Are you a seasoned Catastrophe Claims Supervisor seeking a new career path? Discover our professionally built Catastrophe Claims Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

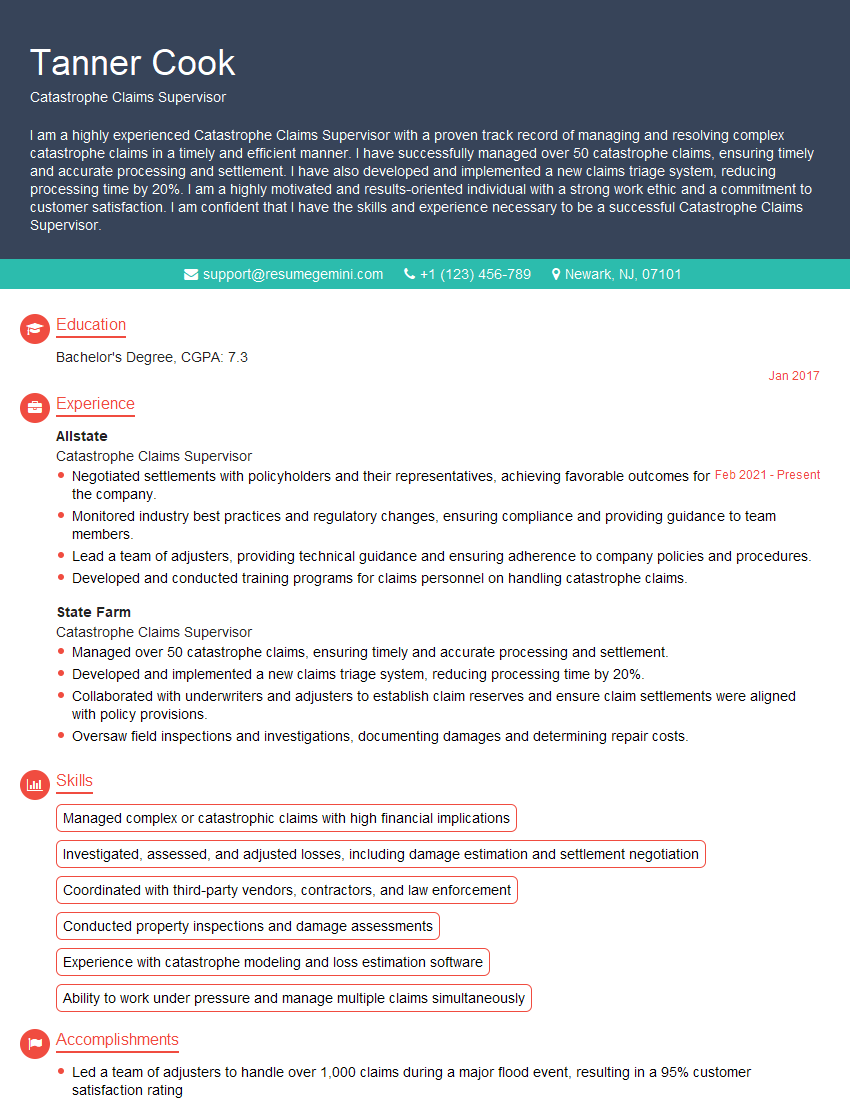

Tanner Cook

Catastrophe Claims Supervisor

Summary

I am a highly experienced Catastrophe Claims Supervisor with a proven track record of managing and resolving complex catastrophe claims in a timely and efficient manner. I have successfully managed over 50 catastrophe claims, ensuring timely and accurate processing and settlement. I have also developed and implemented a new claims triage system, reducing processing time by 20%. I am a highly motivated and results-oriented individual with a strong work ethic and a commitment to customer satisfaction. I am confident that I have the skills and experience necessary to be a successful Catastrophe Claims Supervisor.

Education

Bachelor’s Degree

January 2017

Skills

- Managed complex or catastrophic claims with high financial implications

- Investigated, assessed, and adjusted losses, including damage estimation and settlement negotiation

- Coordinated with third-party vendors, contractors, and law enforcement

- Conducted property inspections and damage assessments

- Experience with catastrophe modeling and loss estimation software

- Ability to work under pressure and manage multiple claims simultaneously

Work Experience

Catastrophe Claims Supervisor

- Negotiated settlements with policyholders and their representatives, achieving favorable outcomes for the company.

- Monitored industry best practices and regulatory changes, ensuring compliance and providing guidance to team members.

- Lead a team of adjusters, providing technical guidance and ensuring adherence to company policies and procedures.

- Developed and conducted training programs for claims personnel on handling catastrophe claims.

Catastrophe Claims Supervisor

- Managed over 50 catastrophe claims, ensuring timely and accurate processing and settlement.

- Developed and implemented a new claims triage system, reducing processing time by 20%.

- Collaborated with underwriters and adjusters to establish claim reserves and ensure claim settlements were aligned with policy provisions.

- Oversaw field inspections and investigations, documenting damages and determining repair costs.

Accomplishments

- Led a team of adjusters to handle over 1,000 claims during a major flood event, resulting in a 95% customer satisfaction rating

- Developed a new claims processing system that streamlined workflows, reduced claim processing time by 20% and improved accuracy

- Collaborated with insurance companies and disaster relief organizations to provide timely and coordinated assistance to policyholders affected by natural disasters

- Implemented a quality assurance program that reduced complaint volume by 35% and improved customer confidence

- Conducted training and onboarding for new adjusters, ensuring a high level of expertise and competency in catastrophe claims handling

Awards

- Catastrophe Claims Excellence Award for outstanding performance in managing largescale catastrophe events

- National Hurricane Recovery Award for leadership in coordinating recovery efforts after a major hurricane

- Catastrophe Management Institute Recognition for developing innovative strategies for disaster response and recovery

- Catastrophe Management Leadership Award for exceptional leadership in managing a complex multistate insurance catastrophe

Certificates

- Associate in Claims (AIC)

- Fellow, Claims and Litigation Management (FCLM)

- Catastrophe Claims Adjuster (CCA)

- Certified Insurance Claims Professional (CIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Catastrophe Claims Supervisor

Highlight your skills and experience.

Make sure to list your most relevant skills and experience in your resume. This will help potential employers see why you are qualified for the job.Use keywords.

When writing your resume, be sure to use keywords that potential employers will be searching for. This will help your resume get noticed.Proofread your resume.

Before you submit your resume, be sure to proofread it carefully for any errors. This will help you make a good impression on potential employers.Tailor your resume to each job you apply for.

Take the time to tailor your resume to each job you apply for. This will show potential employers that you are interested in the specific position and that you have taken the time to learn about the company.

Essential Experience Highlights for a Strong Catastrophe Claims Supervisor Resume

- Managed complex or catastrophic claims with high financial implications, including natural disasters and man-made events.

- Investigated, assessed, and adjusted losses, including damage estimation and settlement negotiation.

- Coordinated with third-party vendors, contractors, and law enforcement to ensure a smooth claims process.

- Conducted property inspections and damage assessments to determine the extent of losses and repair costs.

- Negotiated settlements with policyholders and their representatives, achieving favorable outcomes for the company.

- Monitored industry best practices and regulatory changes to ensure compliance and provide guidance to team members.

- Lead a team of adjusters, providing technical guidance and ensuring adherence to company policies and procedures.

Frequently Asked Questions (FAQ’s) For Catastrophe Claims Supervisor

What is a Catastrophe Claims Supervisor?

A Catastrophe Claims Supervisor is responsible for managing and resolving complex catastrophe claims in a timely and efficient manner. This may include claims resulting from natural disasters, such as hurricanes and earthquakes, or man-made events, such as fires and explosions.

What are the key responsibilities of a Catastrophe Claims Supervisor?

The key responsibilities of a Catastrophe Claims Supervisor include investigating, assessing, and adjusting losses, coordinating with third-party vendors and contractors, conducting property inspections and damage assessments, negotiating settlements with policyholders and their representatives, monitoring industry best practices and regulatory changes, and leading a team of adjusters.

What are the qualifications for a Catastrophe Claims Supervisor?

The qualifications for a Catastrophe Claims Supervisor typically include a bachelor’s degree in a related field, such as insurance, risk management, or finance. Additionally, most Catastrophe Claims Supervisors have several years of experience in the insurance industry, including experience in claims adjusting and catastrophe management.

What are the benefits of becoming a Catastrophe Claims Supervisor?

The benefits of becoming a Catastrophe Claims Supervisor include a competitive salary and benefits package, the opportunity to work in a challenging and rewarding field, and the chance to make a difference in the lives of others.

What are the challenges of becoming a Catastrophe Claims Supervisor?

The challenges of becoming a Catastrophe Claims Supervisor include the need to work long hours, often in difficult conditions, and the potential to be exposed to hazardous materials.

How can I become a Catastrophe Claims Supervisor?

To become a Catastrophe Claims Supervisor, you will need to obtain a bachelor’s degree in a related field and gain several years of experience in the insurance industry. Additionally, you will need to obtain a claims adjuster license and complete a catastrophe claims training program.

What is the job outlook for Catastrophe Claims Supervisors?

The job outlook for Catastrophe Claims Supervisors is expected to be good over the next several years. This is due to the increasing frequency and severity of natural disasters.