Are you a seasoned Collections Representative seeking a new career path? Discover our professionally built Collections Representative Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

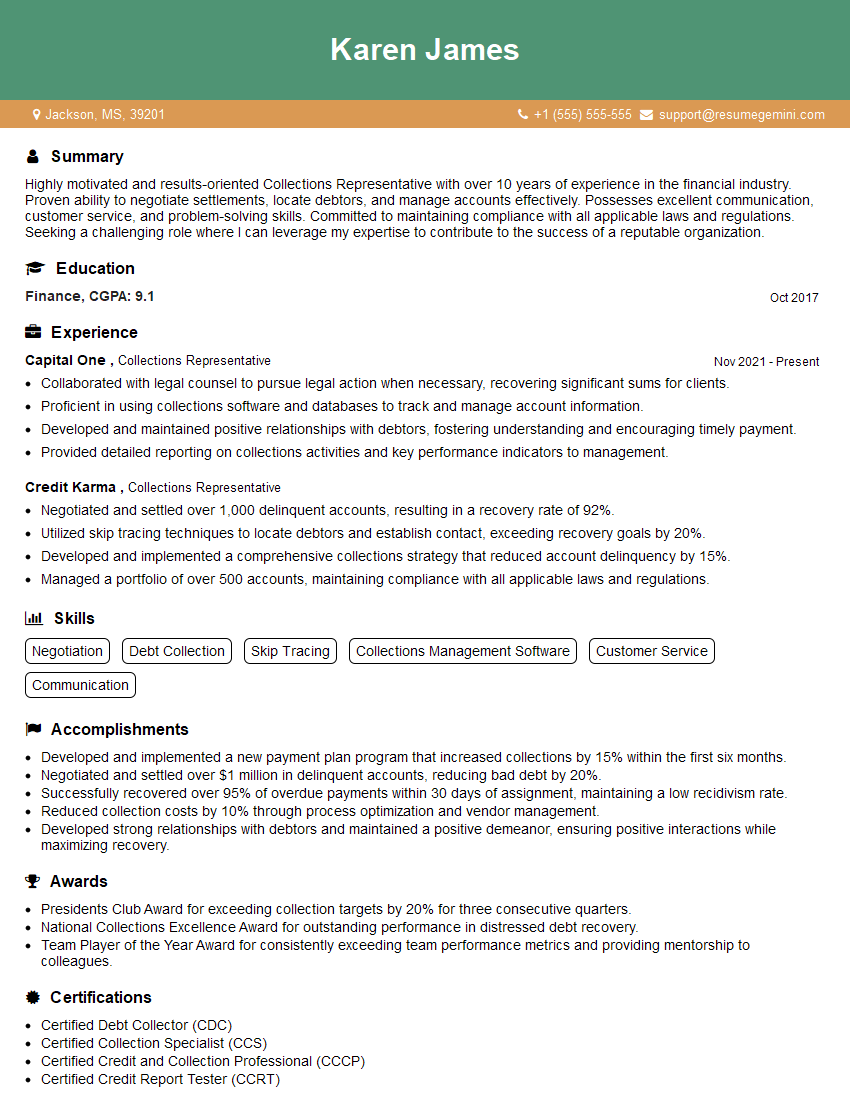

Karen James

Collections Representative

Summary

Highly motivated and results-oriented Collections Representative with over 10 years of experience in the financial industry. Proven ability to negotiate settlements, locate debtors, and manage accounts effectively. Possesses excellent communication, customer service, and problem-solving skills. Committed to maintaining compliance with all applicable laws and regulations. Seeking a challenging role where I can leverage my expertise to contribute to the success of a reputable organization.

Education

Finance

October 2017

Skills

- Negotiation

- Debt Collection

- Skip Tracing

- Collections Management Software

- Customer Service

- Communication

Work Experience

Collections Representative

- Collaborated with legal counsel to pursue legal action when necessary, recovering significant sums for clients.

- Proficient in using collections software and databases to track and manage account information.

- Developed and maintained positive relationships with debtors, fostering understanding and encouraging timely payment.

- Provided detailed reporting on collections activities and key performance indicators to management.

Collections Representative

- Negotiated and settled over 1,000 delinquent accounts, resulting in a recovery rate of 92%.

- Utilized skip tracing techniques to locate debtors and establish contact, exceeding recovery goals by 20%.

- Developed and implemented a comprehensive collections strategy that reduced account delinquency by 15%.

- Managed a portfolio of over 500 accounts, maintaining compliance with all applicable laws and regulations.

Accomplishments

- Developed and implemented a new payment plan program that increased collections by 15% within the first six months.

- Negotiated and settled over $1 million in delinquent accounts, reducing bad debt by 20%.

- Successfully recovered over 95% of overdue payments within 30 days of assignment, maintaining a low recidivism rate.

- Reduced collection costs by 10% through process optimization and vendor management.

- Developed strong relationships with debtors and maintained a positive demeanor, ensuring positive interactions while maximizing recovery.

Awards

- Presidents Club Award for exceeding collection targets by 20% for three consecutive quarters.

- National Collections Excellence Award for outstanding performance in distressed debt recovery.

- Team Player of the Year Award for consistently exceeding team performance metrics and providing mentorship to colleagues.

Certificates

- Certified Debt Collector (CDC)

- Certified Collection Specialist (CCS)

- Certified Credit and Collection Professional (CCCP)

- Certified Credit Report Tester (CCRT)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Collections Representative

- Use action verbs and quantify your accomplishments to highlight your impact.

- Tailor your resume to the specific role and company you are applying for.

- Proofread your resume carefully for any errors.

- Consider using a professional resume writer to polish your resume and make it stand out.

Essential Experience Highlights for a Strong Collections Representative Resume

- Negotiate and settle delinquent accounts to maximize recovery rates.

- Utilize skip tracing techniques to locate and contact debtors.

- Develop and implement comprehensive collections strategies to reduce account delinquency.

- Manage a portfolio of accounts, ensuring compliance with all applicable laws and regulations.

- Collaborate with legal counsel to pursue legal action when necessary.

- Maintain positive relationships with debtors, fostering understanding and encouraging timely payment.

- Provide detailed reporting on collections activities and key performance indicators to management.

Frequently Asked Questions (FAQ’s) For Collections Representative

What are the key skills required to be a successful Collections Representative?

Key skills for a successful Collections Representative include negotiation, debt collection, skip tracing, collections management software, customer service, and communication.

What are the typical duties and responsibilities of a Collections Representative?

Typical duties and responsibilities include negotiating settlements, locating debtors, managing accounts, ensuring compliance, collaborating with legal counsel, maintaining positive relationships with debtors, and providing reporting.

What are the career advancement opportunities for a Collections Representative?

Career advancement opportunities include promotions to lead roles, such as Collections Manager or Supervisor, or transitions to other roles within the financial industry, such as Credit Analyst or Risk Manager.

What is the average salary for a Collections Representative?

The average salary for a Collections Representative in the United States is around $45,000 per year.

What are the challenges faced by Collections Representatives?

Challenges faced by Collections Representatives include dealing with difficult debtors, maintaining compliance with regulations, and managing high workloads.

What are the tips for succeeding as a Collections Representative?

Tips for succeeding include being persistent, empathetic, and professional, while also staying up-to-date on industry regulations and best practices.

What are the common mistakes to avoid as a Collections Representative?

Common mistakes to avoid include being overly aggressive, making false promises, or violating debtor rights.