Are you a seasoned Chief Risk Officer seeking a new career path? Discover our professionally built Chief Risk Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

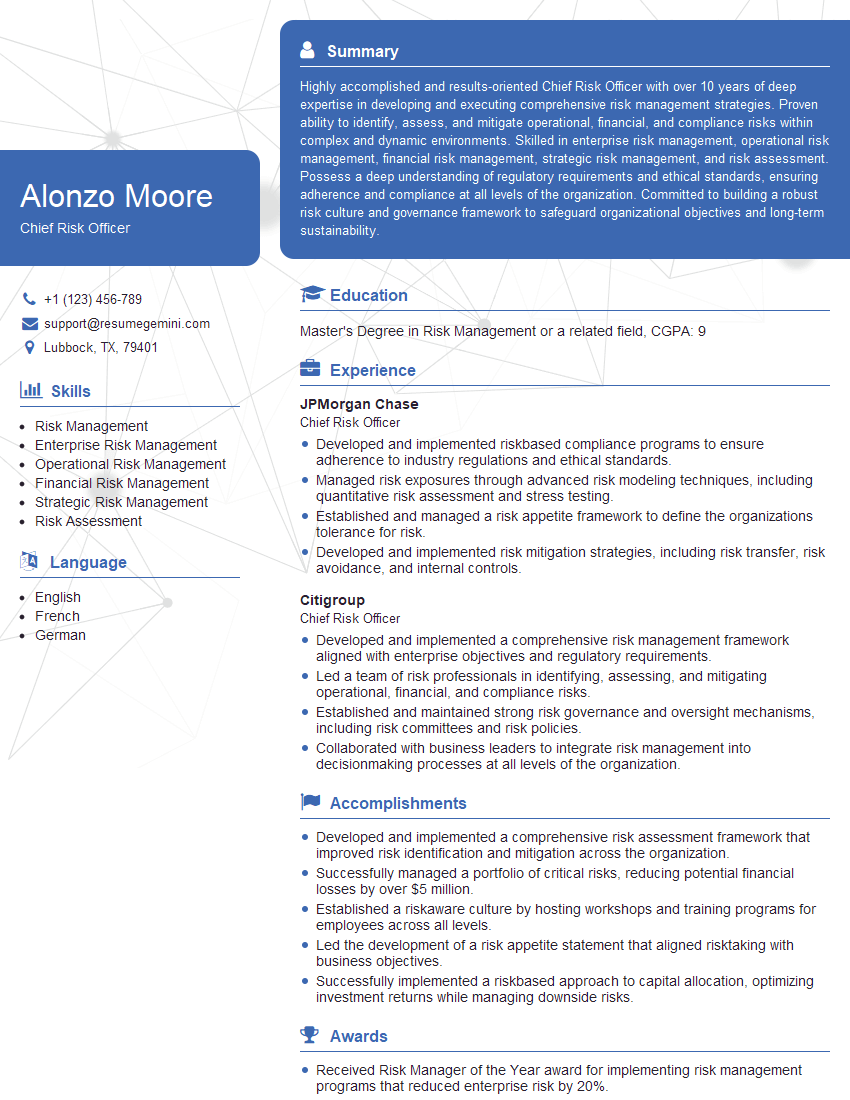

Alonzo Moore

Chief Risk Officer

Summary

Highly accomplished and results-oriented Chief Risk Officer with over 10 years of deep expertise in developing and executing comprehensive risk management strategies. Proven ability to identify, assess, and mitigate operational, financial, and compliance risks within complex and dynamic environments. Skilled in enterprise risk management, operational risk management, financial risk management, strategic risk management, and risk assessment. Possess a deep understanding of regulatory requirements and ethical standards, ensuring adherence and compliance at all levels of the organization. Committed to building a robust risk culture and governance framework to safeguard organizational objectives and long-term sustainability.

Education

Master’s Degree in Risk Management or a related field

May 2017

Skills

- Risk Management

- Enterprise Risk Management

- Operational Risk Management

- Financial Risk Management

- Strategic Risk Management

- Risk Assessment

Work Experience

Chief Risk Officer

- Developed and implemented riskbased compliance programs to ensure adherence to industry regulations and ethical standards.

- Managed risk exposures through advanced risk modeling techniques, including quantitative risk assessment and stress testing.

- Established and managed a risk appetite framework to define the organizations tolerance for risk.

- Developed and implemented risk mitigation strategies, including risk transfer, risk avoidance, and internal controls.

Chief Risk Officer

- Developed and implemented a comprehensive risk management framework aligned with enterprise objectives and regulatory requirements.

- Led a team of risk professionals in identifying, assessing, and mitigating operational, financial, and compliance risks.

- Established and maintained strong risk governance and oversight mechanisms, including risk committees and risk policies.

- Collaborated with business leaders to integrate risk management into decisionmaking processes at all levels of the organization.

Accomplishments

- Developed and implemented a comprehensive risk assessment framework that improved risk identification and mitigation across the organization.

- Successfully managed a portfolio of critical risks, reducing potential financial losses by over $5 million.

- Established a riskaware culture by hosting workshops and training programs for employees across all levels.

- Led the development of a risk appetite statement that aligned risktaking with business objectives.

- Successfully implemented a riskbased approach to capital allocation, optimizing investment returns while managing downside risks.

Awards

- Received Risk Manager of the Year award for implementing risk management programs that reduced enterprise risk by 20%.

- Recognized with Best Risk Management award for leading a team that successfully navigated a highprofile regulatory audit.

- Honored with Thought Leadership Award for developing and presenting innovative risk management strategies at industry conferences.

- Received Excellence in Risk Management award for developing a risk dashboard that provided realtime visibility into key risks.

Certificates

- Certified Risk Manager (CRM)

- Certified Internal Auditor (CIA)

- Certified Information Systems Auditor (CISA)

- Certified Information Systems Security Professional (CISSP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Chief Risk Officer

- Quantify your accomplishments with specific metrics and data points to demonstrate your impact on risk mitigation and organizational resilience.

- Highlight your understanding of industry best practices, regulations, and emerging risk trends, showcasing your commitment to continuous learning and professional development.

- Emphasize your ability to communicate complex risk concepts effectively to senior management and stakeholders, ensuring alignment and buy-in.

- Demonstrate your leadership and collaboration skills by highlighting successful partnerships with cross-functional teams to embed risk management into business processes.

Essential Experience Highlights for a Strong Chief Risk Officer Resume

- Developed and implemented a comprehensive risk management framework aligned with enterprise objectives and regulatory requirements.

- Managed a team of risk professionals in identifying, assessing, and mitigating operational, financial, and compliance risks.

- Established and maintained strong risk governance and oversight mechanisms, including risk committees and risk policies.

- Collaborated with business leaders to integrate risk management into decision-making processes at all levels of the organization.

- Developed and implemented risk-based compliance programs to ensure adherence to industry regulations and ethical standards.

- Managed risk exposures through advanced risk modeling techniques, including quantitative risk assessment and stress testing.

Frequently Asked Questions (FAQ’s) For Chief Risk Officer

What is the primary role of a Chief Risk Officer?

The primary role of a Chief Risk Officer (CRO) is to oversee and manage all aspects of enterprise risk management within an organization. This includes identifying, assessing, mitigating, and monitoring risks that could potentially impact the organization’s objectives, reputation, and financial performance.

What are the key responsibilities of a Chief Risk Officer?

The key responsibilities of a CRO typically include developing and implementing risk management strategies, establishing risk governance frameworks, collaborating with business units to integrate risk management into decision-making, and ensuring compliance with regulatory requirements.

What qualifications and experience are required to become a Chief Risk Officer?

To become a CRO, individuals typically need a master’s degree in risk management, finance, or a related field, along with several years of experience in risk management, financial analysis, or auditing.

What are the career prospects for Chief Risk Officers?

CROs are in high demand due to the increasing importance of risk management in organizations. With experience and a proven track record, CROs can advance to senior leadership roles, such as Chief Executive Officer (CEO) or Chief Operating Officer (COO).

What are the key challenges faced by Chief Risk Officers?

CROs face several challenges, including managing emerging risks, keeping up with regulatory changes, balancing risk and reward, and communicating risk effectively to stakeholders.

What are the top skills required for Chief Risk Officers?

CROs need strong analytical, communication, leadership, and decision-making skills, as well as a deep understanding of risk management principles and best practices.