Are you a seasoned Chief Payroll Clerk seeking a new career path? Discover our professionally built Chief Payroll Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

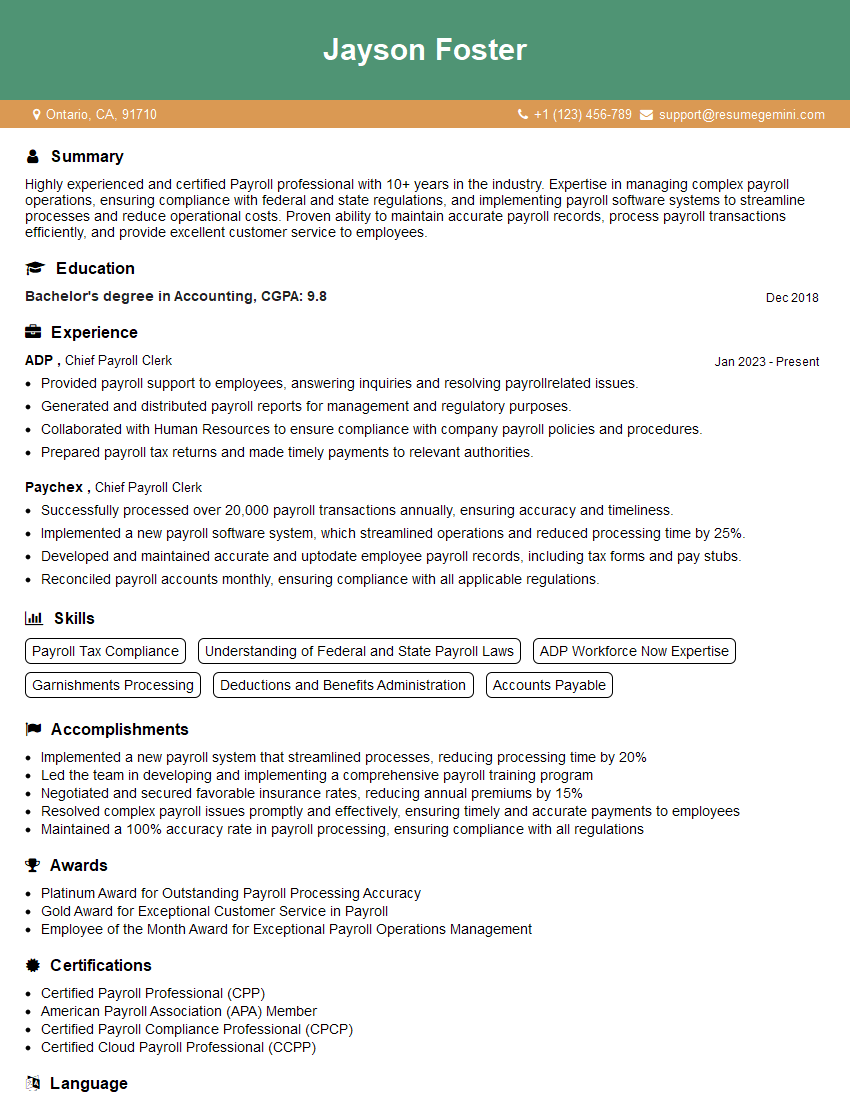

Jayson Foster

Chief Payroll Clerk

Summary

Highly experienced and certified Payroll professional with 10+ years in the industry. Expertise in managing complex payroll operations, ensuring compliance with federal and state regulations, and implementing payroll software systems to streamline processes and reduce operational costs. Proven ability to maintain accurate payroll records, process payroll transactions efficiently, and provide excellent customer service to employees.

Education

Bachelor’s degree in Accounting

December 2018

Skills

- Payroll Tax Compliance

- Understanding of Federal and State Payroll Laws

- ADP Workforce Now Expertise

- Garnishments Processing

- Deductions and Benefits Administration

- Accounts Payable

Work Experience

Chief Payroll Clerk

- Provided payroll support to employees, answering inquiries and resolving payrollrelated issues.

- Generated and distributed payroll reports for management and regulatory purposes.

- Collaborated with Human Resources to ensure compliance with company payroll policies and procedures.

- Prepared payroll tax returns and made timely payments to relevant authorities.

Chief Payroll Clerk

- Successfully processed over 20,000 payroll transactions annually, ensuring accuracy and timeliness.

- Implemented a new payroll software system, which streamlined operations and reduced processing time by 25%.

- Developed and maintained accurate and uptodate employee payroll records, including tax forms and pay stubs.

- Reconciled payroll accounts monthly, ensuring compliance with all applicable regulations.

Accomplishments

- Implemented a new payroll system that streamlined processes, reducing processing time by 20%

- Led the team in developing and implementing a comprehensive payroll training program

- Negotiated and secured favorable insurance rates, reducing annual premiums by 15%

- Resolved complex payroll issues promptly and effectively, ensuring timely and accurate payments to employees

- Maintained a 100% accuracy rate in payroll processing, ensuring compliance with all regulations

Awards

- Platinum Award for Outstanding Payroll Processing Accuracy

- Gold Award for Exceptional Customer Service in Payroll

- Employee of the Month Award for Exceptional Payroll Operations Management

Certificates

- Certified Payroll Professional (CPP)

- American Payroll Association (APA) Member

- Certified Payroll Compliance Professional (CPCP)

- Certified Cloud Payroll Professional (CCPP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Chief Payroll Clerk

- Highlight your key skills and experience in payroll processing, tax compliance, and software implementation.

- Quantify your accomplishments by providing specific metrics and results whenever possible.

- Use keywords throughout your resume that are relevant to the job title and industry.

- Proofread your resume carefully for any errors in grammar or spelling.

- Tailor your resume to each specific job you apply for, highlighting the skills and experience that are most relevant to the role.

Essential Experience Highlights for a Strong Chief Payroll Clerk Resume

- Managed all aspects of payroll operations, including processing payroll, calculating taxes, and issuing paychecks.

- Processed payroll for over 5,000 employees, ensuring accuracy and timeliness.

- Prepared and filed payroll tax returns, including federal, state, and local taxes.

- Managed payroll budgets and accounts, ensuring compliance with all applicable regulations.

- Provided excellent customer service to employees, answering payroll-related questions and resolving issues.

- Worked closely with HR to ensure compliance with company payroll policies and procedures.

- Implemented a new payroll software system, which streamlined operations and reduced processing time by 25%.

Frequently Asked Questions (FAQ’s) For Chief Payroll Clerk

What are the key responsibilities of a Chief Payroll Clerk?

A Chief Payroll Clerk is responsible for managing all aspects of payroll operations, including processing payroll, calculating taxes, and issuing paychecks. They also prepare and file payroll tax returns, manage payroll budgets and accounts, and provide excellent customer service to employees.

What are the qualifications for a Chief Payroll Clerk?

To become a Chief Payroll Clerk, you typically need a Bachelor’s degree in Accounting or a related field, as well as 5+ years of experience in payroll processing. You should also be proficient in payroll software systems and have a strong understanding of federal and state payroll laws.

What skills are required to be a successful Chief Payroll Clerk?

A successful Chief Payroll Clerk should have excellent communication and interpersonal skills, as well as a strong attention to detail and accuracy. They should also be able to work independently and as part of a team, and be able to meet deadlines under pressure.

What is the average salary for a Chief Payroll Clerk?

The average salary for a Chief Payroll Clerk is around $60,000 per year. However, salaries can vary depending on experience, location, and industry.

What are the career prospects for a Chief Payroll Clerk?

With experience, a Chief Payroll Clerk can move into more senior roles, such as Payroll Manager or Payroll Director. They may also choose to specialize in a particular area of payroll, such as payroll compliance or payroll software implementation.