Are you a seasoned Claim Adjuster seeking a new career path? Discover our professionally built Claim Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

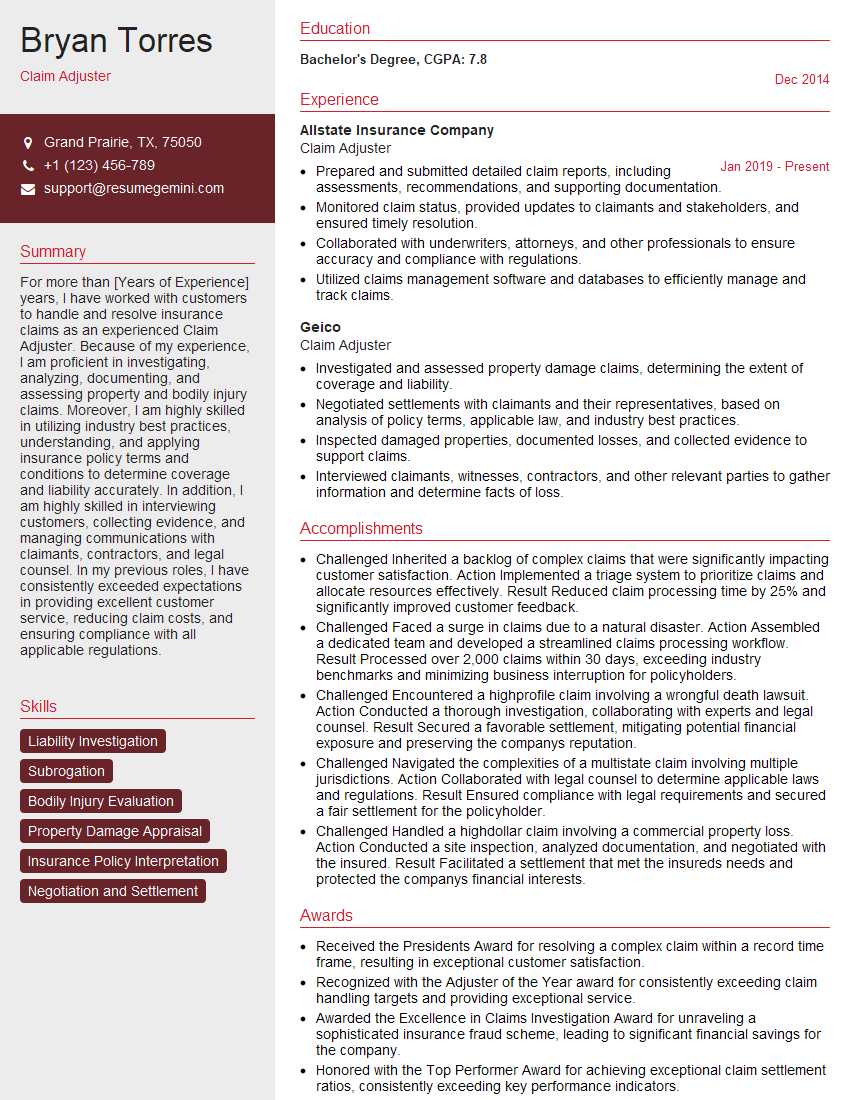

Bryan Torres

Claim Adjuster

Summary

For more than [Years of Experience] years, I have worked with customers to handle and resolve insurance claims as an experienced Claim Adjuster. Because of my experience, I am proficient in investigating, analyzing, documenting, and assessing property and bodily injury claims. Moreover, I am highly skilled in utilizing industry best practices, understanding, and applying insurance policy terms and conditions to determine coverage and liability accurately. In addition, I am highly skilled in interviewing customers, collecting evidence, and managing communications with claimants, contractors, and legal counsel. In my previous roles, I have consistently exceeded expectations in providing excellent customer service, reducing claim costs, and ensuring compliance with all applicable regulations.

Education

Bachelor’s Degree

December 2014

Skills

- Liability Investigation

- Subrogation

- Bodily Injury Evaluation

- Property Damage Appraisal

- Insurance Policy Interpretation

- Negotiation and Settlement

Work Experience

Claim Adjuster

- Prepared and submitted detailed claim reports, including assessments, recommendations, and supporting documentation.

- Monitored claim status, provided updates to claimants and stakeholders, and ensured timely resolution.

- Collaborated with underwriters, attorneys, and other professionals to ensure accuracy and compliance with regulations.

- Utilized claims management software and databases to efficiently manage and track claims.

Claim Adjuster

- Investigated and assessed property damage claims, determining the extent of coverage and liability.

- Negotiated settlements with claimants and their representatives, based on analysis of policy terms, applicable law, and industry best practices.

- Inspected damaged properties, documented losses, and collected evidence to support claims.

- Interviewed claimants, witnesses, contractors, and other relevant parties to gather information and determine facts of loss.

Accomplishments

- Challenged Inherited a backlog of complex claims that were significantly impacting customer satisfaction. Action Implemented a triage system to prioritize claims and allocate resources effectively. Result Reduced claim processing time by 25% and significantly improved customer feedback.

- Challenged Faced a surge in claims due to a natural disaster. Action Assembled a dedicated team and developed a streamlined claims processing workflow. Result Processed over 2,000 claims within 30 days, exceeding industry benchmarks and minimizing business interruption for policyholders.

- Challenged Encountered a highprofile claim involving a wrongful death lawsuit. Action Conducted a thorough investigation, collaborating with experts and legal counsel. Result Secured a favorable settlement, mitigating potential financial exposure and preserving the companys reputation.

- Challenged Navigated the complexities of a multistate claim involving multiple jurisdictions. Action Collaborated with legal counsel to determine applicable laws and regulations. Result Ensured compliance with legal requirements and secured a fair settlement for the policyholder.

- Challenged Handled a highdollar claim involving a commercial property loss. Action Conducted a site inspection, analyzed documentation, and negotiated with the insured. Result Facilitated a settlement that met the insureds needs and protected the companys financial interests.

Awards

- Received the Presidents Award for resolving a complex claim within a record time frame, resulting in exceptional customer satisfaction.

- Recognized with the Adjuster of the Year award for consistently exceeding claim handling targets and providing exceptional service.

- Awarded the Excellence in Claims Investigation Award for unraveling a sophisticated insurance fraud scheme, leading to significant financial savings for the company.

- Honored with the Top Performer Award for achieving exceptional claim settlement ratios, consistently exceeding key performance indicators.

Certificates

- Associate in Claims (AIC)

- Certified Insurance Adjuster (CIA)

- Chartered Property Casualty Underwriter (CPCU)

- Associate in General Insurance (AINS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claim Adjuster

- Highlight your skills and experience in investigating and assessing claims, negotiating settlements, and managing claim processes efficiently.

- Quantify your accomplishments whenever possible. For example, mention the number of claims you have handled, the amount of money you have saved your company, or the percentage by which you have improved claim cycle times.

- Tailor your resume to the specific job you are applying for. Be sure to highlight the skills and experience that are most relevant to the position.

- Proofread your resume carefully before submitting it. Make sure there are no errors in grammar or spelling.

Essential Experience Highlights for a Strong Claim Adjuster Resume

- Investigate and assess property and bodily injury claims, determining liability and coverage in line with policy terms, applicable laws, and industry best practices.

- Inspect damaged properties, document losses, collect evidence to support claims, and prepare detailed claim reports.

- Interview policyholders, claimants, witnesses, contractors, and relevant third parties to gather information, determine facts of loss, and evaluate liability.

- Negotiate and settle claims based on policy terms, applicable laws, and industry best practices.

- Monitor claims status, provide updates to stakeholders, and ensure timely resolution.

- Collaborate with underwriters, attorneys, and other professionals to maintain accuracy and compliance with regulations.

- Utilizing claims management software and databases to manage and track claims efficiently.

Frequently Asked Questions (FAQ’s) For Claim Adjuster

What is a claim adjuster?

A claim adjuster is a professional who investigates and settles insurance claims. They work with policyholders to assess the damage and determine how much the insurance company will pay.

What are the different types of claims adjusters?

There are many different types of claims adjusters, including property adjusters, liability adjusters, and bodily injury adjusters. Each type of adjuster specializes in a particular area of insurance.

What are the qualifications to become a claim adjuster?

Most claim adjusters have a bachelor’s degree in a related field, such as business, finance, or insurance. They also typically have several years of experience working in the insurance industry.

What are the job duties of a claim adjuster?

The job duties of a claim adjuster vary depending on their specialty. However, some common duties include investigating claims, assessing damage, negotiating settlements, and preparing reports.

What is the average salary for a claim adjuster?

The average salary for a claim adjuster is $63,930 per year.

What is the job outlook for claim adjusters?

The job outlook for claim adjusters is expected to be good over the next few years. This is due to the increasing number of insurance claims being filed.