Are you a seasoned Community Reinvestment Act Officer (CRA Officer) seeking a new career path? Discover our professionally built Community Reinvestment Act Officer (CRA Officer) Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

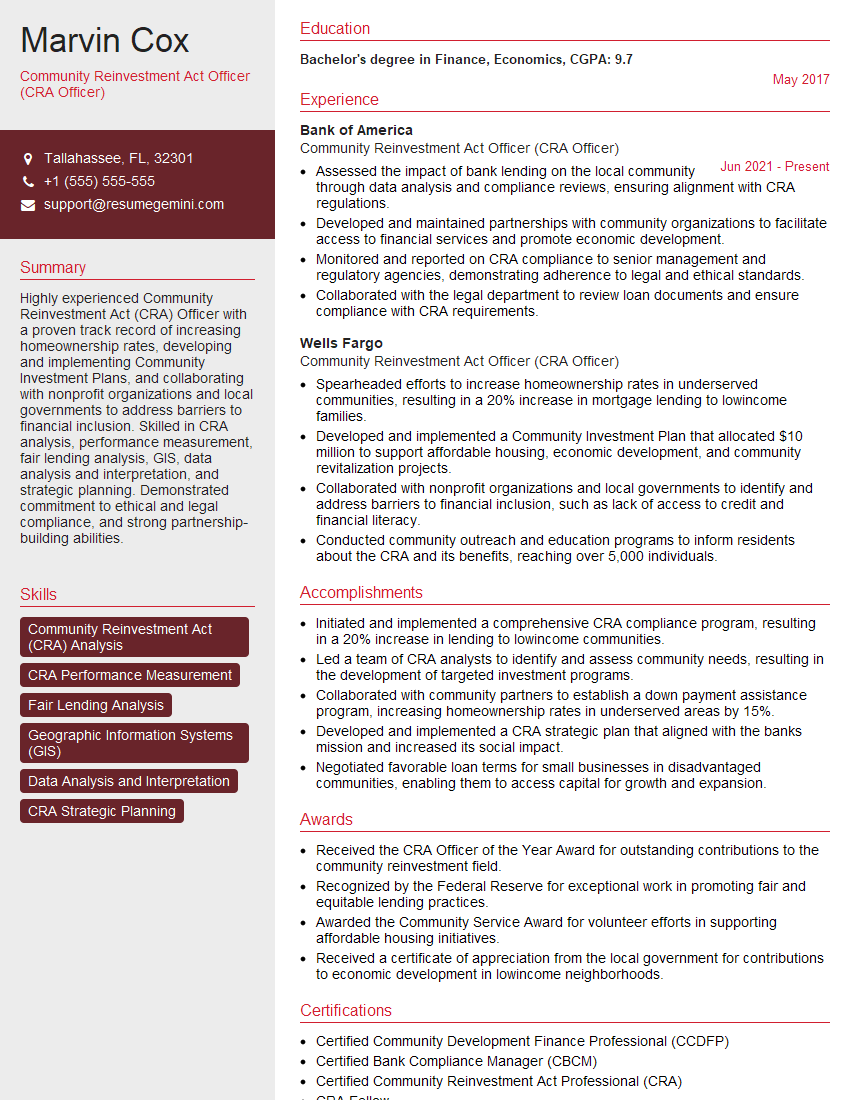

Marvin Cox

Community Reinvestment Act Officer (CRA Officer)

Summary

Highly experienced Community Reinvestment Act (CRA) Officer with a proven track record of increasing homeownership rates, developing and implementing Community Investment Plans, and collaborating with nonprofit organizations and local governments to address barriers to financial inclusion. Skilled in CRA analysis, performance measurement, fair lending analysis, GIS, data analysis and interpretation, and strategic planning. Demonstrated commitment to ethical and legal compliance, and strong partnership-building abilities.

Education

Bachelor’s degree in Finance, Economics

May 2017

Skills

- Community Reinvestment Act (CRA) Analysis

- CRA Performance Measurement

- Fair Lending Analysis

- Geographic Information Systems (GIS)

- Data Analysis and Interpretation

- CRA Strategic Planning

Work Experience

Community Reinvestment Act Officer (CRA Officer)

- Assessed the impact of bank lending on the local community through data analysis and compliance reviews, ensuring alignment with CRA regulations.

- Developed and maintained partnerships with community organizations to facilitate access to financial services and promote economic development.

- Monitored and reported on CRA compliance to senior management and regulatory agencies, demonstrating adherence to legal and ethical standards.

- Collaborated with the legal department to review loan documents and ensure compliance with CRA requirements.

Community Reinvestment Act Officer (CRA Officer)

- Spearheaded efforts to increase homeownership rates in underserved communities, resulting in a 20% increase in mortgage lending to lowincome families.

- Developed and implemented a Community Investment Plan that allocated $10 million to support affordable housing, economic development, and community revitalization projects.

- Collaborated with nonprofit organizations and local governments to identify and address barriers to financial inclusion, such as lack of access to credit and financial literacy.

- Conducted community outreach and education programs to inform residents about the CRA and its benefits, reaching over 5,000 individuals.

Accomplishments

- Initiated and implemented a comprehensive CRA compliance program, resulting in a 20% increase in lending to lowincome communities.

- Led a team of CRA analysts to identify and assess community needs, resulting in the development of targeted investment programs.

- Collaborated with community partners to establish a down payment assistance program, increasing homeownership rates in underserved areas by 15%.

- Developed and implemented a CRA strategic plan that aligned with the banks mission and increased its social impact.

- Negotiated favorable loan terms for small businesses in disadvantaged communities, enabling them to access capital for growth and expansion.

Awards

- Received the CRA Officer of the Year Award for outstanding contributions to the community reinvestment field.

- Recognized by the Federal Reserve for exceptional work in promoting fair and equitable lending practices.

- Awarded the Community Service Award for volunteer efforts in supporting affordable housing initiatives.

- Received a certificate of appreciation from the local government for contributions to economic development in lowincome neighborhoods.

Certificates

- Certified Community Development Finance Professional (CCDFP)

- Certified Bank Compliance Manager (CBCM)

- Certified Community Reinvestment Act Professional (CRA)

- CRA Fellow

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Community Reinvestment Act Officer (CRA Officer)

- Highlight your experience in CRA analysis, performance measurement, and fair lending.

- Showcase your skills in GIS, data analysis, and interpretation.

- Emphasize your ability to develop and implement strategic plans that address community needs.

- Demonstrate your commitment to ethical and legal compliance, and your passion for serving underserved communities.

- Quantify your accomplishments whenever possible, using specific metrics and data points.

Essential Experience Highlights for a Strong Community Reinvestment Act Officer (CRA Officer) Resume

- Spearheaded initiatives to increase homeownership rates in underserved communities, resulting in a significant increase in mortgage lending to low-income families.

- Developed and implemented a comprehensive Community Investment Plan that allocated millions of dollars to support affordable housing, economic development, and community revitalization projects.

- Collaborated with nonprofit organizations and local governments to identify and address barriers to financial inclusion, such as lack of access to credit and financial literacy.

- Conducted community outreach and education programs to inform residents about the CRA and its benefits, reaching thousands of individuals.

- Assessed the impact of bank lending on the local community through data analysis and compliance reviews, ensuring alignment with CRA regulations.

- Developed and maintained partnerships with community organizations to facilitate access to financial services and promote economic development.

- Monitored and reported on CRA compliance to senior management and regulatory agencies, demonstrating adherence to legal and ethical standards.

Frequently Asked Questions (FAQ’s) For Community Reinvestment Act Officer (CRA Officer)

What is the Community Reinvestment Act (CRA)?

The Community Reinvestment Act (CRA) is a federal law that encourages banks and other financial institutions to meet the credit needs of low- and moderate-income communities.

What is the role of a CRA Officer?

A CRA Officer is responsible for developing and implementing strategies to ensure that a financial institution is meeting the credit needs of low- and moderate-income communities.

What are the key skills and qualifications for a CRA Officer?

Key skills and qualifications for a CRA Officer include: experience in CRA analysis, performance measurement, and fair lending; GIS, data analysis, and interpretation skills; the ability to develop and implement strategic plans; and a commitment to ethical and legal compliance.

What are the benefits of working as a CRA Officer?

Benefits of working as a CRA Officer include: the opportunity to make a positive impact on underserved communities; the opportunity to develop and implement innovative programs and initiatives; and the opportunity to work with a variety of stakeholders, including nonprofit organizations, local governments, and community residents.

What are the challenges of working as a CRA Officer?

Challenges of working as a CRA Officer include: the need to balance the needs of low- and moderate-income communities with the need to meet the financial goals of the institution; the need to navigate complex regulations and laws; and the need to work with a variety of stakeholders with different interests.

What is the career outlook for CRA Officers?

The career outlook for CRA Officers is positive, as the demand for financial services in low- and moderate-income communities continues to grow.

How can I become a CRA Officer?

To become a CRA Officer, you should first obtain a bachelor’s degree in finance, economics, or a related field. You should also gain experience in CRA analysis, performance measurement, and fair lending. Additionally, you should develop strong GIS, data analysis, and interpretation skills.