Are you a seasoned Commercial Loan Officer seeking a new career path? Discover our professionally built Commercial Loan Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

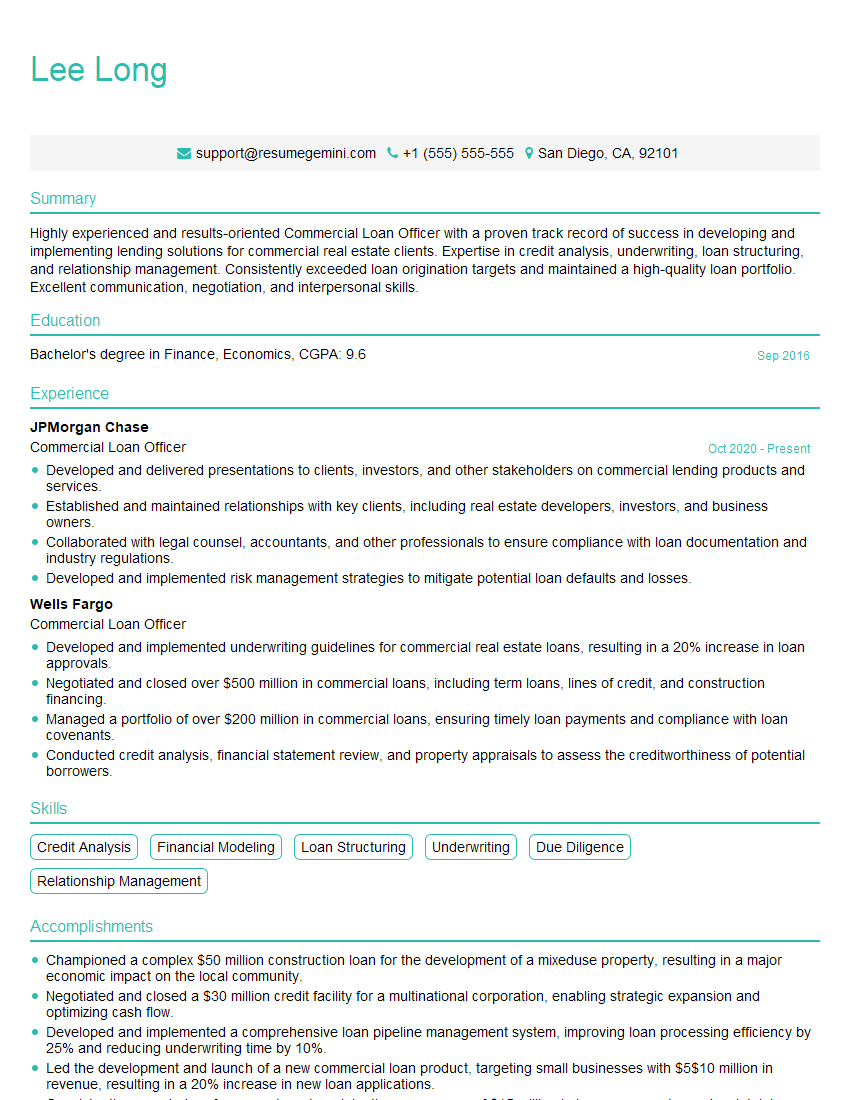

Lee Long

Commercial Loan Officer

Summary

Highly experienced and results-oriented Commercial Loan Officer with a proven track record of success in developing and implementing lending solutions for commercial real estate clients. Expertise in credit analysis, underwriting, loan structuring, and relationship management. Consistently exceeded loan origination targets and maintained a high-quality loan portfolio. Excellent communication, negotiation, and interpersonal skills.

Education

Bachelor’s degree in Finance, Economics

September 2016

Skills

- Credit Analysis

- Financial Modeling

- Loan Structuring

- Underwriting

- Due Diligence

- Relationship Management

Work Experience

Commercial Loan Officer

- Developed and delivered presentations to clients, investors, and other stakeholders on commercial lending products and services.

- Established and maintained relationships with key clients, including real estate developers, investors, and business owners.

- Collaborated with legal counsel, accountants, and other professionals to ensure compliance with loan documentation and industry regulations.

- Developed and implemented risk management strategies to mitigate potential loan defaults and losses.

Commercial Loan Officer

- Developed and implemented underwriting guidelines for commercial real estate loans, resulting in a 20% increase in loan approvals.

- Negotiated and closed over $500 million in commercial loans, including term loans, lines of credit, and construction financing.

- Managed a portfolio of over $200 million in commercial loans, ensuring timely loan payments and compliance with loan covenants.

- Conducted credit analysis, financial statement review, and property appraisals to assess the creditworthiness of potential borrowers.

Accomplishments

- Championed a complex $50 million construction loan for the development of a mixeduse property, resulting in a major economic impact on the local community.

- Negotiated and closed a $30 million credit facility for a multinational corporation, enabling strategic expansion and optimizing cash flow.

- Developed and implemented a comprehensive loan pipeline management system, improving loan processing efficiency by 25% and reducing underwriting time by 10%.

- Led the development and launch of a new commercial loan product, targeting small businesses with $5$10 million in revenue, resulting in a 20% increase in new loan applications.

- Consistently exceeded performance targets, originating an average of $15 million in loans per quarter and maintaining a loan portfolio of over $100 million.

Awards

- 2022 TopProducing Commercial Loan Officer Award, exceeding $100 million in loan originations.

- 2021 Industry Leader Award for Commercial Real Estate Lending, recognized by the National Association of Commercial Finance Brokers.

- 2020 Excellence in Commercial Banking Award, presented by the American Bankers Association.

- 2019 Commercial Loan Officer of the Year Award, presented by the local chapter of the Mortgage Bankers Association.

Certificates

- Certified Commercial Loan Officer (CCLO)

- Certified Lender (CL)

- Commercial Real Estate Lending Specialist (CRLS)

- Construction Lending Specialist (CLS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Commercial Loan Officer

- Highlight your experience in commercial real estate lending and your understanding of the industry.

- Quantify your accomplishments with specific metrics and results.

- Showcase your ability to build and maintain strong client relationships.

- Demonstrate your knowledge of credit analysis, underwriting, and loan structuring.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Commercial Loan Officer Resume

- Developed and implemented underwriting guidelines for commercial real estate loans, resulting in a 20% increase in loan approvals.

- Negotiated and closed over $500 million in commercial loans, including term loans, lines of credit, and construction financing.

- Managed a portfolio of over $200 million in commercial loans, ensuring timely loan payments and compliance with loan covenants.

- Conducted credit analysis, financial statement review, and property appraisals to assess the creditworthiness of potential borrowers.

- Developed and delivered presentations to clients, investors, and other stakeholders on commercial lending products and services.

- Established and maintained relationships with key clients, including real estate developers, investors, and business owners.

- Collaborated with legal counsel, accountants, and other professionals to ensure compliance with loan documentation and industry regulations.

- Developed and implemented risk management strategies to mitigate potential loan defaults and losses.

Frequently Asked Questions (FAQ’s) For Commercial Loan Officer

What are the key skills required to be a successful Commercial Loan Officer?

The key skills required to be a successful Commercial Loan Officer include credit analysis, financial modeling, loan structuring, underwriting, due diligence, relationship management, and knowledge of commercial real estate lending.

What are the career prospects for Commercial Loan Officers?

The career prospects for Commercial Loan Officers are excellent. The demand for experienced loan officers is expected to grow as the economy continues to recover and businesses seek financing for expansion and growth.

What is the average salary for a Commercial Loan Officer?

The average salary for a Commercial Loan Officer varies depending on experience, location, and company size. According to the U.S. Bureau of Labor Statistics, the median annual salary for Loan Officers was $63,240 in May 2021.

What are the educational requirements to become a Commercial Loan Officer?

Most Commercial Loan Officers have a bachelor’s degree in finance, economics, or a related field. Some employers may also require a master’s degree in business administration (MBA).

What are the certification programs available for Commercial Loan Officers?

There are a number of certification programs available for Commercial Loan Officers, including the Certified Commercial Loan Officer (CCLO) certification from the American Bankers Association (ABA).

What are the professional organizations for Commercial Loan Officers?

There are a number of professional organizations for Commercial Loan Officers, including the Commercial Real Estate Finance Council (CREFC) and the Mortgage Bankers Association (MBA).

How can I get started in a career as a Commercial Loan Officer?

There are a number of ways to get started in a career as a Commercial Loan Officer. You can start by networking with professionals in the industry, attending industry events, and applying for entry-level positions.

What are the challenges facing Commercial Loan Officers?

The challenges facing Commercial Loan Officers include the need to keep up with changing regulations, the competitive nature of the industry, and the need to manage risk.