Are you a seasoned Collection Supervisor seeking a new career path? Discover our professionally built Collection Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

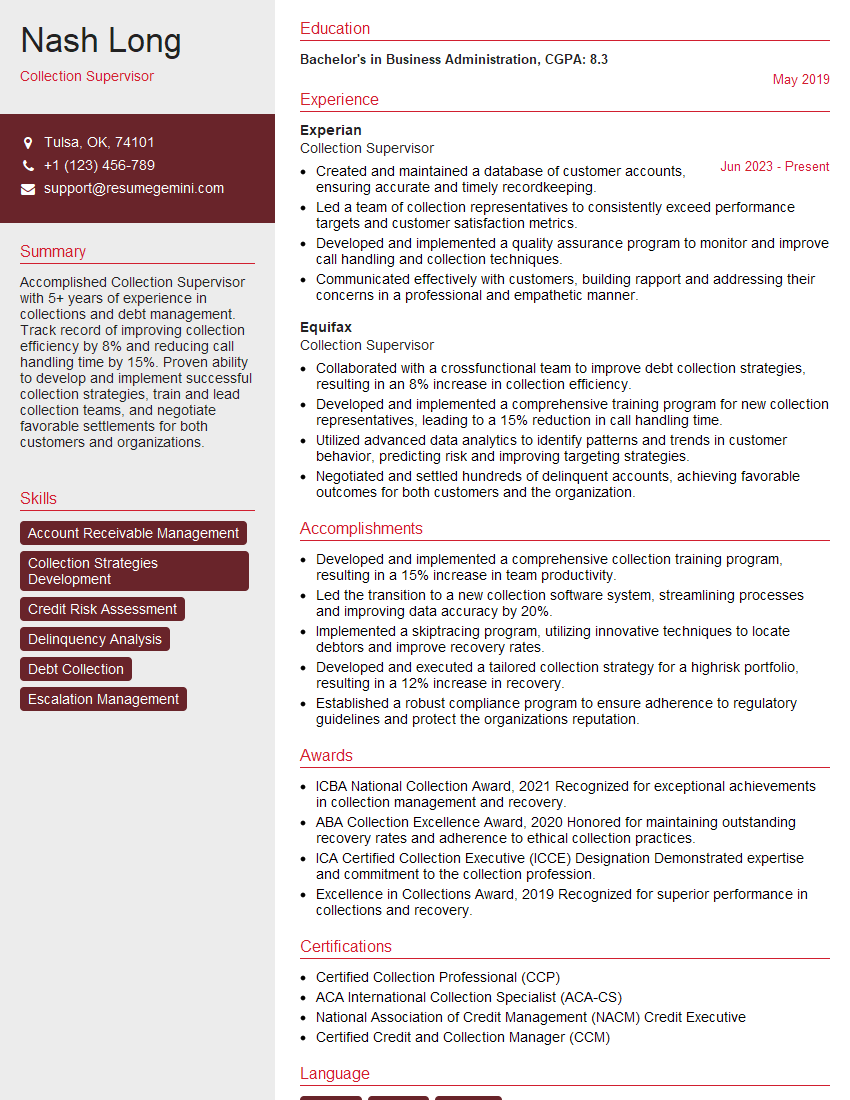

Nash Long

Collection Supervisor

Summary

Accomplished Collection Supervisor with 5+ years of experience in collections and debt management. Track record of improving collection efficiency by 8% and reducing call handling time by 15%. Proven ability to develop and implement successful collection strategies, train and lead collection teams, and negotiate favorable settlements for both customers and organizations.

Education

Bachelor’s in Business Administration

May 2019

Skills

- Account Receivable Management

- Collection Strategies Development

- Credit Risk Assessment

- Delinquency Analysis

- Debt Collection

- Escalation Management

Work Experience

Collection Supervisor

- Created and maintained a database of customer accounts, ensuring accurate and timely recordkeeping.

- Led a team of collection representatives to consistently exceed performance targets and customer satisfaction metrics.

- Developed and implemented a quality assurance program to monitor and improve call handling and collection techniques.

- Communicated effectively with customers, building rapport and addressing their concerns in a professional and empathetic manner.

Collection Supervisor

- Collaborated with a crossfunctional team to improve debt collection strategies, resulting in an 8% increase in collection efficiency.

- Developed and implemented a comprehensive training program for new collection representatives, leading to a 15% reduction in call handling time.

- Utilized advanced data analytics to identify patterns and trends in customer behavior, predicting risk and improving targeting strategies.

- Negotiated and settled hundreds of delinquent accounts, achieving favorable outcomes for both customers and the organization.

Accomplishments

- Developed and implemented a comprehensive collection training program, resulting in a 15% increase in team productivity.

- Led the transition to a new collection software system, streamlining processes and improving data accuracy by 20%.

- Implemented a skiptracing program, utilizing innovative techniques to locate debtors and improve recovery rates.

- Developed and executed a tailored collection strategy for a highrisk portfolio, resulting in a 12% increase in recovery.

- Established a robust compliance program to ensure adherence to regulatory guidelines and protect the organizations reputation.

Awards

- ICBA National Collection Award, 2021 Recognized for exceptional achievements in collection management and recovery.

- ABA Collection Excellence Award, 2020 Honored for maintaining outstanding recovery rates and adherence to ethical collection practices.

- ICA Certified Collection Executive (ICCE) Designation Demonstrated expertise and commitment to the collection profession.

- Excellence in Collections Award, 2019 Recognized for superior performance in collections and recovery.

Certificates

- Certified Collection Professional (CCP)

- ACA International Collection Specialist (ACA-CS)

- National Association of Credit Management (NACM) Credit Executive

- Certified Credit and Collection Manager (CCM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Collection Supervisor

- Highlight your experience in developing and implementing successful collection strategies.

- Showcase your ability to train and lead collection teams.

- Emphasize your negotiation and settlement skills.

- Provide specific examples of how you have improved collection efficiency and customer satisfaction.

Essential Experience Highlights for a Strong Collection Supervisor Resume

- Collaborate with cross-functional teams to improve debt collection strategies.

- Develop and implement training programs for new collection representatives.

- Utilize advanced data analytics to identify patterns and trends in customer behavior.

- Negotiate and settle delinquent accounts, achieving favorable outcomes.

- Create and maintain a database of customer accounts, ensuring accurate recordkeeping.

- Lead a team of collection representatives to consistently exceed performance targets and customer satisfaction metrics.

- Develop and implement quality assurance programs to monitor and improve call handling and collection techniques.

Frequently Asked Questions (FAQ’s) For Collection Supervisor

What are the key skills required for a Collection Supervisor?

Key skills include account receivable management, collection strategies development, credit risk assessment, delinquency analysis, debt collection, escalation management, and strong communication skills.

What are the top companies that hire Collection Supervisors?

Top companies include Experian, Equifax, TransUnion, and various financial institutions.

What is the average salary for a Collection Supervisor?

The average salary for a Collection Supervisor in the United States is around $65,000 per year.

What are the career advancement opportunities for a Collection Supervisor?

Career advancement opportunities include Manager of Collections, Director of Collections, or leadership roles within the credit and finance industry.

What are the challenges faced by a Collection Supervisor?

Challenges include managing high-volume workloads, dealing with difficult customers, and ensuring compliance with regulations and ethical guidelines.

How can I prepare for an interview for a Collection Supervisor position?

Be prepared to discuss your experience in debt collection, negotiation, and team management. Research common interview questions and practice your answers.