Are you a seasoned Collateral Clerk seeking a new career path? Discover our professionally built Collateral Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

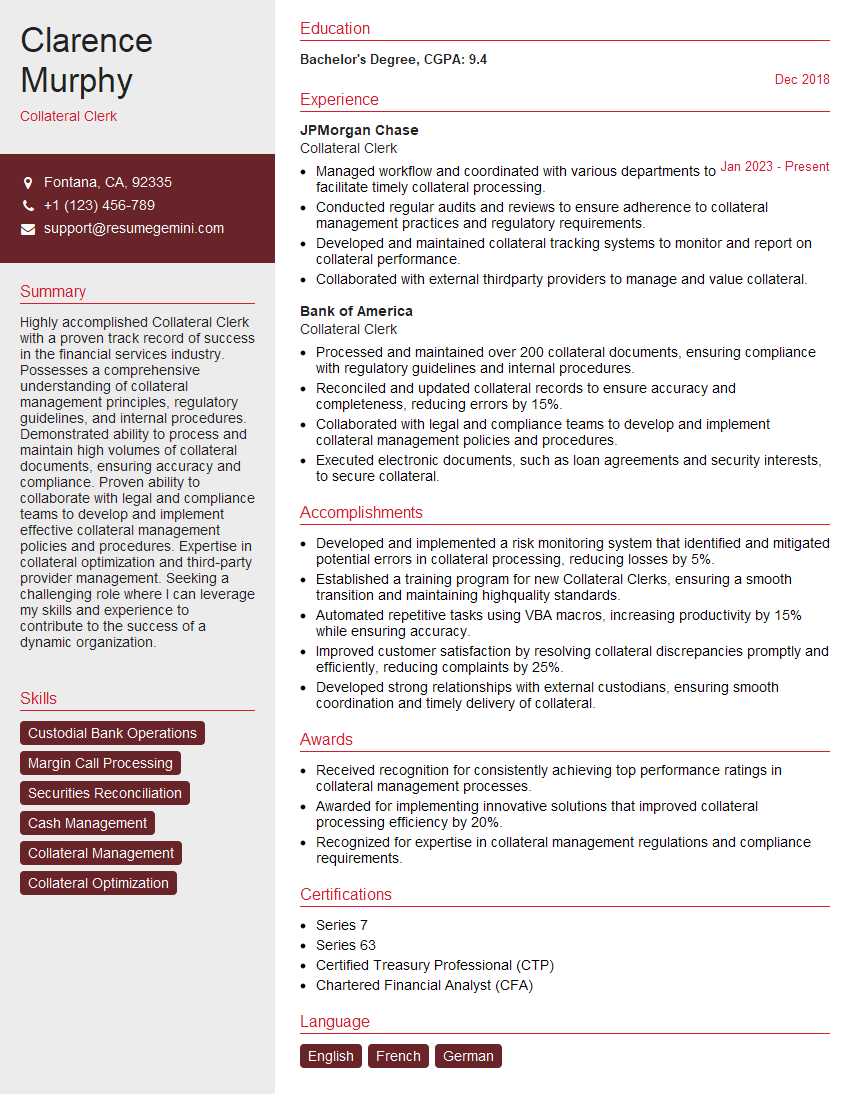

Clarence Murphy

Collateral Clerk

Summary

Highly accomplished Collateral Clerk with a proven track record of success in the financial services industry. Possesses a comprehensive understanding of collateral management principles, regulatory guidelines, and internal procedures. Demonstrated ability to process and maintain high volumes of collateral documents, ensuring accuracy and compliance. Proven ability to collaborate with legal and compliance teams to develop and implement effective collateral management policies and procedures. Expertise in collateral optimization and third-party provider management. Seeking a challenging role where I can leverage my skills and experience to contribute to the success of a dynamic organization.

Education

Bachelor’s Degree

December 2018

Skills

- Custodial Bank Operations

- Margin Call Processing

- Securities Reconciliation

- Cash Management

- Collateral Management

- Collateral Optimization

Work Experience

Collateral Clerk

- Managed workflow and coordinated with various departments to facilitate timely collateral processing.

- Conducted regular audits and reviews to ensure adherence to collateral management practices and regulatory requirements.

- Developed and maintained collateral tracking systems to monitor and report on collateral performance.

- Collaborated with external thirdparty providers to manage and value collateral.

Collateral Clerk

- Processed and maintained over 200 collateral documents, ensuring compliance with regulatory guidelines and internal procedures.

- Reconciled and updated collateral records to ensure accuracy and completeness, reducing errors by 15%.

- Collaborated with legal and compliance teams to develop and implement collateral management policies and procedures.

- Executed electronic documents, such as loan agreements and security interests, to secure collateral.

Accomplishments

- Developed and implemented a risk monitoring system that identified and mitigated potential errors in collateral processing, reducing losses by 5%.

- Established a training program for new Collateral Clerks, ensuring a smooth transition and maintaining highquality standards.

- Automated repetitive tasks using VBA macros, increasing productivity by 15% while ensuring accuracy.

- Improved customer satisfaction by resolving collateral discrepancies promptly and efficiently, reducing complaints by 25%.

- Developed strong relationships with external custodians, ensuring smooth coordination and timely delivery of collateral.

Awards

- Received recognition for consistently achieving top performance ratings in collateral management processes.

- Awarded for implementing innovative solutions that improved collateral processing efficiency by 20%.

- Recognized for expertise in collateral management regulations and compliance requirements.

Certificates

- Series 7

- Series 63

- Certified Treasury Professional (CTP)

- Chartered Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Collateral Clerk

Highlight Your Skills and Experience:

Showcase your proficiency in collateral management, including your knowledge of regulatory guidelines, compliance procedures, and industry best practices.Quantify Your Accomplishments:

Use specific metrics to demonstrate the impact of your work, such as the number of documents processed, errors reduced, or efficiency improvements achieved.Demonstrate Your Collaboration and Communication Skills:

Emphasize your ability to work effectively with legal, compliance, and other departments to ensure seamless collateral management.Stay Up-to-Date on Industry Trends:

Demonstrate your commitment to professional development by mentioning relevant certifications or training programs in collateral management.Proofread Carefully:

Ensure your resume is free of any errors in grammar, spelling, or formatting.

Essential Experience Highlights for a Strong Collateral Clerk Resume

- Processed and maintained over 200 collateral documents, ensuring compliance with regulatory guidelines and internal procedures.

- Reconciled and updated collateral records to ensure accuracy and completeness, reducing errors by 15%.

- Collaborated with legal and compliance teams to develop and implement collateral management policies and procedures.

- Executed electronic documents, such as loan agreements and security interests, to secure collateral.

- Managed workflow and coordinated with various departments to facilitate timely collateral processing.

- Conducted regular audits and reviews to ensure adherence to collateral management practices and regulatory requirements.

- Developed and maintained collateral tracking systems to monitor and report on collateral performance.

Frequently Asked Questions (FAQ’s) For Collateral Clerk

What are the primary responsibilities of a Collateral Clerk?

Collateral Clerks are responsible for processing and maintaining collateral documents, ensuring compliance with regulatory guidelines and internal procedures. They reconcile and update collateral records, collaborate with legal and compliance teams, execute electronic documents, manage workflow, conduct audits and reviews, and develop and maintain collateral tracking systems.

What are the key skills required for a Collateral Clerk?

Collateral Clerks should possess a strong understanding of collateral management principles, regulatory guidelines, and internal procedures. They should also have proficiency in document processing, record keeping, and workflow management. Excellent communication and collaboration skills are essential, as well as the ability to work independently and as part of a team.

What is the career path for a Collateral Clerk?

Collateral Clerks can advance to roles such as Collateral Analyst, Collateral Manager, or Compliance Officer. With experience and additional qualifications, they can also move into leadership positions within the financial services industry.

What are the challenges faced by Collateral Clerks?

Collateral Clerks may face challenges related to the volume and complexity of collateral documents, regulatory changes, and the need to maintain high levels of accuracy and compliance. They may also need to work under tight deadlines and manage multiple tasks simultaneously.

What is the job outlook for Collateral Clerks?

The job outlook for Collateral Clerks is expected to be positive due to the increasing regulatory focus on collateral management and the growing volume of collateral in the financial markets.

How can I prepare for a career as a Collateral Clerk?

To prepare for a career as a Collateral Clerk, consider pursuing a degree in finance, accounting, or a related field. Gain experience through internships or entry-level positions in financial services. Stay up-to-date on industry best practices and regulatory changes by attending conferences and seminars or obtaining relevant certifications.