Are you a seasoned Commodity Loan Clerk seeking a new career path? Discover our professionally built Commodity Loan Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

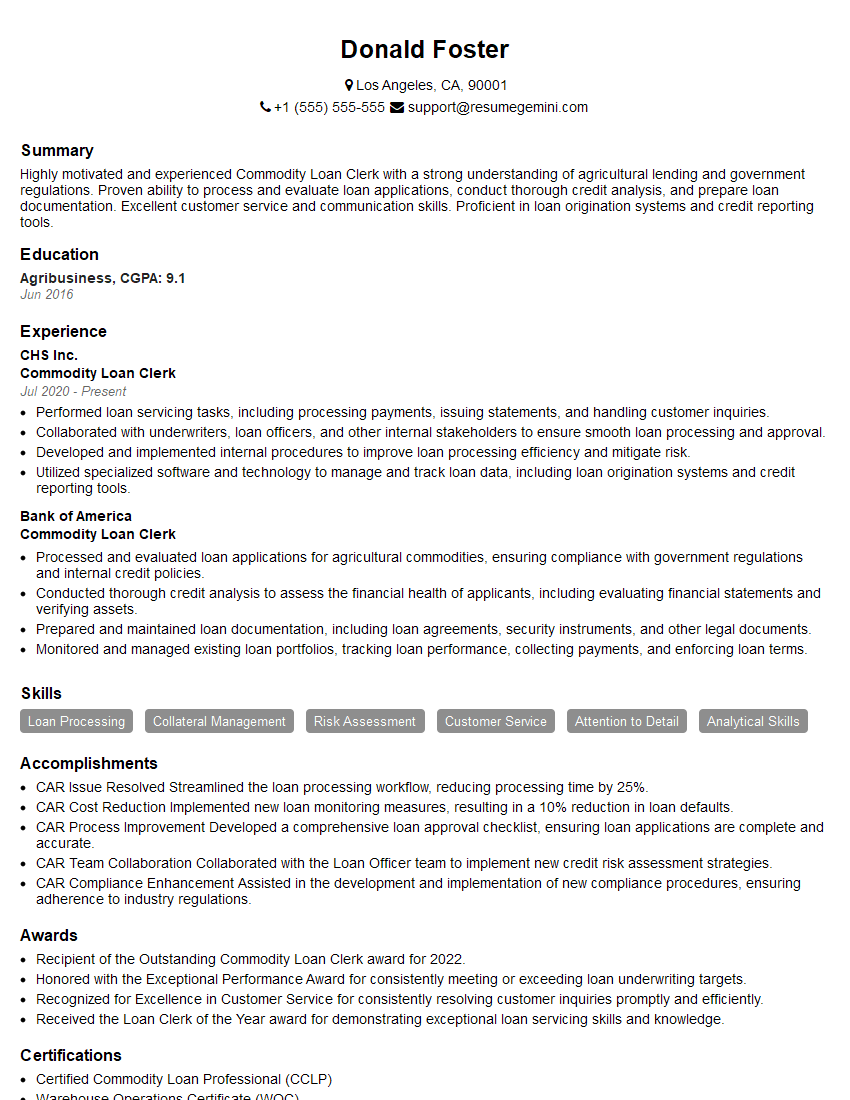

Donald Foster

Commodity Loan Clerk

Summary

Highly motivated and experienced Commodity Loan Clerk with a strong understanding of agricultural lending and government regulations. Proven ability to process and evaluate loan applications, conduct thorough credit analysis, and prepare loan documentation. Excellent customer service and communication skills. Proficient in loan origination systems and credit reporting tools.

Education

Agribusiness

June 2016

Skills

- Loan Processing

- Collateral Management

- Risk Assessment

- Customer Service

- Attention to Detail

- Analytical Skills

Work Experience

Commodity Loan Clerk

- Performed loan servicing tasks, including processing payments, issuing statements, and handling customer inquiries.

- Collaborated with underwriters, loan officers, and other internal stakeholders to ensure smooth loan processing and approval.

- Developed and implemented internal procedures to improve loan processing efficiency and mitigate risk.

- Utilized specialized software and technology to manage and track loan data, including loan origination systems and credit reporting tools.

Commodity Loan Clerk

- Processed and evaluated loan applications for agricultural commodities, ensuring compliance with government regulations and internal credit policies.

- Conducted thorough credit analysis to assess the financial health of applicants, including evaluating financial statements and verifying assets.

- Prepared and maintained loan documentation, including loan agreements, security instruments, and other legal documents.

- Monitored and managed existing loan portfolios, tracking loan performance, collecting payments, and enforcing loan terms.

Accomplishments

- CAR Issue Resolved Streamlined the loan processing workflow, reducing processing time by 25%.

- CAR Cost Reduction Implemented new loan monitoring measures, resulting in a 10% reduction in loan defaults.

- CAR Process Improvement Developed a comprehensive loan approval checklist, ensuring loan applications are complete and accurate.

- CAR Team Collaboration Collaborated with the Loan Officer team to implement new credit risk assessment strategies.

- CAR Compliance Enhancement Assisted in the development and implementation of new compliance procedures, ensuring adherence to industry regulations.

Awards

- Recipient of the Outstanding Commodity Loan Clerk award for 2022.

- Honored with the Exceptional Performance Award for consistently meeting or exceeding loan underwriting targets.

- Recognized for Excellence in Customer Service for consistently resolving customer inquiries promptly and efficiently.

- Received the Loan Clerk of the Year award for demonstrating exceptional loan servicing skills and knowledge.

Certificates

- Certified Commodity Loan Professional (CCLP)

- Warehouse Operations Certificate (WOC)

- Certified Loan Officer (CLO)

- Certified Credit Analyst (CCA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Commodity Loan Clerk

- Highlight your experience in agricultural lending and government regulations.

- Showcase your analytical skills and ability to assess financial statements.

- Emphasize your proficiency in loan origination systems and credit reporting tools.

- Quantify your accomplishments whenever possible, using specific metrics and results.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Commodity Loan Clerk Resume

- Processed and evaluated loan applications for agricultural commodities, ensuring compliance with government regulations and internal credit policies.

- Conducted thorough credit analysis to assess the financial health of applicants, including evaluating financial statements and verifying assets.

- Prepared and maintained loan documentation, including loan agreements, security instruments, and other legal documents.

- Monitored and managed existing loan portfolios, tracking loan performance, collecting payments, and enforcing loan terms.

- Performed loan servicing tasks, including processing payments, issuing statements, and handling customer inquiries.

- Collaborated with underwriters, loan officers, and other internal stakeholders to ensure smooth loan processing and approval.

Frequently Asked Questions (FAQ’s) For Commodity Loan Clerk

What are the key responsibilities of a Commodity Loan Clerk?

The key responsibilities of a Commodity Loan Clerk include processing and evaluating loan applications, conducting credit analysis, preparing loan documentation, monitoring loan portfolios, and performing loan servicing tasks.

What qualifications are needed to become a Commodity Loan Clerk?

To become a Commodity Loan Clerk, you typically need a bachelor’s degree in agribusiness or a related field, as well as experience in agricultural lending and government regulations.

What are the career prospects for a Commodity Loan Clerk?

With experience, Commodity Loan Clerks can advance to positions such as Loan Officer, Credit Analyst, or Branch Manager.

What are the salary expectations for a Commodity Loan Clerk?

The salary expectations for a Commodity Loan Clerk vary depending on experience, location, and employer. According to Salary.com, the average salary for a Commodity Loan Clerk in the United States is around $60,000 per year.

What are the challenges of being a Commodity Loan Clerk?

The challenges of being a Commodity Loan Clerk include the need to stay up-to-date on government regulations and agricultural lending practices, as well as the need to work with a variety of clients and stakeholders.

What are some tips for being a successful Commodity Loan Clerk?

Tips for being a successful Commodity Loan Clerk include staying organized, being detail-oriented, and having strong communication and interpersonal skills.