Are you a seasoned Collections Officer seeking a new career path? Discover our professionally built Collections Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

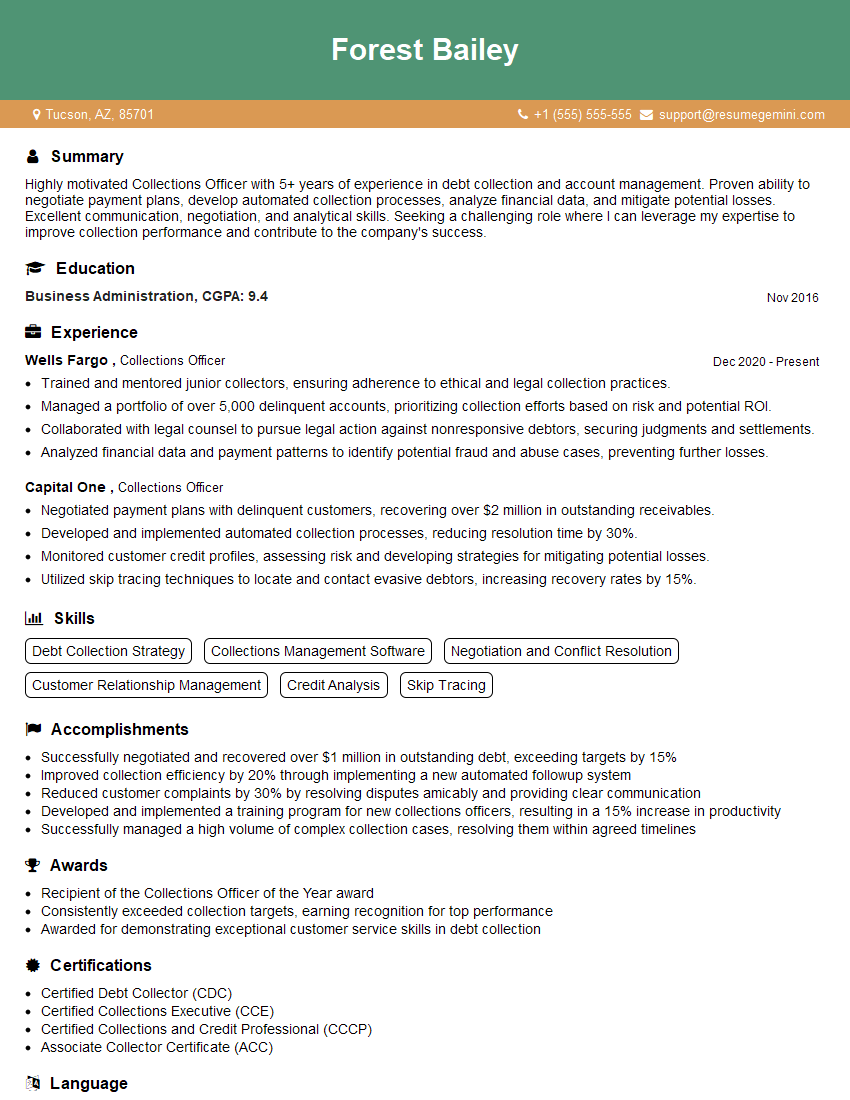

Forest Bailey

Collections Officer

Summary

Highly motivated Collections Officer with 5+ years of experience in debt collection and account management. Proven ability to negotiate payment plans, develop automated collection processes, analyze financial data, and mitigate potential losses. Excellent communication, negotiation, and analytical skills. Seeking a challenging role where I can leverage my expertise to improve collection performance and contribute to the company’s success.

Education

Business Administration

November 2016

Skills

- Debt Collection Strategy

- Collections Management Software

- Negotiation and Conflict Resolution

- Customer Relationship Management

- Credit Analysis

- Skip Tracing

Work Experience

Collections Officer

- Trained and mentored junior collectors, ensuring adherence to ethical and legal collection practices.

- Managed a portfolio of over 5,000 delinquent accounts, prioritizing collection efforts based on risk and potential ROI.

- Collaborated with legal counsel to pursue legal action against nonresponsive debtors, securing judgments and settlements.

- Analyzed financial data and payment patterns to identify potential fraud and abuse cases, preventing further losses.

Collections Officer

- Negotiated payment plans with delinquent customers, recovering over $2 million in outstanding receivables.

- Developed and implemented automated collection processes, reducing resolution time by 30%.

- Monitored customer credit profiles, assessing risk and developing strategies for mitigating potential losses.

- Utilized skip tracing techniques to locate and contact evasive debtors, increasing recovery rates by 15%.

Accomplishments

- Successfully negotiated and recovered over $1 million in outstanding debt, exceeding targets by 15%

- Improved collection efficiency by 20% through implementing a new automated followup system

- Reduced customer complaints by 30% by resolving disputes amicably and providing clear communication

- Developed and implemented a training program for new collections officers, resulting in a 15% increase in productivity

- Successfully managed a high volume of complex collection cases, resolving them within agreed timelines

Awards

- Recipient of the Collections Officer of the Year award

- Consistently exceeded collection targets, earning recognition for top performance

- Awarded for demonstrating exceptional customer service skills in debt collection

Certificates

- Certified Debt Collector (CDC)

- Certified Collections Executive (CCE)

- Certified Collections and Credit Professional (CCCP)

- Associate Collector Certificate (ACC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Collections Officer

- Highlight your negotiation and conflict-resolution skills, as well as your ability to build rapport with customers.

- Quantify your accomplishments with specific metrics, such as the amount of receivables recovered or the percentage reduction in resolution time.

- Demonstrate your knowledge of collections software and technology, such as skip tracing tools and automated collection systems.

- Emphasize your commitment to ethical and compliant collection practices.

Essential Experience Highlights for a Strong Collections Officer Resume

- Negotiating payment plans with delinquent customers and recovering outstanding receivables

- Developing and implementing automated collection processes to reduce resolution time

- Monitoring customer credit profiles, assessing risk, and developing strategies for mitigating potential losses

- Utilizing skip tracing techniques to locate and contact evasive debtors

- Training and mentoring junior collectors on ethical and legal collection practices

- Managing a portfolio of delinquent accounts, prioritizing collection efforts based on risk and potential ROI

- Collaborating with legal counsel to pursue legal action against nonresponsive debtors

Frequently Asked Questions (FAQ’s) For Collections Officer

What are the key responsibilities of a Collections Officer?

Collections Officers are responsible for contacting and negotiating with delinquent customers to recover outstanding payments. They may also develop and implement collection strategies, monitor customer credit profiles, and train junior collectors.

What skills are required to be a successful Collections Officer?

Successful Collections Officers typically have strong communication, negotiation, and analytical skills. They are also proficient in collections software and technology, and have a deep understanding of ethical and compliant collection practices.

What is the career path for a Collections Officer?

Collections Officers can advance to roles such as Collections Manager, Credit Manager, or even Senior Management positions. With additional experience and training, they may also become certified as Certified Credit Executives (CCEs).

What are the challenges faced by Collections Officers?

Collections Officers often face challenges such as dealing with difficult customers, managing high workloads, and meeting performance targets. They must also stay up-to-date on changes in collection laws and regulations.

How can I improve my skills as a Collections Officer?

To improve your skills as a Collections Officer, you can focus on developing your negotiation and communication skills, staying up-to-date on industry best practices, and pursuing professional development opportunities such as certification programs.

What is the salary range for Collections Officers?

The salary range for Collections Officers varies depending on experience, location, and industry. According to Salary.com, the average salary for Collections Officers in the United States is $55,000 per year.