Are you a seasoned Certified Public Accountant seeking a new career path? Discover our professionally built Certified Public Accountant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

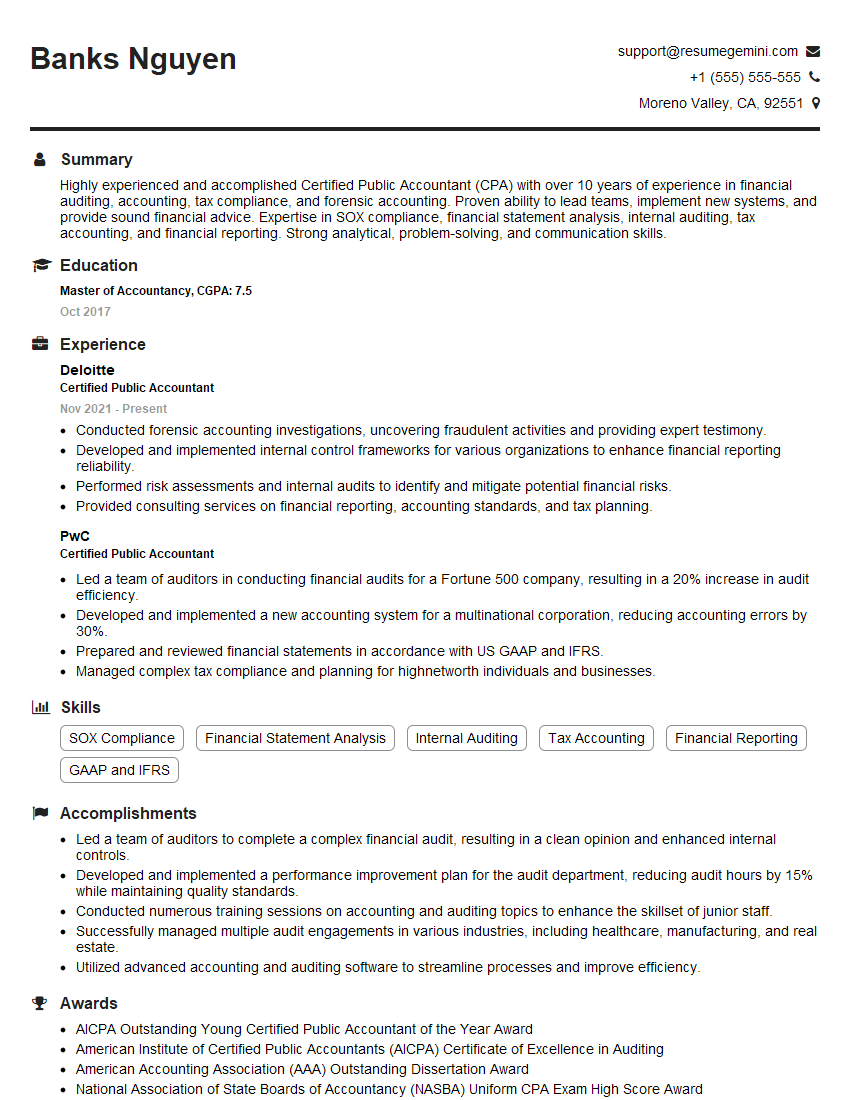

Banks Nguyen

Certified Public Accountant

Summary

Highly experienced and accomplished Certified Public Accountant (CPA) with over 10 years of experience in financial auditing, accounting, tax compliance, and forensic accounting. Proven ability to lead teams, implement new systems, and provide sound financial advice. Expertise in SOX compliance, financial statement analysis, internal auditing, tax accounting, and financial reporting. Strong analytical, problem-solving, and communication skills.

Education

Master of Accountancy

October 2017

Skills

- SOX Compliance

- Financial Statement Analysis

- Internal Auditing

- Tax Accounting

- Financial Reporting

- GAAP and IFRS

Work Experience

Certified Public Accountant

- Conducted forensic accounting investigations, uncovering fraudulent activities and providing expert testimony.

- Developed and implemented internal control frameworks for various organizations to enhance financial reporting reliability.

- Performed risk assessments and internal audits to identify and mitigate potential financial risks.

- Provided consulting services on financial reporting, accounting standards, and tax planning.

Certified Public Accountant

- Led a team of auditors in conducting financial audits for a Fortune 500 company, resulting in a 20% increase in audit efficiency.

- Developed and implemented a new accounting system for a multinational corporation, reducing accounting errors by 30%.

- Prepared and reviewed financial statements in accordance with US GAAP and IFRS.

- Managed complex tax compliance and planning for highnetworth individuals and businesses.

Accomplishments

- Led a team of auditors to complete a complex financial audit, resulting in a clean opinion and enhanced internal controls.

- Developed and implemented a performance improvement plan for the audit department, reducing audit hours by 15% while maintaining quality standards.

- Conducted numerous training sessions on accounting and auditing topics to enhance the skillset of junior staff.

- Successfully managed multiple audit engagements in various industries, including healthcare, manufacturing, and real estate.

- Utilized advanced accounting and auditing software to streamline processes and improve efficiency.

Awards

- AICPA Outstanding Young Certified Public Accountant of the Year Award

- American Institute of Certified Public Accountants (AICPA) Certificate of Excellence in Auditing

- American Accounting Association (AAA) Outstanding Dissertation Award

- National Association of State Boards of Accountancy (NASBA) Uniform CPA Exam High Score Award

Certificates

- Certified Public Accountant (CPA)

- Certified Internal Auditor (CIA)

- Certified Fraud Examiner (CFE)

- Certified Management Accountant (CMA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Certified Public Accountant

- Highlight your CPA certification and any other relevant credentials.

- Quantify your accomplishments with specific metrics to demonstrate your impact.

- Showcase your expertise in key areas such as SOX compliance, financial auditing, and tax planning.

- Use strong action verbs and industry-specific keywords to make your resume stand out.

- Proofread carefully for any errors in grammar, spelling, or formatting.

Essential Experience Highlights for a Strong Certified Public Accountant Resume

- Led teams of auditors in conducting financial audits, resulting in significant improvements in audit efficiency and effectiveness.

- Developed and implemented a new accounting system for a multinational corporation, reducing accounting errors by 30%.

- Prepared and reviewed financial statements in accordance with US GAAP and IFRS, ensuring accuracy and compliance.

- Managed complex tax compliance and planning for high-net-worth individuals and businesses, maximizing tax savings and minimizing liabilities.

- Conducted forensic accounting investigations, uncovering fraudulent activities and providing expert testimony in legal proceedings.

- Developed and implemented internal control frameworks for various organizations, enhancing the reliability of financial reporting.

- Performed risk assessments and internal audits to identify and mitigate potential financial risks.

Frequently Asked Questions (FAQ’s) For Certified Public Accountant

What is the role of a Certified Public Accountant (CPA)?

A Certified Public Accountant (CPA) is a licensed professional who provides financial accounting, auditing, tax, and consulting services to individuals and organizations. CPAs ensure the accuracy and reliability of financial information, help businesses comply with tax laws, and provide valuable insights for financial decision-making.

What are the educational and experience requirements to become a CPA?

To become a CPA, individuals typically need a bachelor’s degree in accounting or a related field, along with passing the Uniform CPA Examination. Most states also require candidates to complete a certain number of hours of work experience under the supervision of a licensed CPA.

What are the key skills and qualities of a successful CPA?

Successful CPAs possess strong analytical, problem-solving, and communication skills. They are also proficient in accounting principles, tax laws, and auditing procedures. Additionally, they must maintain a high level of ethical conduct and professional integrity.

What are the career opportunities for CPAs?

CPAs have a wide range of career opportunities in various industries, including public accounting firms, corporations, government agencies, and non-profit organizations. They can work in areas such as auditing, financial reporting, tax planning, consulting, and forensic accounting.

How can I prepare for a successful career as a CPA?

To prepare for a successful career as a CPA, individuals should focus on developing a strong foundation in accounting principles, tax laws, and auditing procedures. They should also seek opportunities to gain practical experience through internships or entry-level positions. Additionally, obtaining the CPA certification is essential for career advancement.

What are the ethical responsibilities of a CPA?

CPAs have an ethical responsibility to maintain the highest standards of integrity and objectivity in their work. They must comply with all applicable laws and regulations, and avoid any conflicts of interest. CPAs also have a duty to protect the confidentiality of client information.

How can I find a job as a CPA?

To find a job as a CPA, individuals can search for openings on job boards, company websites, and through professional networking. They can also contact staffing agencies that specialize in accounting and finance. Additionally, attending industry events and conferences can provide opportunities to connect with potential employers.

What is the salary range for CPAs?

The salary range for CPAs varies depending on factors such as experience, location, and industry. According to the U.S. Bureau of Labor Statistics, the median annual salary for accountants and auditors was $73,500 in May 2021. However, CPAs with specialized skills and experience can earn significantly more.