Are you a seasoned Claims Consultant seeking a new career path? Discover our professionally built Claims Consultant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

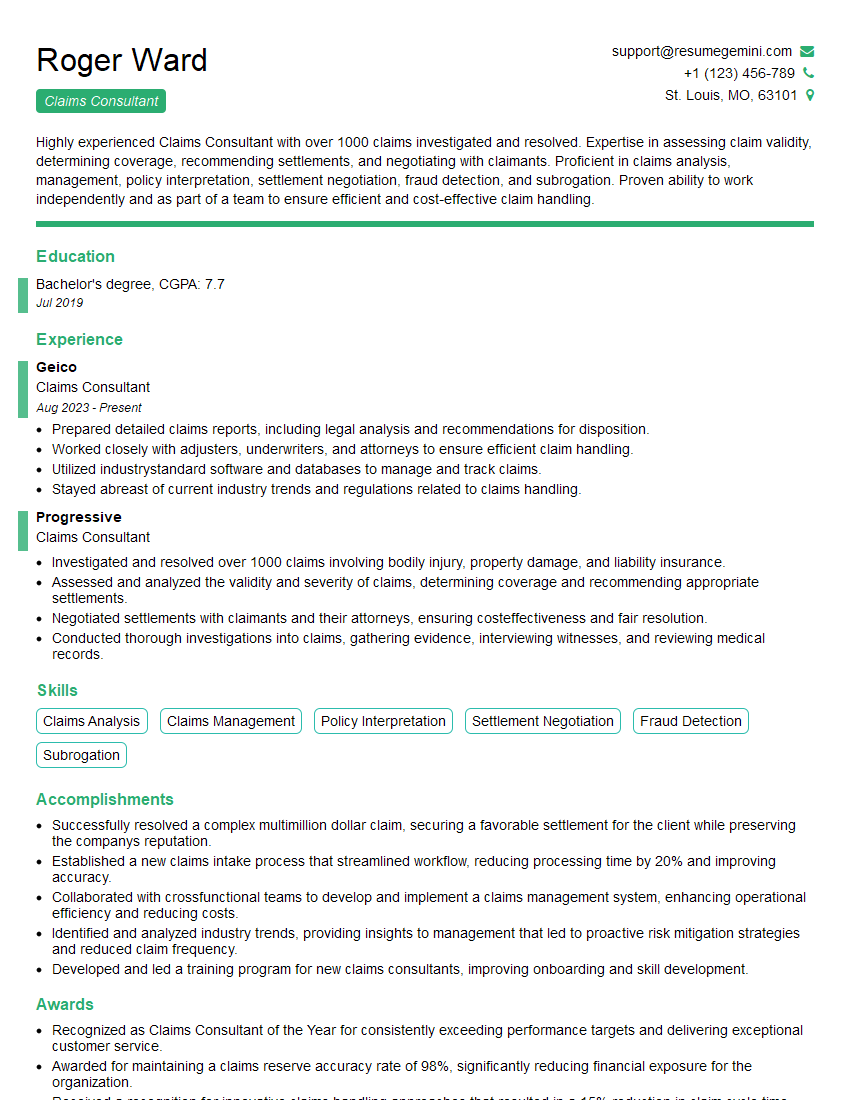

Roger Ward

Claims Consultant

Summary

Highly experienced Claims Consultant with over 1000 claims investigated and resolved. Expertise in assessing claim validity, determining coverage, recommending settlements, and negotiating with claimants. Proficient in claims analysis, management, policy interpretation, settlement negotiation, fraud detection, and subrogation. Proven ability to work independently and as part of a team to ensure efficient and cost-effective claim handling.

Education

Bachelor’s degree

July 2019

Skills

- Claims Analysis

- Claims Management

- Policy Interpretation

- Settlement Negotiation

- Fraud Detection

- Subrogation

Work Experience

Claims Consultant

- Prepared detailed claims reports, including legal analysis and recommendations for disposition.

- Worked closely with adjusters, underwriters, and attorneys to ensure efficient claim handling.

- Utilized industrystandard software and databases to manage and track claims.

- Stayed abreast of current industry trends and regulations related to claims handling.

Claims Consultant

- Investigated and resolved over 1000 claims involving bodily injury, property damage, and liability insurance.

- Assessed and analyzed the validity and severity of claims, determining coverage and recommending appropriate settlements.

- Negotiated settlements with claimants and their attorneys, ensuring costeffectiveness and fair resolution.

- Conducted thorough investigations into claims, gathering evidence, interviewing witnesses, and reviewing medical records.

Accomplishments

- Successfully resolved a complex multimillion dollar claim, securing a favorable settlement for the client while preserving the companys reputation.

- Established a new claims intake process that streamlined workflow, reducing processing time by 20% and improving accuracy.

- Collaborated with crossfunctional teams to develop and implement a claims management system, enhancing operational efficiency and reducing costs.

- Identified and analyzed industry trends, providing insights to management that led to proactive risk mitigation strategies and reduced claim frequency.

- Developed and led a training program for new claims consultants, improving onboarding and skill development.

Awards

- Recognized as Claims Consultant of the Year for consistently exceeding performance targets and delivering exceptional customer service.

- Awarded for maintaining a claims reserve accuracy rate of 98%, significantly reducing financial exposure for the organization.

- Received a recognition for innovative claims handling approaches that resulted in a 15% reduction in claim cycle time.

Certificates

- Associate in Claims (AIC)

- Certified Claims Professional (CCP)

- Fellow, Casualty Actuarial Society (FCAS)

- Associate, Society of Actuaries (ASA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claims Consultant

- Highlight your experience and skills in quantifiable terms.

- Showcase your knowledge of claims handling processes and procedures.

- Demonstrate your ability to work independently and as part of a team.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

- Proofread your resume carefully before submitting it.

Essential Experience Highlights for a Strong Claims Consultant Resume

- Investigate and resolve claims involving bodily injury, property damage, and liability insurance.

- Assess and analyze the validity and severity of claims, determining coverage and recommending appropriate settlements.

- Negotiate settlements with claimants and their attorneys, ensuring cost-effectiveness and fair resolution.

- Conduct thorough investigations into claims, gathering evidence, interviewing witnesses, and reviewing medical records.

- Prepare detailed claims reports, including legal analysis and recommendations for disposition.

- Work closely with adjusters, underwriters, and attorneys to ensure efficient claim handling.

- Utilize industry-standard software and databases to manage and track claims.

- Stay abreast of current industry trends and regulations related to claims handling.

Frequently Asked Questions (FAQ’s) For Claims Consultant

What is the role of a Claims Consultant?

A Claims Consultant is responsible for investigating and resolving insurance claims. They assess the validity and severity of claims, determine coverage, recommend settlements, and negotiate with claimants. They also conduct investigations, gather evidence, interview witnesses, and prepare claims reports.

What skills are required to be a successful Claims Consultant?

Successful Claims Consultants possess strong analytical, problem-solving, and communication skills. They are also proficient in claims handling processes and procedures, and have a deep understanding of insurance policies and regulations. Additionally, they are able to work independently and as part of a team.

What is the career path for a Claims Consultant?

With experience, Claims Consultants can advance to roles such as Claims Manager, Claims Director, or Vice President of Claims. They may also specialize in a particular area of claims, such as bodily injury, property damage, or liability.

What is the job outlook for Claims Consultants?

The job outlook for Claims Consultants is expected to be positive over the next few years. The increasing number of insurance claims is expected to drive demand for qualified Claims Consultants.

How can I prepare for a career as a Claims Consultant?

To prepare for a career as a Claims Consultant, consider pursuing a bachelor’s degree in a related field, such as business, finance, or insurance. You can also gain experience through internships or entry-level positions in the insurance industry.