Are you a seasoned Compliance Clerk seeking a new career path? Discover our professionally built Compliance Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

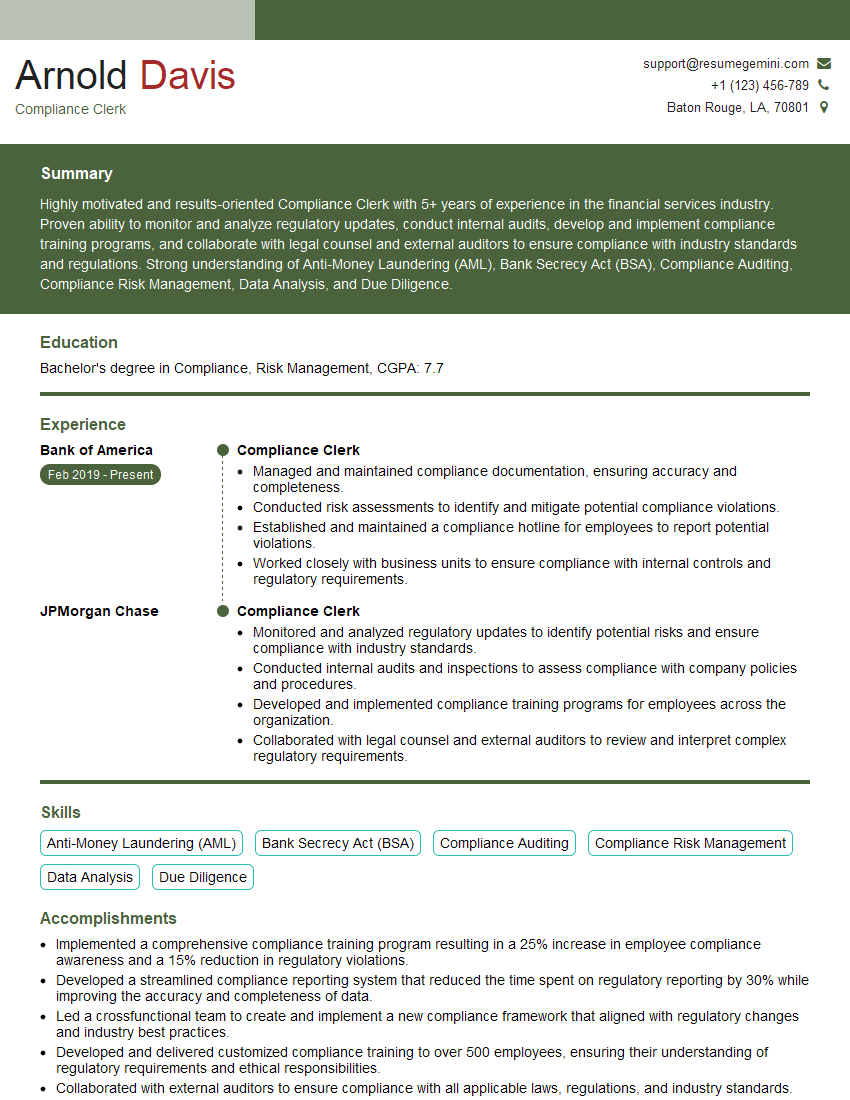

Arnold Davis

Compliance Clerk

Summary

Highly motivated and results-oriented Compliance Clerk with 5+ years of experience in the financial services industry. Proven ability to monitor and analyze regulatory updates, conduct internal audits, develop and implement compliance training programs, and collaborate with legal counsel and external auditors to ensure compliance with industry standards and regulations. Strong understanding of Anti-Money Laundering (AML), Bank Secrecy Act (BSA), Compliance Auditing, Compliance Risk Management, Data Analysis, and Due Diligence.

Education

Bachelor’s degree in Compliance, Risk Management

January 2015

Skills

- Anti-Money Laundering (AML)

- Bank Secrecy Act (BSA)

- Compliance Auditing

- Compliance Risk Management

- Data Analysis

- Due Diligence

Work Experience

Compliance Clerk

- Managed and maintained compliance documentation, ensuring accuracy and completeness.

- Conducted risk assessments to identify and mitigate potential compliance violations.

- Established and maintained a compliance hotline for employees to report potential violations.

- Worked closely with business units to ensure compliance with internal controls and regulatory requirements.

Compliance Clerk

- Monitored and analyzed regulatory updates to identify potential risks and ensure compliance with industry standards.

- Conducted internal audits and inspections to assess compliance with company policies and procedures.

- Developed and implemented compliance training programs for employees across the organization.

- Collaborated with legal counsel and external auditors to review and interpret complex regulatory requirements.

Accomplishments

- Implemented a comprehensive compliance training program resulting in a 25% increase in employee compliance awareness and a 15% reduction in regulatory violations.

- Developed a streamlined compliance reporting system that reduced the time spent on regulatory reporting by 30% while improving the accuracy and completeness of data.

- Led a crossfunctional team to create and implement a new compliance framework that aligned with regulatory changes and industry best practices.

- Developed and delivered customized compliance training to over 500 employees, ensuring their understanding of regulatory requirements and ethical responsibilities.

- Collaborated with external auditors to ensure compliance with all applicable laws, regulations, and industry standards.

Awards

- Received Compliance Officer of the Year Award from the Compliance Institute of America for outstanding contributions to the field of compliance.

- Recognized by the Financial Industry Regulatory Authority (FINRA) for exemplary efforts in promoting industry best practices and ensuring market integrity.

- Received the Compliance Excellence Award from the Association of Compliance Officers and Ethics Professionals for consistently exceeding expectations in compliance management.

- Recognized by the Bank Secrecy Act (BSA) Compliance Association for exceptional contributions to the fight against financial crime.

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Bank Secrecy Act Specialist (CBAS)

- Certified Compliance and Ethics Professional (CCEP)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Compliance Clerk

- Highlight your experience in monitoring and analyzing regulatory updates.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Demonstrate your knowledge of AML, BSA, and other relevant regulations.

- Emphasize your ability to collaborate with legal counsel and external auditors.

- Review sample resumes and job descriptions to get an idea of the skills and experience that employers are looking for.

Essential Experience Highlights for a Strong Compliance Clerk Resume

- Monitored and analyzed regulatory updates to identify potential risks and ensure compliance with industry standards.

- Conducted internal audits and inspections to assess compliance with company policies and procedures.

- Developed and implemented compliance training programs for employees across the organization.

- Collaborated with legal counsel and external auditors to review and interpret complex regulatory requirements.

- Managed and maintained compliance documentation, ensuring accuracy and completeness.

- Conducted risk assessments to identify and mitigate potential compliance violations.

Frequently Asked Questions (FAQ’s) For Compliance Clerk

What are the key skills required for a Compliance Clerk?

Key skills for a Compliance Clerk include: Anti-Money Laundering (AML), Bank Secrecy Act (BSA), Compliance Auditing, Compliance Risk Management, Data Analysis, and Due Diligence.

What is the role of a Compliance Clerk?

A Compliance Clerk is responsible for monitoring and analyzing regulatory updates, conducting internal audits, developing and implementing compliance training programs, and collaborating with legal counsel and external auditors to ensure compliance with industry standards and regulations.

What are the career prospects for a Compliance Clerk?

Compliance Clerks with experience can advance to roles such as Compliance Officer, Compliance Manager, or Chief Compliance Officer.

What is the salary range for a Compliance Clerk?

The salary range for a Compliance Clerk varies depending on experience and location, but typically falls between $50,000 and $100,000 per year.

What are the educational requirements for a Compliance Clerk?

Most Compliance Clerks have a bachelor’s degree in Compliance, Risk Management, or a related field.

What are the certifications that are helpful for a Compliance Clerk?

Helpful certifications for a Compliance Clerk include: Certified Anti-Money Laundering Specialist (CAMS), Certified Compliance and Ethics Professional (CCEP), and Certified Regulatory Compliance Manager (CRCM).