Are you a seasoned Commercial Underwriter seeking a new career path? Discover our professionally built Commercial Underwriter Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

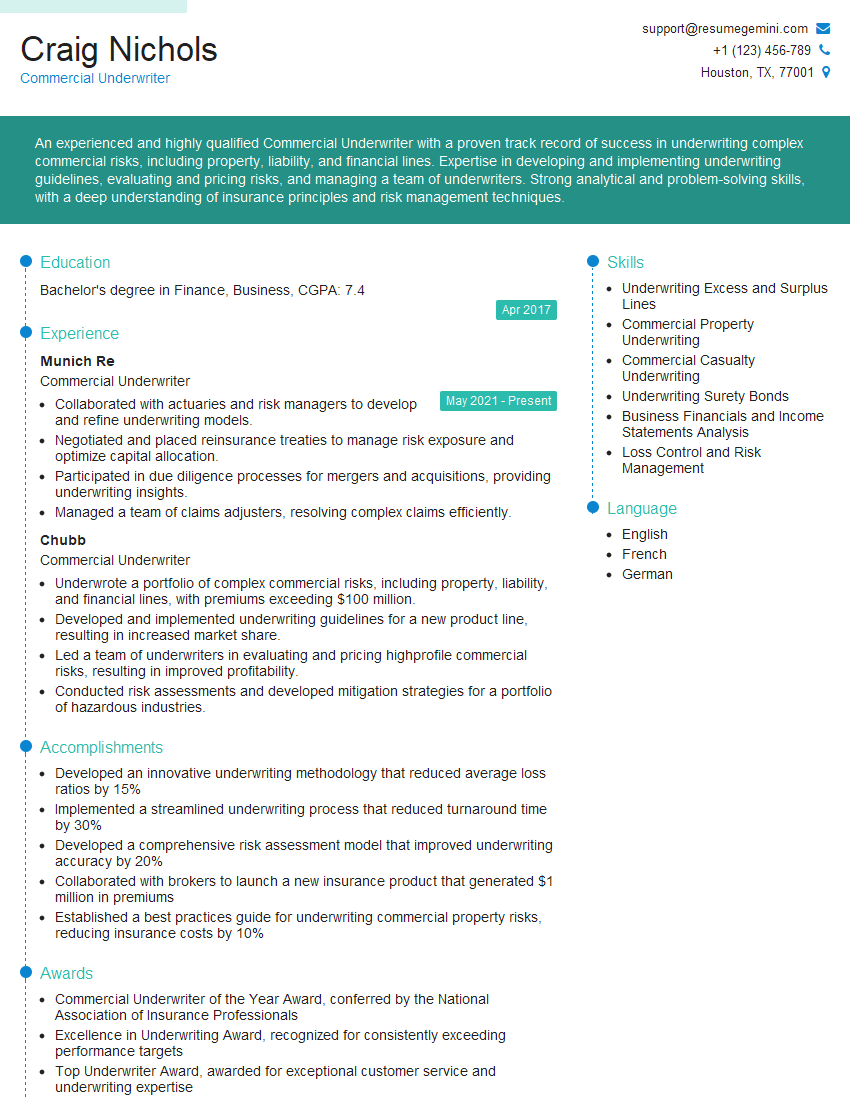

Craig Nichols

Commercial Underwriter

Summary

An experienced and highly qualified Commercial Underwriter with a proven track record of success in underwriting complex commercial risks, including property, liability, and financial lines. Expertise in developing and implementing underwriting guidelines, evaluating and pricing risks, and managing a team of underwriters. Strong analytical and problem-solving skills, with a deep understanding of insurance principles and risk management techniques.

Education

Bachelor’s degree in Finance, Business

April 2017

Skills

- Underwriting Excess and Surplus Lines

- Commercial Property Underwriting

- Commercial Casualty Underwriting

- Underwriting Surety Bonds

- Business Financials and Income Statements Analysis

- Loss Control and Risk Management

Work Experience

Commercial Underwriter

- Collaborated with actuaries and risk managers to develop and refine underwriting models.

- Negotiated and placed reinsurance treaties to manage risk exposure and optimize capital allocation.

- Participated in due diligence processes for mergers and acquisitions, providing underwriting insights.

- Managed a team of claims adjusters, resolving complex claims efficiently.

Commercial Underwriter

- Underwrote a portfolio of complex commercial risks, including property, liability, and financial lines, with premiums exceeding $100 million.

- Developed and implemented underwriting guidelines for a new product line, resulting in increased market share.

- Led a team of underwriters in evaluating and pricing highprofile commercial risks, resulting in improved profitability.

- Conducted risk assessments and developed mitigation strategies for a portfolio of hazardous industries.

Accomplishments

- Developed an innovative underwriting methodology that reduced average loss ratios by 15%

- Implemented a streamlined underwriting process that reduced turnaround time by 30%

- Developed a comprehensive risk assessment model that improved underwriting accuracy by 20%

- Collaborated with brokers to launch a new insurance product that generated $1 million in premiums

- Established a best practices guide for underwriting commercial property risks, reducing insurance costs by 10%

Awards

- Commercial Underwriter of the Year Award, conferred by the National Association of Insurance Professionals

- Excellence in Underwriting Award, recognized for consistently exceeding performance targets

- Top Underwriter Award, awarded for exceptional customer service and underwriting expertise

- Commercial Underwriter of Distinction Award, presented by the Independent Insurance Agents and Brokers of America

Certificates

- Associate in Risk Management (ARM)

- Certified Insurance Counselor (CIC)

- Chartered Property Casualty Underwriter (CPCU)

- Construction Risk and Insurance Specialist (CRIS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Commercial Underwriter

- Highlight your experience in underwriting complex commercial risks.

- Showcase your ability to develop and implement underwriting guidelines.

- Demonstrate your skills in evaluating and pricing risks.

- Emphasize your knowledge of insurance principles and risk management techniques.

- Quantify your accomplishments with specific metrics and examples.

Essential Experience Highlights for a Strong Commercial Underwriter Resume

- Underwrite a portfolio of commercial risks, including property, liability, and financial lines

- Develop and implement underwriting guidelines for new and existing product lines

- Evaluate and price risks using a variety of underwriting tools and techniques

- Conduct risk assessments and develop mitigation strategies for hazardous industries

- Negotiate and place reinsurance treaties to manage risk exposure and optimize capital allocation

- Participate in due diligence processes for mergers and acquisitions

- Manage a team of underwriters and claims adjusters

Frequently Asked Questions (FAQ’s) For Commercial Underwriter

What is the role of a Commercial Underwriter?

A Commercial Underwriter assesses and evaluates the risk associated with insuring commercial entities, such as businesses and organizations. They determine the appropriate insurance coverage and premiums based on the risk profile of the insured.

What are the key skills required for a Commercial Underwriter?

Strong analytical and problem-solving abilities, expertise in underwriting principles and risk management, proficiency in financial analysis, excellent communication and negotiation skills, and knowledge of insurance regulations and industry best practices.

What industries do Commercial Underwriters typically work in?

Commercial Underwriters work in various industries, including insurance companies, reinsurance companies, and insurance brokerages. They may specialize in specific sectors, such as property and casualty insurance, liability insurance, or financial lines insurance.

What is the career path for a Commercial Underwriter?

With experience and expertise, Commercial Underwriters can advance to roles such as Senior Underwriter, Underwriting Manager, or Chief Underwriting Officer. They may also transition into related fields like risk management or insurance consulting.

What is the job outlook for Commercial Underwriters?

The job outlook for Commercial Underwriters is expected to be favorable due to the increasing demand for insurance coverage and risk management services. Technological advancements and the growing complexity of risks are also driving the need for skilled professionals in this field.

What are the earning prospects for Commercial Underwriters?

Commercial Underwriters can earn competitive salaries commensurate with their experience, expertise, and industry specialization. Senior-level underwriters with specialized knowledge and a strong track record can command higher salaries.

What are the educational requirements for Commercial Underwriters?

Commercial Underwriters typically hold a Bachelor’s degree in Finance, Business, or a related field. Some may also pursue professional designations or certifications, such as the Associate in Commercial Underwriting (AU) or the Chartered Property Casualty Underwriter (CPCU), to enhance their credibility and expertise.

What are the soft skills required for Commercial Underwriters?

Commercial Underwriters should possess excellent communication and interpersonal skills, as they interact with clients, brokers, and other stakeholders regularly. They should also be detail-oriented, organized, and have strong analytical and problem-solving abilities.