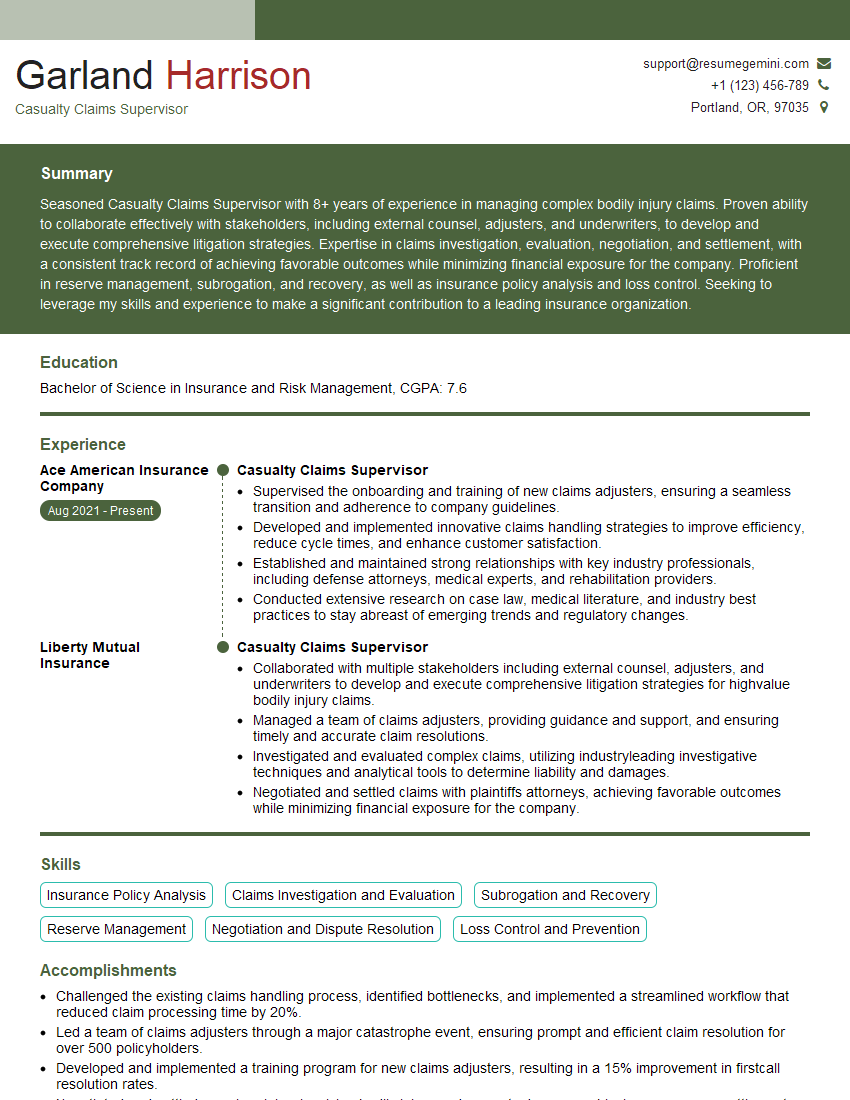

Garland Harrison

Casualty Claims Supervisor

Summary

Seasoned Casualty Claims Supervisor with 8+ years of experience in managing complex bodily injury claims. Proven ability to collaborate effectively with stakeholders, including external counsel, adjusters, and underwriters, to develop and execute comprehensive litigation strategies. Expertise in claims investigation, evaluation, negotiation, and settlement, with a consistent track record of achieving favorable outcomes while minimizing financial exposure for the company. Proficient in reserve management, subrogation, and recovery, as well as insurance policy analysis and loss control. Seeking to leverage my skills and experience to make a significant contribution to a leading insurance organization.

Education

Bachelor of Science in Insurance and Risk Management

July 2017

Skills

- Insurance Policy Analysis

- Claims Investigation and Evaluation

- Subrogation and Recovery

- Reserve Management

- Negotiation and Dispute Resolution

- Loss Control and Prevention

Work Experience

Casualty Claims Supervisor

- Supervised the onboarding and training of new claims adjusters, ensuring a seamless transition and adherence to company guidelines.

- Developed and implemented innovative claims handling strategies to improve efficiency, reduce cycle times, and enhance customer satisfaction.

- Established and maintained strong relationships with key industry professionals, including defense attorneys, medical experts, and rehabilitation providers.

- Conducted extensive research on case law, medical literature, and industry best practices to stay abreast of emerging trends and regulatory changes.

Casualty Claims Supervisor

- Collaborated with multiple stakeholders including external counsel, adjusters, and underwriters to develop and execute comprehensive litigation strategies for highvalue bodily injury claims.

- Managed a team of claims adjusters, providing guidance and support, and ensuring timely and accurate claim resolutions.

- Investigated and evaluated complex claims, utilizing industryleading investigative techniques and analytical tools to determine liability and damages.

- Negotiated and settled claims with plaintiffs attorneys, achieving favorable outcomes while minimizing financial exposure for the company.

Accomplishments

- Challenged the existing claims handling process, identified bottlenecks, and implemented a streamlined workflow that reduced claim processing time by 20%.

- Led a team of claims adjusters through a major catastrophe event, ensuring prompt and efficient claim resolution for over 500 policyholders.

- Developed and implemented a training program for new claims adjusters, resulting in a 15% improvement in firstcall resolution rates.

- Negotiated and settled complex claims involving bodily injury and property damage, achieving an average settlement amount 10% below industry benchmarks.

- Developed and implemented a quality assurance program to monitor claim handling practices and ensure compliance with regulatory standards.

Awards

- Recipient of the Claims Excellence Award for outstanding performance in claims handling and customer service.

- Recognized with the Team Leadership Award for successfully managing a highperforming claims team and driving operational efficiency.

- Received the Chairmans Award for Innovation for developing and implementing a new claims process that significantly reduced resolution time and improved customer satisfaction.

- Earned the Certified Claims Professional (CCP) designation from the National Association of Insurance Professionals.

Certificates

- Associate in Claims (AIC)

- Accredited Claims Manager (ACM)

- Certified Insurance Counselor (CIC)

- Certified Property and Casualty Underwriter (CPCU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Casualty Claims Supervisor

- Highlight your experience in handling complex bodily injury claims, emphasizing your ability to manage litigation and negotiate favorable settlements.

- Showcase your skills in claims investigation and evaluation, including your knowledge of industry-leading investigative techniques and analytical tools.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate the impact of your contributions.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the specific role.

Essential Experience Highlights for a Strong Casualty Claims Supervisor Resume

- Collaborated with multiple stakeholders, including external counsel, adjusters, and underwriters, to develop and execute comprehensive litigation strategies for high-value bodily injury claims.

- Managed a team of claims adjusters, providing guidance and support, and ensuring timely and accurate claim resolutions.

- Investigated and evaluated complex claims, utilizing industry-leading investigative techniques and analytical tools to determine liability and damages.

- Negotiated and settled claims with plaintiffs’ attorneys, achieving favorable outcomes while minimizing financial exposure for the company.

- Supervised the onboarding and training of new claims adjusters, ensuring a seamless transition and adherence to company guidelines.

- Developed and implemented innovative claims handling strategies to improve efficiency, reduce cycle times, and enhance customer satisfaction.

Frequently Asked Questions (FAQ’s) For Casualty Claims Supervisor

What is the role of a Casualty Claims Supervisor?

A Casualty Claims Supervisor is responsible for managing and resolving bodily injury claims, ensuring timely and accurate claim resolutions while minimizing financial exposure for the insurance company.

What are the key skills required for a Casualty Claims Supervisor?

Key skills include claims investigation and evaluation, negotiation and dispute resolution, insurance policy analysis, subrogation and recovery, and loss control and prevention.

What is the career path for a Casualty Claims Supervisor?

With experience and additional qualifications, Casualty Claims Supervisors can advance to roles such as Claims Manager, Senior Claims Adjuster, or Underwriter.

What are the challenges faced by Casualty Claims Supervisors?

Challenges include managing complex claims, negotiating with claimants and attorneys, and staying up-to-date with industry regulations and best practices.

What are the benefits of working as a Casualty Claims Supervisor?

Benefits include job security, competitive salaries, and the opportunity to make a positive impact by helping individuals and businesses recover from accidents.

How can I prepare for a career as a Casualty Claims Supervisor?

You can prepare by obtaining a degree in insurance or a related field, gaining experience in claims handling, and pursuing professional certifications.