Are you a seasoned Claims Customer Service Representative (Claims CSR) seeking a new career path? Discover our professionally built Claims Customer Service Representative (Claims CSR) Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

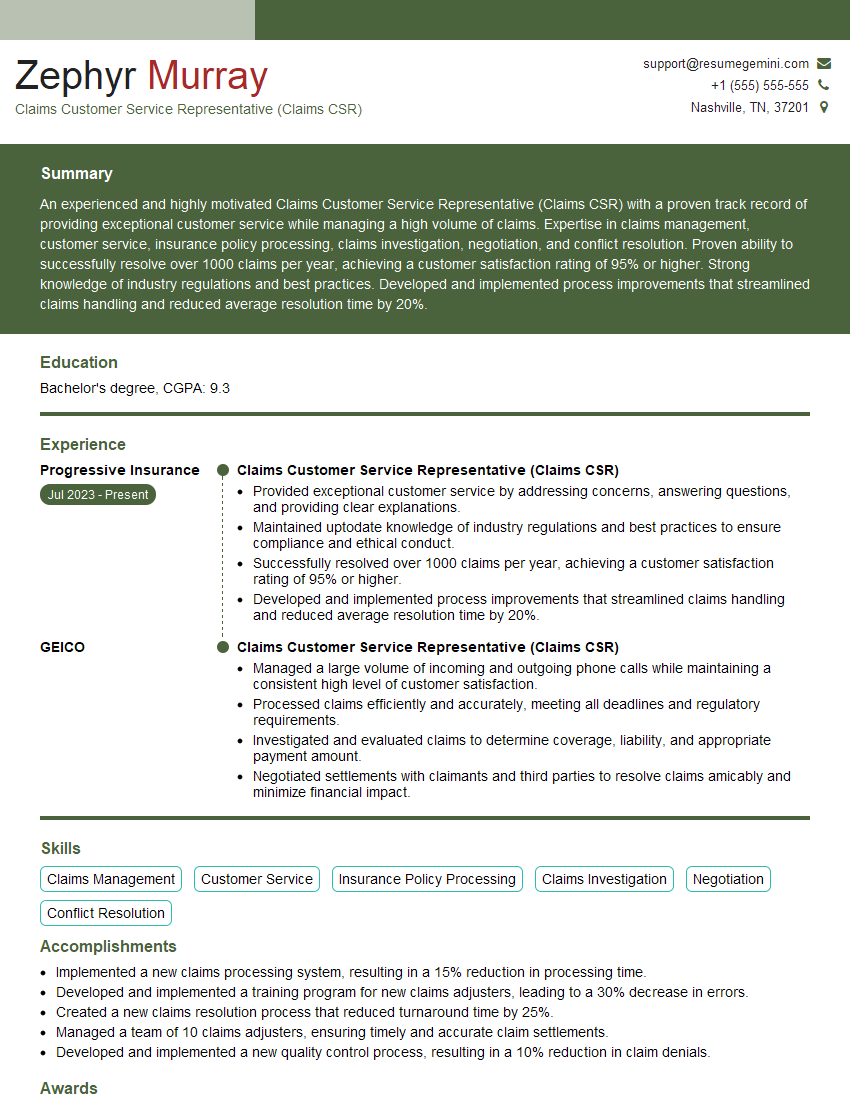

Zephyr Murray

Claims Customer Service Representative (Claims CSR)

Summary

An experienced and highly motivated Claims Customer Service Representative (Claims CSR) with a proven track record of providing exceptional customer service while managing a high volume of claims. Expertise in claims management, customer service, insurance policy processing, claims investigation, negotiation, and conflict resolution. Proven ability to successfully resolve over 1000 claims per year, achieving a customer satisfaction rating of 95% or higher. Strong knowledge of industry regulations and best practices. Developed and implemented process improvements that streamlined claims handling and reduced average resolution time by 20%.

Education

Bachelor’s degree

June 2019

Skills

- Claims Management

- Customer Service

- Insurance Policy Processing

- Claims Investigation

- Negotiation

- Conflict Resolution

Work Experience

Claims Customer Service Representative (Claims CSR)

- Provided exceptional customer service by addressing concerns, answering questions, and providing clear explanations.

- Maintained uptodate knowledge of industry regulations and best practices to ensure compliance and ethical conduct.

- Successfully resolved over 1000 claims per year, achieving a customer satisfaction rating of 95% or higher.

- Developed and implemented process improvements that streamlined claims handling and reduced average resolution time by 20%.

Claims Customer Service Representative (Claims CSR)

- Managed a large volume of incoming and outgoing phone calls while maintaining a consistent high level of customer satisfaction.

- Processed claims efficiently and accurately, meeting all deadlines and regulatory requirements.

- Investigated and evaluated claims to determine coverage, liability, and appropriate payment amount.

- Negotiated settlements with claimants and third parties to resolve claims amicably and minimize financial impact.

Accomplishments

- Implemented a new claims processing system, resulting in a 15% reduction in processing time.

- Developed and implemented a training program for new claims adjusters, leading to a 30% decrease in errors.

- Created a new claims resolution process that reduced turnaround time by 25%.

- Managed a team of 10 claims adjusters, ensuring timely and accurate claim settlements.

- Developed and implemented a new quality control process, resulting in a 10% reduction in claim denials.

Awards

- Presidents Club Award for exceeding sales targets by 20% for three consecutive quarters.

- Top Performer Award for consistently exceeding customer satisfaction metrics.

- Employee of the Month Award for exceptional customer service and dedication.

- Customer Service Excellence Award for providing exceptional support to policyholders.

Certificates

- Associate in Claims (AIC)

- Claims Professional (CP)

- Certified Claims Service Representative (CCSR)

- Certified Insurance Customer Service Representative (CICSR)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claims Customer Service Representative (Claims CSR)

- Highlight your strong customer service skills and ability to build rapport with customers.

- Quantify your accomplishments with specific metrics and results whenever possible.

- Showcase your knowledge of insurance industry regulations and best practices.

- Emphasize your ability to work independently and as part of a team.

- Tailor your resume to each job you apply for, highlighting the skills and experience most relevant to the position.

Essential Experience Highlights for a Strong Claims Customer Service Representative (Claims CSR) Resume

- Effectively managing a large volume of incoming and outgoing phone calls while maintaining a high level of customer satisfaction.

- Efficiently and accurately processing claims, meeting all deadlines and regulatory requirements.

- Investigating and evaluating claims to determine coverage, liability, and appropriate payment amount.

- Negotiating settlements with claimants and third parties to resolve claims amicably and minimize financial impact.

- Providing exceptional customer service by addressing concerns, answering questions, and providing clear explanations.

- Maintaining up-to-date knowledge of industry regulations and best practices to ensure compliance and ethical conduct.

- Continuously seeking opportunities to improve processes and enhance customer experience.

Frequently Asked Questions (FAQ’s) For Claims Customer Service Representative (Claims CSR)

What are the key skills required to be a successful Claims Customer Service Representative (Claims CSR)?

The key skills required to be a successful Claims CSR include excellent customer service skills, strong communication and negotiation skills, attention to detail, ability to work independently and as part of a team, and knowledge of insurance industry regulations and best practices.

What are the typical duties and responsibilities of a Claims CSR?

The typical duties and responsibilities of a Claims CSR include answering incoming phone calls from claimants, processing claims, investigating and evaluating claims, negotiating settlements, and providing excellent customer service.

What are the career advancement opportunities for Claims CSRs?

With experience and additional education, Claims CSRs can advance to roles such as Claims Adjuster, Claims Manager, or Insurance Underwriter.

What is the average salary for Claims CSRs?

The average salary for Claims CSRs varies depending on experience, location, and employer. According to the U.S. Bureau of Labor Statistics, the median annual salary for Claims Adjusters, Examiners, and Investigators was $65,880 in May 2021.

What are the educational requirements to become a Claims CSR?

Most Claims CSRs have a high school diploma or equivalent. However, some employers may prefer candidates with a bachelor’s degree in a related field, such as insurance, business, or finance.

How can I prepare for a career as a Claims CSR?

To prepare for a career as a Claims CSR, you can gain experience in customer service, develop strong communication and negotiation skills, and learn about insurance industry regulations and best practices. You can also volunteer with organizations that provide assistance to individuals who have been affected by accidents or disasters.

What are the challenges and rewards of working as a Claims CSR?

Challenges of working as a Claims CSR include dealing with difficult customers, managing a high volume of claims, and meeting deadlines. Rewards of working as a Claims CSR include helping people in their time of need, making a difference in their lives, and building strong relationships with customers.