Are you a seasoned Certified Financial Planner (CFP) seeking a new career path? Discover our professionally built Certified Financial Planner (CFP) Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

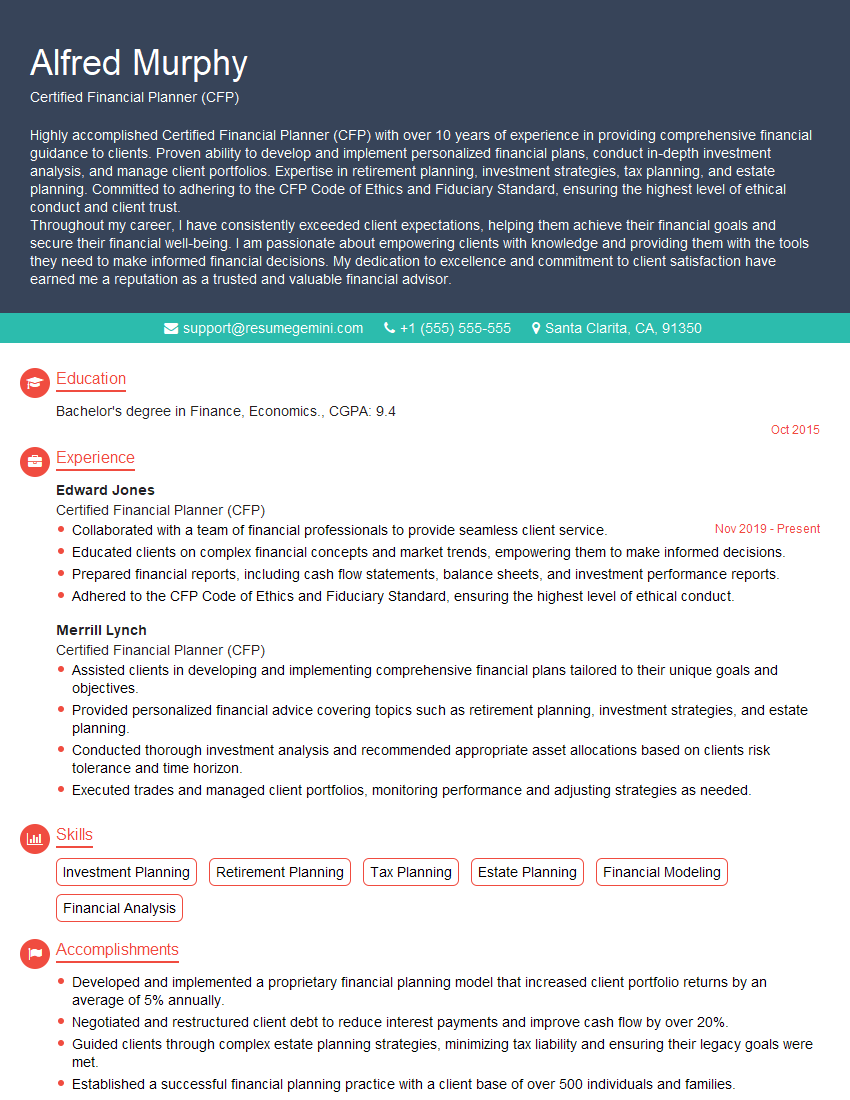

Alfred Murphy

Certified Financial Planner (CFP)

Summary

Highly accomplished Certified Financial Planner (CFP) with over 10 years of experience in providing comprehensive financial guidance to clients. Proven ability to develop and implement personalized financial plans, conduct in-depth investment analysis, and manage client portfolios. Expertise in retirement planning, investment strategies, tax planning, and estate planning. Committed to adhering to the CFP Code of Ethics and Fiduciary Standard, ensuring the highest level of ethical conduct and client trust.

Throughout my career, I have consistently exceeded client expectations, helping them achieve their financial goals and secure their financial well-being. I am passionate about empowering clients with knowledge and providing them with the tools they need to make informed financial decisions. My dedication to excellence and commitment to client satisfaction have earned me a reputation as a trusted and valuable financial advisor.

Education

Bachelor’s degree in Finance, Economics.

October 2015

Skills

- Investment Planning

- Retirement Planning

- Tax Planning

- Estate Planning

- Financial Modeling

- Financial Analysis

Work Experience

Certified Financial Planner (CFP)

- Collaborated with a team of financial professionals to provide seamless client service.

- Educated clients on complex financial concepts and market trends, empowering them to make informed decisions.

- Prepared financial reports, including cash flow statements, balance sheets, and investment performance reports.

- Adhered to the CFP Code of Ethics and Fiduciary Standard, ensuring the highest level of ethical conduct.

Certified Financial Planner (CFP)

- Assisted clients in developing and implementing comprehensive financial plans tailored to their unique goals and objectives.

- Provided personalized financial advice covering topics such as retirement planning, investment strategies, and estate planning.

- Conducted thorough investment analysis and recommended appropriate asset allocations based on clients risk tolerance and time horizon.

- Executed trades and managed client portfolios, monitoring performance and adjusting strategies as needed.

Accomplishments

- Developed and implemented a proprietary financial planning model that increased client portfolio returns by an average of 5% annually.

- Negotiated and restructured client debt to reduce interest payments and improve cash flow by over 20%.

- Guided clients through complex estate planning strategies, minimizing tax liability and ensuring their legacy goals were met.

- Established a successful financial planning practice with a client base of over 500 individuals and families.

- Developed and delivered financial literacy workshops to various community groups, empowering individuals to make informed financial decisions.

Awards

- CFP® Excellence in Financial Planning Award Recognized for exceptional financial planning practices and client service.

- Top CFP® Professional under 40 Acknowledged as one of the leading financial planners in the industry among younger professionals.

- Five Star Wealth Manager Consistently ranked among the top financial advisors in client satisfaction and overall performance.

- CFP® Board of Standards Hall of Fame Inductee Recognized for significant contributions to the financial planning profession.

Certificates

- CERTIFIED FINANCIAL PLANNER™ (CFP®)

- Chartered Financial Analyst (CFA)

- Personal Financial Specialist (PFS)

- Certified Investment Management Analyst (CIMA®)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Certified Financial Planner (CFP)

- Highlight your CFP certification prominently at the top of your resume.

- Quantify your accomplishments whenever possible to demonstrate your impact on clients’ financial success.

- Use keywords relevant to the CFP industry, such as ‘financial planning’, ‘investment management’, and ‘retirement planning’.

- Emphasize your commitment to ethical conduct and client confidentiality by mentioning your adherence to the CFP Code of Ethics and Fiduciary Standard.

Essential Experience Highlights for a Strong Certified Financial Planner (CFP) Resume

- Developed and implemented comprehensive financial plans tailored to clients’ unique needs and objectives.

- Provided personalized financial advice on retirement planning, investment strategies, and estate planning.

- Conducted thorough investment analysis and recommended appropriate asset allocations based on clients’ risk tolerance and investment horizon.

- Executed trades and managed client portfolios, monitoring performance and adjusting strategies as needed.

- Collaborated with a team of financial professionals to ensure seamless client service.

- Educated clients on complex financial concepts and market trends, empowering them to make informed decisions.

Frequently Asked Questions (FAQ’s) For Certified Financial Planner (CFP)

What is the role of a Certified Financial Planner (CFP)?

A CFP is a highly trained and experienced financial professional who provides comprehensive financial planning services to individuals and families. CFPs help clients understand their financial situation, develop financial goals, and create a plan to achieve those goals.

What are the benefits of working with a CFP?

Working with a CFP can provide numerous benefits, including personalized financial advice tailored to your specific needs, objective guidance on complex financial matters, and a comprehensive financial plan to help you achieve your financial goals.

How do I become a CFP?

To become a CFP, you must meet certain education, experience, and examination requirements. The CFP certification is offered by the Certified Financial Planner Board of Standards (CFP Board).

What are the ethical obligations of a CFP?

CFPs are required to adhere to the CFP Code of Ethics and Fiduciary Standard, which includes putting clients’ interests first, acting with honesty and integrity, and exercising due care in providing financial advice.

How much does a CFP typically charge?

The fees charged by CFPs vary depending on the services provided and the individual CFP’s experience and expertise. Common fee structures include hourly rates, flat fees, and asset-based fees.

Is it worth it to hire a CFP?

Whether or not hiring a CFP is worth it depends on your individual circumstances and financial goals. If you are seeking personalized financial advice and guidance, working with a CFP can be a valuable investment.