Are you a seasoned Claims Adjuster seeking a new career path? Discover our professionally built Claims Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

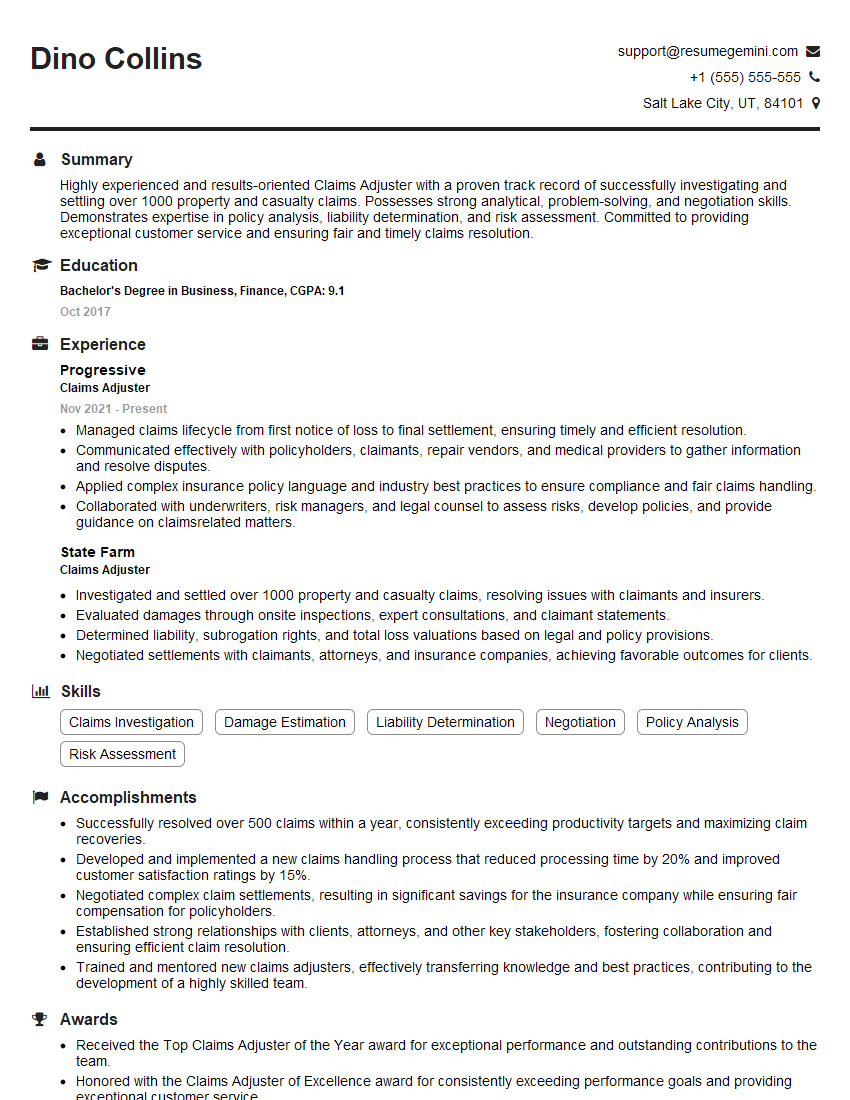

Dino Collins

Claims Adjuster

Summary

Highly experienced and results-oriented Claims Adjuster with a proven track record of successfully investigating and settling over 1000 property and casualty claims. Possesses strong analytical, problem-solving, and negotiation skills. Demonstrates expertise in policy analysis, liability determination, and risk assessment. Committed to providing exceptional customer service and ensuring fair and timely claims resolution.

Education

Bachelor’s Degree in Business, Finance

October 2017

Skills

- Claims Investigation

- Damage Estimation

- Liability Determination

- Negotiation

- Policy Analysis

- Risk Assessment

Work Experience

Claims Adjuster

- Managed claims lifecycle from first notice of loss to final settlement, ensuring timely and efficient resolution.

- Communicated effectively with policyholders, claimants, repair vendors, and medical providers to gather information and resolve disputes.

- Applied complex insurance policy language and industry best practices to ensure compliance and fair claims handling.

- Collaborated with underwriters, risk managers, and legal counsel to assess risks, develop policies, and provide guidance on claimsrelated matters.

Claims Adjuster

- Investigated and settled over 1000 property and casualty claims, resolving issues with claimants and insurers.

- Evaluated damages through onsite inspections, expert consultations, and claimant statements.

- Determined liability, subrogation rights, and total loss valuations based on legal and policy provisions.

- Negotiated settlements with claimants, attorneys, and insurance companies, achieving favorable outcomes for clients.

Accomplishments

- Successfully resolved over 500 claims within a year, consistently exceeding productivity targets and maximizing claim recoveries.

- Developed and implemented a new claims handling process that reduced processing time by 20% and improved customer satisfaction ratings by 15%.

- Negotiated complex claim settlements, resulting in significant savings for the insurance company while ensuring fair compensation for policyholders.

- Established strong relationships with clients, attorneys, and other key stakeholders, fostering collaboration and ensuring efficient claim resolution.

- Trained and mentored new claims adjusters, effectively transferring knowledge and best practices, contributing to the development of a highly skilled team.

Awards

- Received the Top Claims Adjuster of the Year award for exceptional performance and outstanding contributions to the team.

- Honored with the Claims Adjuster of Excellence award for consistently exceeding performance goals and providing exceptional customer service.

- Recognized as a Certified Claims Adjuster by the National Association of Independent Insurance Adjusters (NAIIA).

- Awarded the Presidential Citation for resolving complex claims with accuracy, efficiency, and a high level of professionalism.

Certificates

- Associate in Claims (AIC)

- Fellow, Casualty Actuarial Society (FCAS)

- Property and Casualty Adjuster License (PCA)

- Certified Insurance Counselor (CIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claims Adjuster

- Highlight your experience and expertise in claims handling, investigation, and settlement.

- Showcase your strong analytical, problem-solving, and negotiation skills.

- Emphasize your ability to effectively communicate with policyholders, claimants, and other stakeholders.

- Demonstrate your commitment to ethical and compliant claims practices.

- Quantify your accomplishments whenever possible to showcase your impact on the organization.

Essential Experience Highlights for a Strong Claims Adjuster Resume

- Investigate claims, evaluate damages, and determine liability

- Interview policyholders, witnesses, and experts to gather information

- Negotiate settlements with claimants and their representatives

- Prepare and present reports, including estimates, recommendations, and settlement offers

- Manage claim files and ensure compliance with company policies and procedures

- Stay up-to-date on changes in insurance laws and regulations

- Provide excellent customer service and build positive relationships with policyholders

Frequently Asked Questions (FAQ’s) For Claims Adjuster

What is the role of a Claims Adjuster?

A Claims Adjuster is responsible for investigating, evaluating, and settling insurance claims. They gather information, determine liability, negotiate settlements, and ensure that claims are resolved fairly and efficiently.

What skills are required to be a successful Claims Adjuster?

Successful Claims Adjusters possess strong analytical, problem-solving, and negotiation skills. They are also proficient in policy analysis, liability determination, and risk assessment. Excellent communication and interpersonal skills are essential for building positive relationships with policyholders and other stakeholders.

What is the career path for a Claims Adjuster?

Claims Adjusters can advance to roles such as Senior Claims Adjuster, Claims Supervisor, or Claims Manager. With experience and additional qualifications, they may also move into roles in underwriting, risk management, or insurance consulting.

What is the job outlook for Claims Adjusters?

The job outlook for Claims Adjusters is expected to be positive due to the increasing demand for insurance services. As the population grows and the economy fluctuates, the need for individuals to manage and resolve insurance claims will continue.

What is the average salary for a Claims Adjuster?

The average salary for a Claims Adjuster varies depending on experience, location, and employer. According to the U.S. Bureau of Labor Statistics, the median annual salary for Claims Adjusters was $67,180 in May 2021.

What are the benefits of working as a Claims Adjuster?

Benefits of working as a Claims Adjuster include job stability, opportunities for career advancement, and the chance to make a positive impact on the lives of policyholders. Claims Adjusters also enjoy competitive salaries and benefits packages.

What are the challenges of working as a Claims Adjuster?

Challenges of working as a Claims Adjuster include dealing with stressful situations, managing heavy workloads, and working irregular hours. Claims Adjusters may also face ethical dilemmas and need to make difficult decisions that can impact the lives of others.

How can I become a Claims Adjuster?

To become a Claims Adjuster, you typically need a high school diploma or equivalent and relevant work experience or training. Many Claims Adjusters have a bachelor’s degree in business, finance, or a related field. Some states require Claims Adjusters to be licensed.