Are you a seasoned Check Processor seeking a new career path? Discover our professionally built Check Processor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

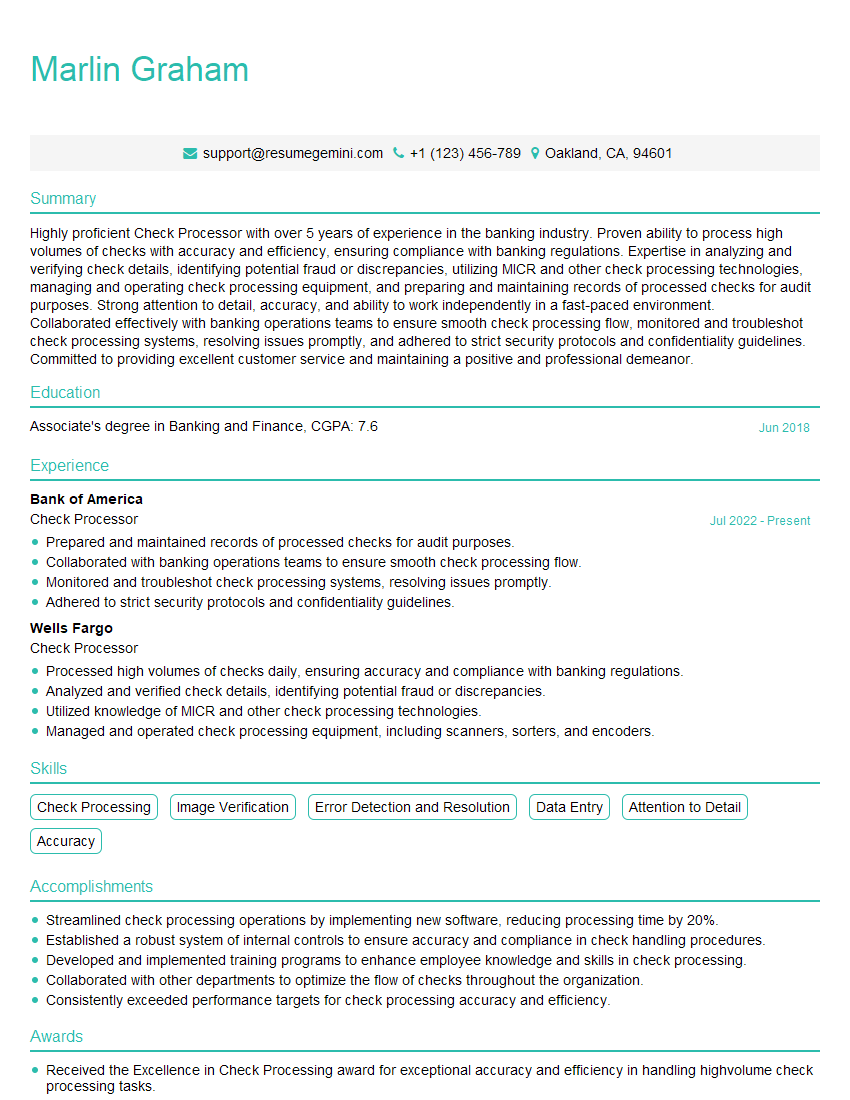

Marlin Graham

Check Processor

Summary

Highly proficient Check Processor with over 5 years of experience in the banking industry. Proven ability to process high volumes of checks with accuracy and efficiency, ensuring compliance with banking regulations. Expertise in analyzing and verifying check details, identifying potential fraud or discrepancies, utilizing MICR and other check processing technologies, managing and operating check processing equipment, and preparing and maintaining records of processed checks for audit purposes. Strong attention to detail, accuracy, and ability to work independently in a fast-paced environment.

Collaborated effectively with banking operations teams to ensure smooth check processing flow, monitored and troubleshot check processing systems, resolving issues promptly, and adhered to strict security protocols and confidentiality guidelines. Committed to providing excellent customer service and maintaining a positive and professional demeanor.

Education

Associate’s degree in Banking and Finance

June 2018

Skills

- Check Processing

- Image Verification

- Error Detection and Resolution

- Data Entry

- Attention to Detail

- Accuracy

Work Experience

Check Processor

- Prepared and maintained records of processed checks for audit purposes.

- Collaborated with banking operations teams to ensure smooth check processing flow.

- Monitored and troubleshot check processing systems, resolving issues promptly.

- Adhered to strict security protocols and confidentiality guidelines.

Check Processor

- Processed high volumes of checks daily, ensuring accuracy and compliance with banking regulations.

- Analyzed and verified check details, identifying potential fraud or discrepancies.

- Utilized knowledge of MICR and other check processing technologies.

- Managed and operated check processing equipment, including scanners, sorters, and encoders.

Accomplishments

- Streamlined check processing operations by implementing new software, reducing processing time by 20%.

- Established a robust system of internal controls to ensure accuracy and compliance in check handling procedures.

- Developed and implemented training programs to enhance employee knowledge and skills in check processing.

- Collaborated with other departments to optimize the flow of checks throughout the organization.

- Consistently exceeded performance targets for check processing accuracy and efficiency.

Awards

- Received the Excellence in Check Processing award for exceptional accuracy and efficiency in handling highvolume check processing tasks.

- Recognized with the Quality Assurance Champion award for consistently maintaining the highest levels of accuracy and compliance in check processing operations.

- Awarded the Process Improvement Leader accolade for identifying and implementing innovative solutions that streamlined check processing workflows and reduced turnaround times.

Certificates

- Certified Check Processor (CCP)

- Certified Financial Services Professional (CFSP)

- Bank Secrecy Act (BSA) Compliance

- Anti-Money Laundering (AML)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Check Processor

Highlight your key skills and experience.

In your resume summary and job descriptions, emphasize your proficiency in check processing, image verification, error detection and resolution, data entry, and attention to detail. Quantify your accomplishments whenever possible to demonstrate your impact. For example, you could state that you processed an average of 1,000 checks per hour with 99% accuracy.

Showcase your knowledge of check processing technologies.

Check processors must be familiar with a variety of check processing technologies, including MICR, OCR, and image scanners. In your resume, highlight your experience with these technologies and any certifications you have obtained. This will show potential employers that you are up-to-date on the latest industry trends.

Demonstrate your ability to work independently and as part of a team.

Check processors typically work independently, but they must also be able to collaborate with other team members to ensure smooth check processing operations. In your resume, highlight your ability to work both independently and as part of a team. Provide examples of how you have successfully worked with others to achieve common goals.

Proofread your resume carefully before submitting it.

Check processors must have excellent attention to detail. This means that you should proofread your resume carefully before submitting it to potential employers. Make sure that there are no errors in grammar, spelling, or punctuation.

Essential Experience Highlights for a Strong Check Processor Resume

- Processed high volumes of checks daily, ensuring accuracy and compliance with banking regulations.

- Analyzed and verified check details, identifying potential fraud or discrepancies.

- Utilized knowledge of MICR and other check processing technologies.

- Managed and operated check processing equipment, including scanners, sorters, and encoders.

- Prepared and maintained records of processed checks for audit purposes.

- Collaborated with banking operations teams to ensure smooth check processing flow.

- Monitored and troubleshot check processing systems, resolving issues promptly.

Frequently Asked Questions (FAQ’s) For Check Processor

What is the job outlook for Check Processors?

According to the U.S. Bureau of Labor Statistics, the job outlook for Check Processors is expected to decline by 10% from 2019 to 2029. This decline is due to the increasing use of electronic payment methods, such as direct deposit and online bill pay. However, there will still be a need for Check Processors in industries that still rely heavily on checks, such as banking and healthcare.

What are the educational requirements for becoming a Check Processor?

Most Check Processors have a high school diploma or equivalent. However, some employers may prefer candidates with an associate’s degree in banking and finance or a related field.

What are the key skills for a Check Processor?

Key skills for a Check Processor include attention to detail, accuracy, data entry skills, and the ability to work independently and as part of a team. Check Processors must also be familiar with check processing technologies, such as MICR and OCR.

What is the average salary for a Check Processor?

The average salary for a Check Processor is $35,000 per year. However, salaries can vary depending on experience, location, and employer.

What are the career advancement opportunities for a Check Processor?

Check Processors can advance their careers by becoming Check Processing Supervisors or Check Fraud Investigators. With additional education and experience, Check Processors can also move into management positions in banking or finance.

What are the major challenges facing Check Processors?

The major challenges facing Check Processors include the increasing use of electronic payment methods and the need to comply with complex banking regulations. Check Processors must also be able to work independently and as part of a team in a fast-paced environment.

What are the benefits of working as a Check Processor?

Benefits of working as a Check Processor include a stable income, the opportunity to work in a variety of industries, and the potential for career advancement. Check Processors also have the opportunity to learn about the financial industry and develop valuable skills.