Are you a seasoned Certified Income Tax Preparer (CTP) seeking a new career path? Discover our professionally built Certified Income Tax Preparer (CTP) Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

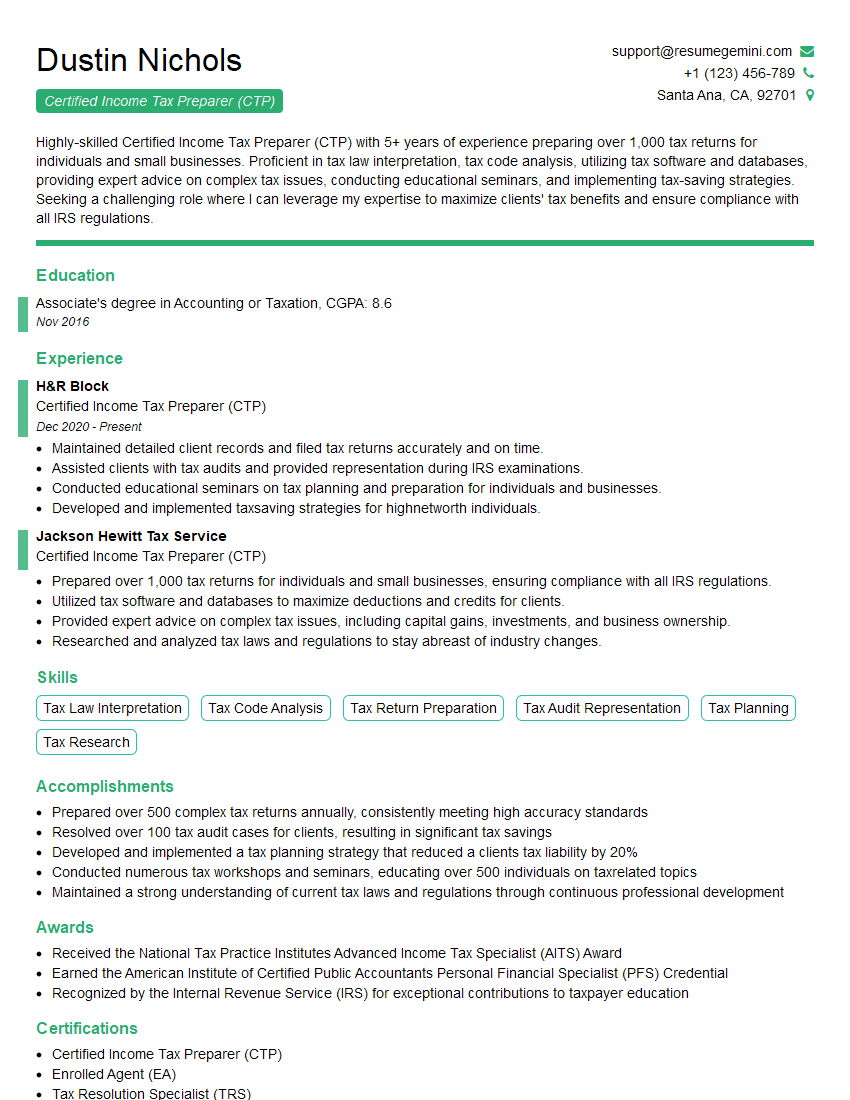

Dustin Nichols

Certified Income Tax Preparer (CTP)

Summary

Highly-skilled Certified Income Tax Preparer (CTP) with 5+ years of experience preparing over 1,000 tax returns for individuals and small businesses. Proficient in tax law interpretation, tax code analysis, utilizing tax software and databases, providing expert advice on complex tax issues, conducting educational seminars, and implementing tax-saving strategies. Seeking a challenging role where I can leverage my expertise to maximize clients’ tax benefits and ensure compliance with all IRS regulations.

Education

Associate’s degree in Accounting or Taxation

November 2016

Skills

- Tax Law Interpretation

- Tax Code Analysis

- Tax Return Preparation

- Tax Audit Representation

- Tax Planning

- Tax Research

Work Experience

Certified Income Tax Preparer (CTP)

- Maintained detailed client records and filed tax returns accurately and on time.

- Assisted clients with tax audits and provided representation during IRS examinations.

- Conducted educational seminars on tax planning and preparation for individuals and businesses.

- Developed and implemented taxsaving strategies for highnetworth individuals.

Certified Income Tax Preparer (CTP)

- Prepared over 1,000 tax returns for individuals and small businesses, ensuring compliance with all IRS regulations.

- Utilized tax software and databases to maximize deductions and credits for clients.

- Provided expert advice on complex tax issues, including capital gains, investments, and business ownership.

- Researched and analyzed tax laws and regulations to stay abreast of industry changes.

Accomplishments

- Prepared over 500 complex tax returns annually, consistently meeting high accuracy standards

- Resolved over 100 tax audit cases for clients, resulting in significant tax savings

- Developed and implemented a tax planning strategy that reduced a clients tax liability by 20%

- Conducted numerous tax workshops and seminars, educating over 500 individuals on taxrelated topics

- Maintained a strong understanding of current tax laws and regulations through continuous professional development

Awards

- Received the National Tax Practice Institutes Advanced Income Tax Specialist (AITS) Award

- Earned the American Institute of Certified Public Accountants Personal Financial Specialist (PFS) Credential

- Recognized by the Internal Revenue Service (IRS) for exceptional contributions to taxpayer education

Certificates

- Certified Income Tax Preparer (CTP)

- Enrolled Agent (EA)

- Tax Resolution Specialist (TRS)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Certified Income Tax Preparer (CTP)

- Highlight your experience and qualifications by quantifying your accomplishments whenever possible.

- Showcase your knowledge of tax laws and regulations by referencing specific codes and provisions.

- Demonstrate your ability to work independently and as part of a team in a fast-paced environment.

- Use strong action verbs and specific examples to describe your skills and responsibilities.

- Proofread your resume carefully for any errors in grammar, spelling, or punctuation.

Essential Experience Highlights for a Strong Certified Income Tax Preparer (CTP) Resume

- Prepared and filed accurate and timely tax returns for individuals and small businesses.

- Utilized tax software and databases to maximize deductions and credits for clients.

- Provided expert advice on complex tax issues, including capital gains, investments, and business ownership.

- Researched and analyzed tax laws and regulations to stay abreast of industry changes.

- Maintained detailed client records and ensured all tax returns were filed accurately and on time.

- Assisted clients with tax audits and provided representation during IRS examinations.

- Conducted educational seminars on tax planning and preparation for individuals and businesses.

Frequently Asked Questions (FAQ’s) For Certified Income Tax Preparer (CTP)

What is the role of a Certified Income Tax Preparer (CTP)?

A CTP is responsible for preparing and filing tax returns for individuals and businesses, ensuring compliance with all IRS regulations.

What are the key skills required to be a successful CTP?

Key skills include tax law interpretation, tax code analysis, tax return preparation, tax audit representation, tax planning, and tax research.

What are the steps to becoming a CTP?

To become a CTP, you typically need to pass an exam administered by an IRS-approved organization and meet certain experience requirements.

What are the career prospects for a CTP?

CTPs can work in various settings, including public accounting firms, tax preparation firms, and corporate tax departments.

What is the average salary for a CTP?

The average salary for a CTP can vary depending on experience, location, and employer.

What are the key challenges faced by a CTP?

Key challenges include staying up-to-date with tax laws and regulations, handling complex tax issues, and meeting client deadlines.

What are the tips for writing a standout CTP resume?

Highlight your experience and qualifications, showcase your knowledge of tax laws and regulations, demonstrate your ability to work independently and as part of a team, use strong action verbs and specific examples, and proofread your resume carefully.

What are the benefits of becoming a CTP?

Benefits include increased job opportunities, higher earning potential, and professional recognition.