Are you a seasoned Commercial Credit Officer seeking a new career path? Discover our professionally built Commercial Credit Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

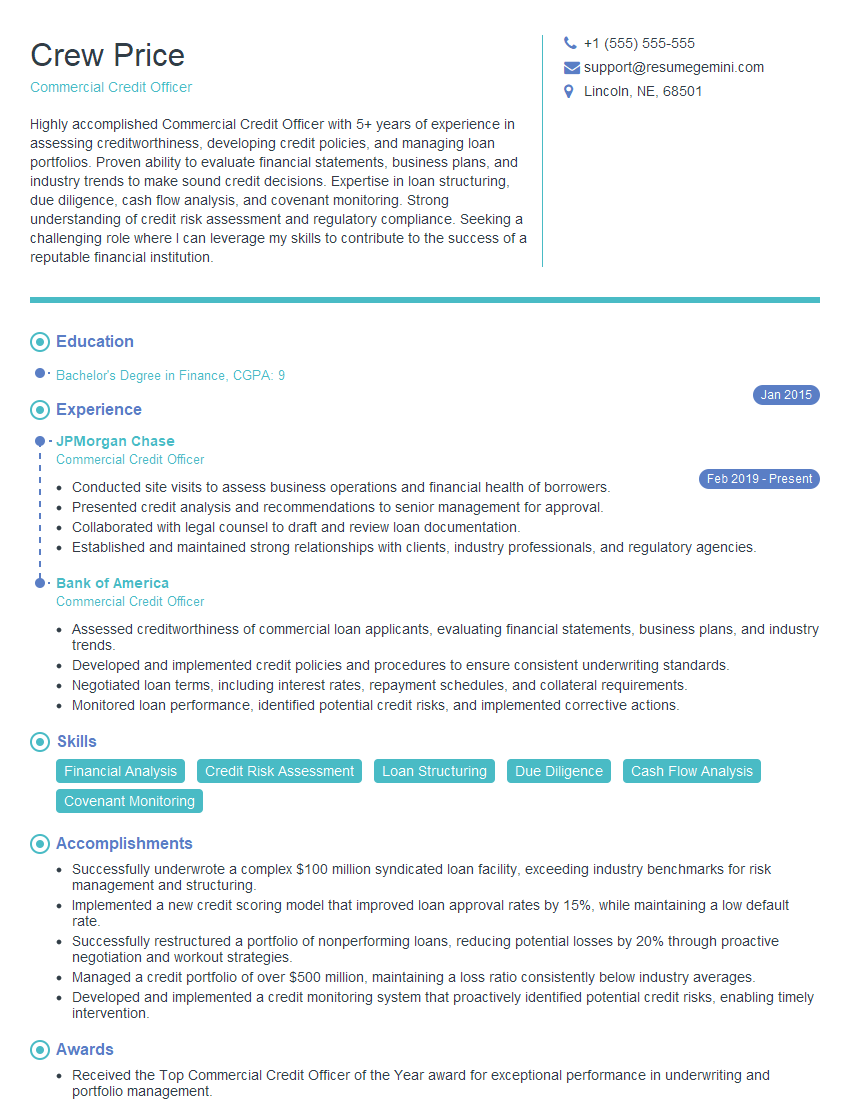

Crew Price

Commercial Credit Officer

Summary

Highly accomplished Commercial Credit Officer with 5+ years of experience in assessing creditworthiness, developing credit policies, and managing loan portfolios. Proven ability to evaluate financial statements, business plans, and industry trends to make sound credit decisions. Expertise in loan structuring, due diligence, cash flow analysis, and covenant monitoring. Strong understanding of credit risk assessment and regulatory compliance. Seeking a challenging role where I can leverage my skills to contribute to the success of a reputable financial institution.

Education

Bachelor’s Degree in Finance

January 2015

Skills

- Financial Analysis

- Credit Risk Assessment

- Loan Structuring

- Due Diligence

- Cash Flow Analysis

- Covenant Monitoring

Work Experience

Commercial Credit Officer

- Conducted site visits to assess business operations and financial health of borrowers.

- Presented credit analysis and recommendations to senior management for approval.

- Collaborated with legal counsel to draft and review loan documentation.

- Established and maintained strong relationships with clients, industry professionals, and regulatory agencies.

Commercial Credit Officer

- Assessed creditworthiness of commercial loan applicants, evaluating financial statements, business plans, and industry trends.

- Developed and implemented credit policies and procedures to ensure consistent underwriting standards.

- Negotiated loan terms, including interest rates, repayment schedules, and collateral requirements.

- Monitored loan performance, identified potential credit risks, and implemented corrective actions.

Accomplishments

- Successfully underwrote a complex $100 million syndicated loan facility, exceeding industry benchmarks for risk management and structuring.

- Implemented a new credit scoring model that improved loan approval rates by 15%, while maintaining a low default rate.

- Successfully restructured a portfolio of nonperforming loans, reducing potential losses by 20% through proactive negotiation and workout strategies.

- Managed a credit portfolio of over $500 million, maintaining a loss ratio consistently below industry averages.

- Developed and implemented a credit monitoring system that proactively identified potential credit risks, enabling timely intervention.

Awards

- Received the Top Commercial Credit Officer of the Year award for exceptional performance in underwriting and portfolio management.

- Recognized as Credit Analyst of the Year within the Risk Management team for consistently delivering accurate and insightful credit analysis.

- Awarded Credit Officer of the Quarter for exceptional customer service and problemsolving skills, resolving complex credit issues effectively.

- Received Team Leader of the Year award for mentoring and developing junior credit officers, fostering a highperforming team environment.

Certificates

- Certified Commercial Credit Analyst (CCA)

- Certified Risk Professional (CRP)

- Chartered Financial Analyst (CFA)

- Certified Bank Auditor (CBA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Commercial Credit Officer

- Highlight your financial analysis and credit risk assessment skills

- Demonstrate your experience in loan structuring and due diligence

- Showcase your ability to manage loan portfolios and monitor loan performance

- Emphasize your strong understanding of credit risk assessment and regulatory compliance

- Quantify your accomplishments and provide specific examples of your success

Essential Experience Highlights for a Strong Commercial Credit Officer Resume

- Assessed creditworthiness of commercial loan applicants by evaluating financial statements, business plans, and industry trends

- Developed and implemented credit policies and procedures to ensure consistent underwriting standards

- Negotiated loan terms, including interest rates, repayment schedules, and collateral requirements

- Monitored loan performance, identified potential credit risks, and implemented corrective actions

- Conducted site visits to assess business operations and financial health of borrowers

- Presented credit analysis and recommendations to senior management for approval

- Collaborated with legal counsel to draft and review loan documentation

Frequently Asked Questions (FAQ’s) For Commercial Credit Officer

What are the key responsibilities of a Commercial Credit Officer?

The key responsibilities of a Commercial Credit Officer include assessing creditworthiness, developing credit policies, negotiating loan terms, monitoring loan performance, and collaborating with legal counsel.

What qualifications are required to become a Commercial Credit Officer?

To become a Commercial Credit Officer, a bachelor’s degree in finance or a related field is typically required. Additionally, 3-5 years of experience in commercial lending or a related field is also typically required.

What are the career prospects for Commercial Credit Officers?

Commercial Credit Officers can advance to senior roles within their organization, such as Credit Manager or Vice President of Commercial Lending. They may also move into other areas of finance, such as investment banking or private equity.

What is the average salary for a Commercial Credit Officer?

The average salary for a Commercial Credit Officer in the United States is around $75,000 per year.

What are the top skills for a Commercial Credit Officer?

The top skills for a Commercial Credit Officer include financial analysis, credit risk assessment, loan structuring, due diligence, and strong communication and interpersonal skills.