Are you a seasoned Commercial Lines Insurance Agent seeking a new career path? Discover our professionally built Commercial Lines Insurance Agent Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

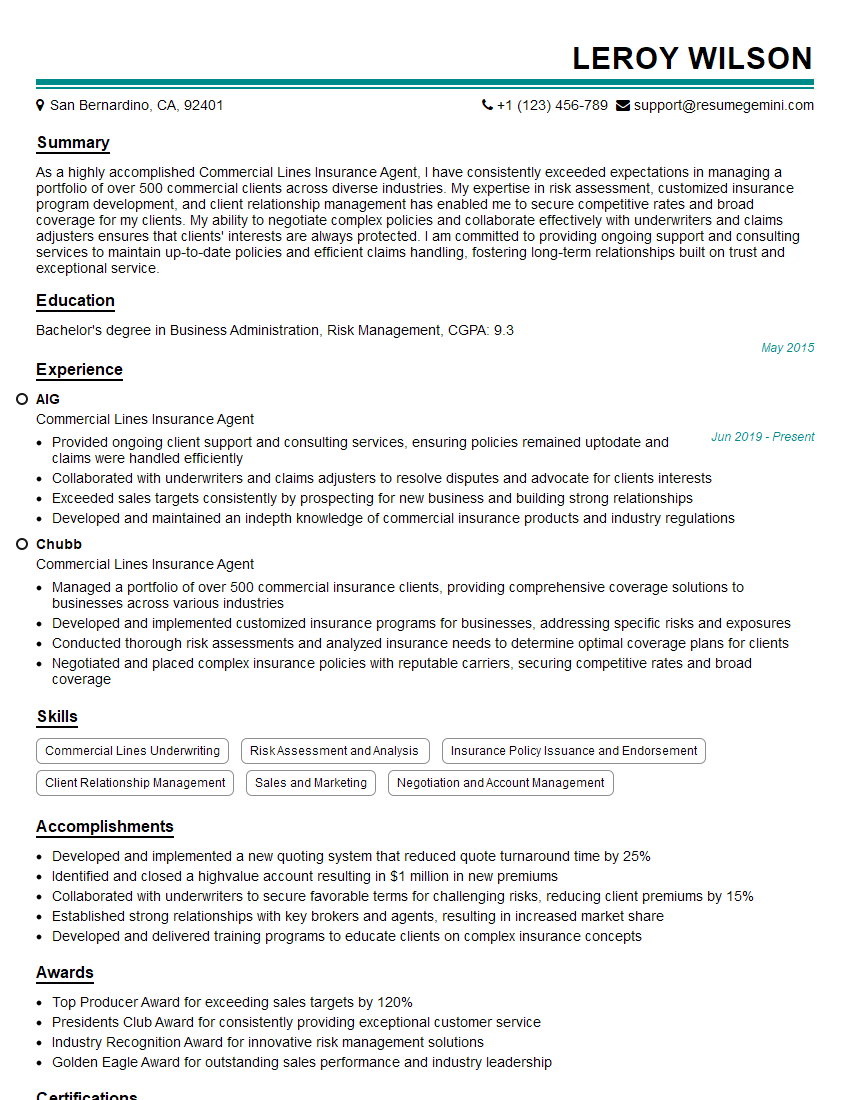

Leroy Wilson

Commercial Lines Insurance Agent

Summary

As a highly accomplished Commercial Lines Insurance Agent, I have consistently exceeded expectations in managing a portfolio of over 500 commercial clients across diverse industries. My expertise in risk assessment, customized insurance program development, and client relationship management has enabled me to secure competitive rates and broad coverage for my clients. My ability to negotiate complex policies and collaborate effectively with underwriters and claims adjusters ensures that clients’ interests are always protected. I am committed to providing ongoing support and consulting services to maintain up-to-date policies and efficient claims handling, fostering long-term relationships built on trust and exceptional service.

Education

Bachelor’s degree in Business Administration, Risk Management

May 2015

Skills

- Commercial Lines Underwriting

- Risk Assessment and Analysis

- Insurance Policy Issuance and Endorsement

- Client Relationship Management

- Sales and Marketing

- Negotiation and Account Management

Work Experience

Commercial Lines Insurance Agent

- Provided ongoing client support and consulting services, ensuring policies remained uptodate and claims were handled efficiently

- Collaborated with underwriters and claims adjusters to resolve disputes and advocate for clients interests

- Exceeded sales targets consistently by prospecting for new business and building strong relationships

- Developed and maintained an indepth knowledge of commercial insurance products and industry regulations

Commercial Lines Insurance Agent

- Managed a portfolio of over 500 commercial insurance clients, providing comprehensive coverage solutions to businesses across various industries

- Developed and implemented customized insurance programs for businesses, addressing specific risks and exposures

- Conducted thorough risk assessments and analyzed insurance needs to determine optimal coverage plans for clients

- Negotiated and placed complex insurance policies with reputable carriers, securing competitive rates and broad coverage

Accomplishments

- Developed and implemented a new quoting system that reduced quote turnaround time by 25%

- Identified and closed a highvalue account resulting in $1 million in new premiums

- Collaborated with underwriters to secure favorable terms for challenging risks, reducing client premiums by 15%

- Established strong relationships with key brokers and agents, resulting in increased market share

- Developed and delivered training programs to educate clients on complex insurance concepts

Awards

- Top Producer Award for exceeding sales targets by 120%

- Presidents Club Award for consistently providing exceptional customer service

- Industry Recognition Award for innovative risk management solutions

- Golden Eagle Award for outstanding sales performance and industry leadership

Certificates

- Certified Insurance Counselor (CIC)

- Associate in Commercial Underwriting (AU)

- Certified Risk Manager (CRM)

- Associate in Risk Management (ARM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Commercial Lines Insurance Agent

- Highlight your expertise in commercial insurance products and industry regulations.

- Showcase your ability to build and maintain strong client relationships.

- Emphasize your negotiation and account management skills.

- Demonstrate your commitment to continuing education and professional development.

Essential Experience Highlights for a Strong Commercial Lines Insurance Agent Resume

- Managed a portfolio of over 500 commercial insurance clients, providing comprehensive coverage solutions to businesses across various industries

- Developed and implemented customized insurance programs for businesses, addressing specific risks and exposures

- Conducted thorough risk assessments and analyzed insurance needs to determine optimal coverage plans for clients

- Negotiated and placed complex insurance policies with reputable carriers, securing competitive rates and broad coverage

- Provided ongoing client support and consulting services, ensuring policies remained up-to-date and claims were handled efficiently

- Collaborated with underwriters and claims adjusters to resolve disputes and advocate for clients’ interests

- Exceeded sales targets consistently by prospecting for new business and building strong relationships

Frequently Asked Questions (FAQ’s) For Commercial Lines Insurance Agent

What are the key responsibilities of a Commercial Lines Insurance Agent?

Commercial Lines Insurance Agents are responsible for managing a portfolio of commercial clients, conducting risk assessments, developing customized insurance programs, negotiating and placing policies, providing ongoing client support, collaborating with underwriters and claims adjusters, and exceeding sales targets.

What are the essential skills for a successful Commercial Lines Insurance Agent?

Successful Commercial Lines Insurance Agents possess expertise in commercial insurance products and industry regulations, strong client relationship management skills, negotiation and account management abilities, and a commitment to continuing education and professional development.

What industries do Commercial Lines Insurance Agents typically work with?

Commercial Lines Insurance Agents work with businesses across various industries, including construction, manufacturing, healthcare, retail, and technology.

How can I become a Commercial Lines Insurance Agent?

To become a Commercial Lines Insurance Agent, you typically need a bachelor’s degree in Business Administration, Risk Management, or a related field, along with relevant experience in the insurance industry. Obtaining industry certifications and licenses is also recommended.

What is the career outlook for Commercial Lines Insurance Agents?

The career outlook for Commercial Lines Insurance Agents is projected to be positive due to the increasing demand for specialized insurance services for businesses.

What are the top companies that hire Commercial Lines Insurance Agents?

Top companies that hire Commercial Lines Insurance Agents include AIG, Chubb, Liberty Mutual, Travelers, and Zurich.

What is the average salary for a Commercial Lines Insurance Agent?

The average salary for a Commercial Lines Insurance Agent can vary depending on experience, location, and company. According to the U.S. Bureau of Labor Statistics, the median annual salary for insurance sales agents is around $53,000.

What are the benefits of working as a Commercial Lines Insurance Agent?

Benefits of working as a Commercial Lines Insurance Agent include competitive salary and benefits, opportunities for career advancement, and the chance to make a positive impact on businesses by providing essential risk management solutions.