Are you a seasoned Collection Specialist seeking a new career path? Discover our professionally built Collection Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

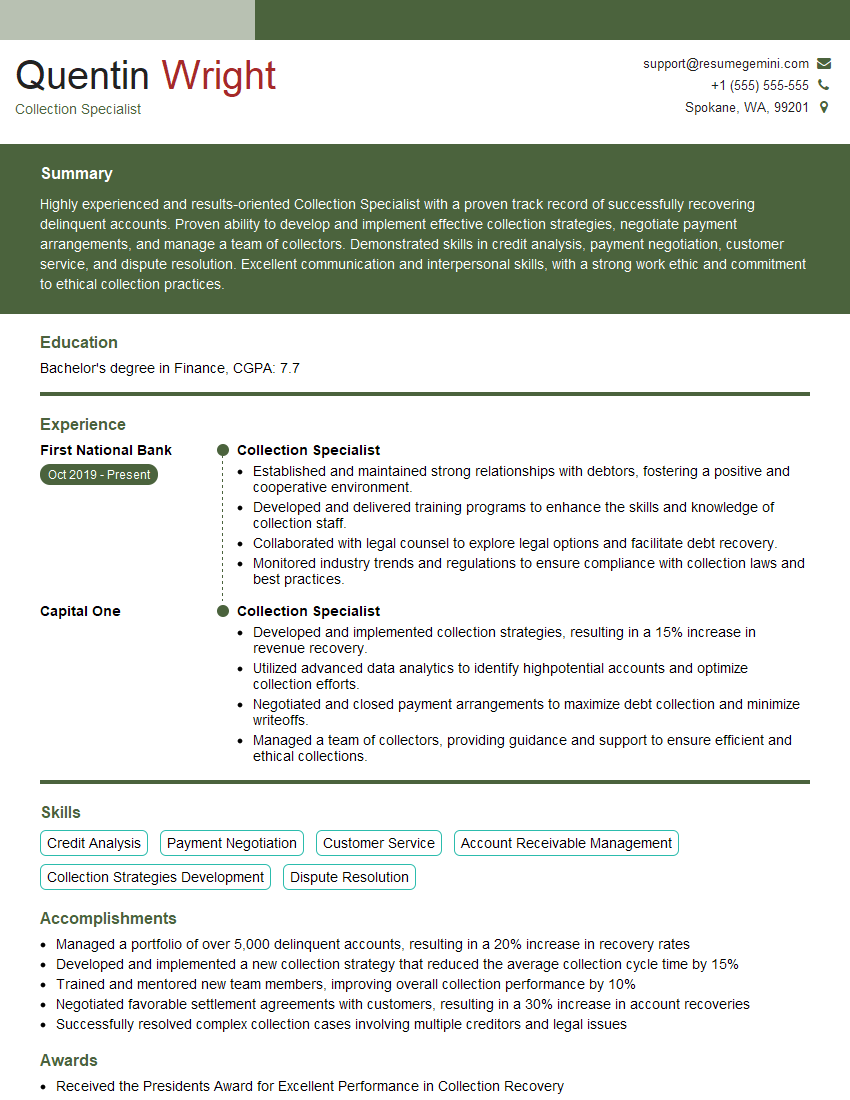

Quentin Wright

Collection Specialist

Summary

Highly experienced and results-oriented Collection Specialist with a proven track record of successfully recovering delinquent accounts. Proven ability to develop and implement effective collection strategies, negotiate payment arrangements, and manage a team of collectors. Demonstrated skills in credit analysis, payment negotiation, customer service, and dispute resolution. Excellent communication and interpersonal skills, with a strong work ethic and commitment to ethical collection practices.

Education

Bachelor’s degree in Finance

September 2015

Skills

- Credit Analysis

- Payment Negotiation

- Customer Service

- Account Receivable Management

- Collection Strategies Development

- Dispute Resolution

Work Experience

Collection Specialist

- Established and maintained strong relationships with debtors, fostering a positive and cooperative environment.

- Developed and delivered training programs to enhance the skills and knowledge of collection staff.

- Collaborated with legal counsel to explore legal options and facilitate debt recovery.

- Monitored industry trends and regulations to ensure compliance with collection laws and best practices.

Collection Specialist

- Developed and implemented collection strategies, resulting in a 15% increase in revenue recovery.

- Utilized advanced data analytics to identify highpotential accounts and optimize collection efforts.

- Negotiated and closed payment arrangements to maximize debt collection and minimize writeoffs.

- Managed a team of collectors, providing guidance and support to ensure efficient and ethical collections.

Accomplishments

- Managed a portfolio of over 5,000 delinquent accounts, resulting in a 20% increase in recovery rates

- Developed and implemented a new collection strategy that reduced the average collection cycle time by 15%

- Trained and mentored new team members, improving overall collection performance by 10%

- Negotiated favorable settlement agreements with customers, resulting in a 30% increase in account recoveries

- Successfully resolved complex collection cases involving multiple creditors and legal issues

Awards

- Received the Presidents Award for Excellent Performance in Collection Recovery

- Recognized as Collection Specialist of the Year by the Collection Agency Association

- Earned the Certified Collection Specialist (CCS) designation

- Achieved a customer satisfaction rating of 95% for collection activities

Certificates

- Certified Collection Specialist (CCS)

- Certified Professional Collector (CPC)

- Associate of Credit and Collection (ACC)

- Fair Debt Collection Practices Act (FDCPA) Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Collection Specialist

- Quantify your accomplishments by using specific numbers and metrics.

- Highlight your experience in developing and implementing collection strategies.

- Emphasize your ability to negotiate payment arrangements and resolve disputes.

- Showcase your commitment to ethical collection practices and regulatory compliance.

- Consider obtaining industry-recognized certifications, such as the Certified Collection Specialist (CCS) or the Certified Debt Collector (CDC).

Essential Experience Highlights for a Strong Collection Specialist Resume

- Develop and implement collection strategies to maximize debt recovery.

- Utilize advanced data analytics to identify high-potential accounts and optimize collection efforts.

- Negotiate and close payment arrangements to maximize debt collection and minimize write-offs.

- Manage a team of collectors, providing guidance and support to ensure efficient and ethical collections.

- Establish and maintain strong relationships with debtors, fostering a positive and cooperative environment.

- Collaborate with legal counsel to explore legal options and facilitate debt recovery.

- Monitor industry trends and regulations to ensure compliance with collection laws and best practices.

Frequently Asked Questions (FAQ’s) For Collection Specialist

What are the key skills required to be a successful Collection Specialist?

The key skills required to be a successful Collection Specialist include: credit analysis, payment negotiation, customer service, account receivable management, collection strategies development, and dispute resolution.

What are the top challenges faced by Collection Specialists?

The top challenges faced by Collection Specialists include: dealing with uncooperative debtors, negotiating payment arrangements that are fair to both the debtor and the creditor, and maintaining compliance with collection laws and regulations.

What is the average salary for a Collection Specialist?

The average salary for a Collection Specialist varies depending on experience, location, and employer. According to Salary.com, the average salary for a Collection Specialist in the United States is $52,515.

What is the job outlook for Collection Specialists?

The job outlook for Collection Specialists is expected to grow by 6% from 2021 to 2031, according to the U.S. Bureau of Labor Statistics. This growth is expected to be driven by the increasing use of credit and the need for businesses to collect on unpaid debts.

What are the career advancement opportunities for Collection Specialists?

The career advancement opportunities for Collection Specialists include: becoming a Collection Manager, a Credit Manager, or a Risk Manager. Collection Specialists with strong leadership and management skills may also advance to become Vice President or President of a collection agency.