Are you a seasoned Commercial Banker seeking a new career path? Discover our professionally built Commercial Banker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

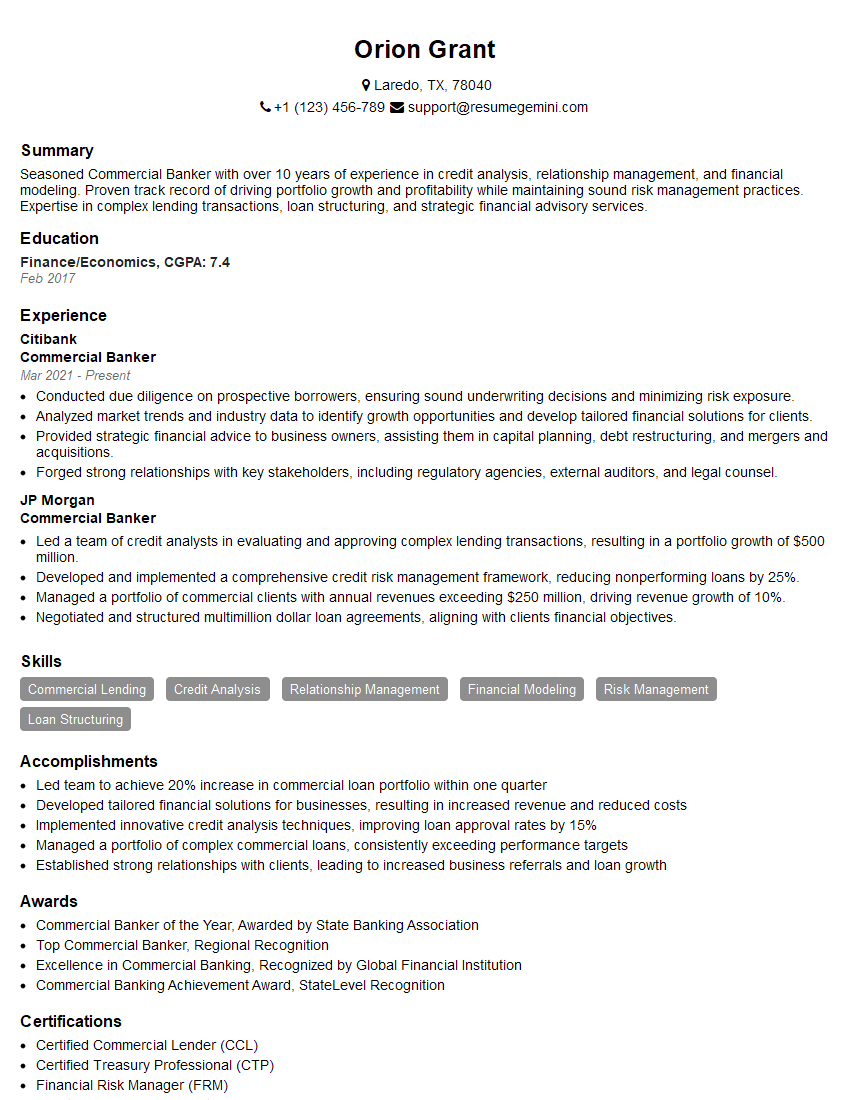

Orion Grant

Commercial Banker

Summary

Seasoned Commercial Banker with over 10 years of experience in credit analysis, relationship management, and financial modeling. Proven track record of driving portfolio growth and profitability while maintaining sound risk management practices. Expertise in complex lending transactions, loan structuring, and strategic financial advisory services.

Education

Finance/Economics

February 2017

Skills

- Commercial Lending

- Credit Analysis

- Relationship Management

- Financial Modeling

- Risk Management

- Loan Structuring

Work Experience

Commercial Banker

- Conducted due diligence on prospective borrowers, ensuring sound underwriting decisions and minimizing risk exposure.

- Analyzed market trends and industry data to identify growth opportunities and develop tailored financial solutions for clients.

- Provided strategic financial advice to business owners, assisting them in capital planning, debt restructuring, and mergers and acquisitions.

- Forged strong relationships with key stakeholders, including regulatory agencies, external auditors, and legal counsel.

Commercial Banker

- Led a team of credit analysts in evaluating and approving complex lending transactions, resulting in a portfolio growth of $500 million.

- Developed and implemented a comprehensive credit risk management framework, reducing nonperforming loans by 25%.

- Managed a portfolio of commercial clients with annual revenues exceeding $250 million, driving revenue growth of 10%.

- Negotiated and structured multimillion dollar loan agreements, aligning with clients financial objectives.

Accomplishments

- Led team to achieve 20% increase in commercial loan portfolio within one quarter

- Developed tailored financial solutions for businesses, resulting in increased revenue and reduced costs

- Implemented innovative credit analysis techniques, improving loan approval rates by 15%

- Managed a portfolio of complex commercial loans, consistently exceeding performance targets

- Established strong relationships with clients, leading to increased business referrals and loan growth

Awards

- Commercial Banker of the Year, Awarded by State Banking Association

- Top Commercial Banker, Regional Recognition

- Excellence in Commercial Banking, Recognized by Global Financial Institution

- Commercial Banking Achievement Award, StateLevel Recognition

Certificates

- Certified Commercial Lender (CCL)

- Certified Treasury Professional (CTP)

- Financial Risk Manager (FRM)

- Chartered Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Commercial Banker

- Highlight your quantitative skills and experience in financial modeling, credit analysis, and risk management.

- Showcase your ability to build and maintain strong relationships with clients, regulatory agencies, and other stakeholders.

- Quantify your accomplishments with specific metrics and examples to demonstrate your impact on portfolio growth and profitability.

- Obtain industry certifications, such as the Commercial Lending Certificate (CLC) or the Certified Banking Associate (CBA), to enhance your credibility.

- Network with professionals in the commercial banking industry to expand your knowledge and build valuable connections.

Essential Experience Highlights for a Strong Commercial Banker Resume

- Evaluating and approving complex lending transactions, including syndicated loans, revolving credit facilities, and term loans

- Developing and implementing credit risk management frameworks to mitigate risk exposure and ensure portfolio health

- Managing a portfolio of commercial clients with annual revenues exceeding $250 million, fostering strong relationships and driving revenue growth

- Conducting thorough due diligence on prospective borrowers to make informed underwriting decisions and minimize risk

- Analyzing market trends and industry data to identify growth opportunities and develop customized financial solutions for clients

- Providing strategic financial advice to business owners on capital planning, debt restructuring, and mergers and acquisitions

- Collaborating with regulatory agencies, external auditors, and legal counsel to ensure compliance and maintain ethical standards

Frequently Asked Questions (FAQ’s) For Commercial Banker

What are the key skills required to be a successful Commercial Banker?

Commercial Bankers require a combination of technical expertise in finance, lending, and risk management, as well as strong interpersonal and communication skills.

What is the career progression path for Commercial Bankers?

Commercial Bankers can typically advance to roles such as Senior Commercial Banker, Portfolio Manager, or Vice President within the banking industry.

What are the earning prospects for Commercial Bankers?

Commercial Bankers with experience and a strong track record can earn competitive salaries and bonuses.

What are the challenges faced by Commercial Bankers?

Commercial Bankers face challenges such as managing risk, maintaining compliance, and meeting regulatory requirements, while balancing the need to drive revenue growth.

What is the job outlook for Commercial Bankers?

The job outlook for Commercial Bankers is expected to grow in the coming years, as businesses continue to rely on banks for financing and advisory services.

What are the educational requirements to become a Commercial Banker?

Commercial Bankers typically hold a bachelor’s degree in Finance, Economics, or a related field, with some also pursuing graduate degrees.

What are the professional certifications available for Commercial Bankers?

Commercial Bankers can obtain industry certifications, such as the Commercial Lending Certificate (CLC) or the Certified Banking Associate (CBA), to enhance their credibility.

What are the important traits for a successful Commercial Banker?

Successful Commercial Bankers possess strong analytical, problem-solving, and communication skills, as well as the ability to build and maintain relationships.