Are you a seasoned Comprehensive Advisor seeking a new career path? Discover our professionally built Comprehensive Advisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

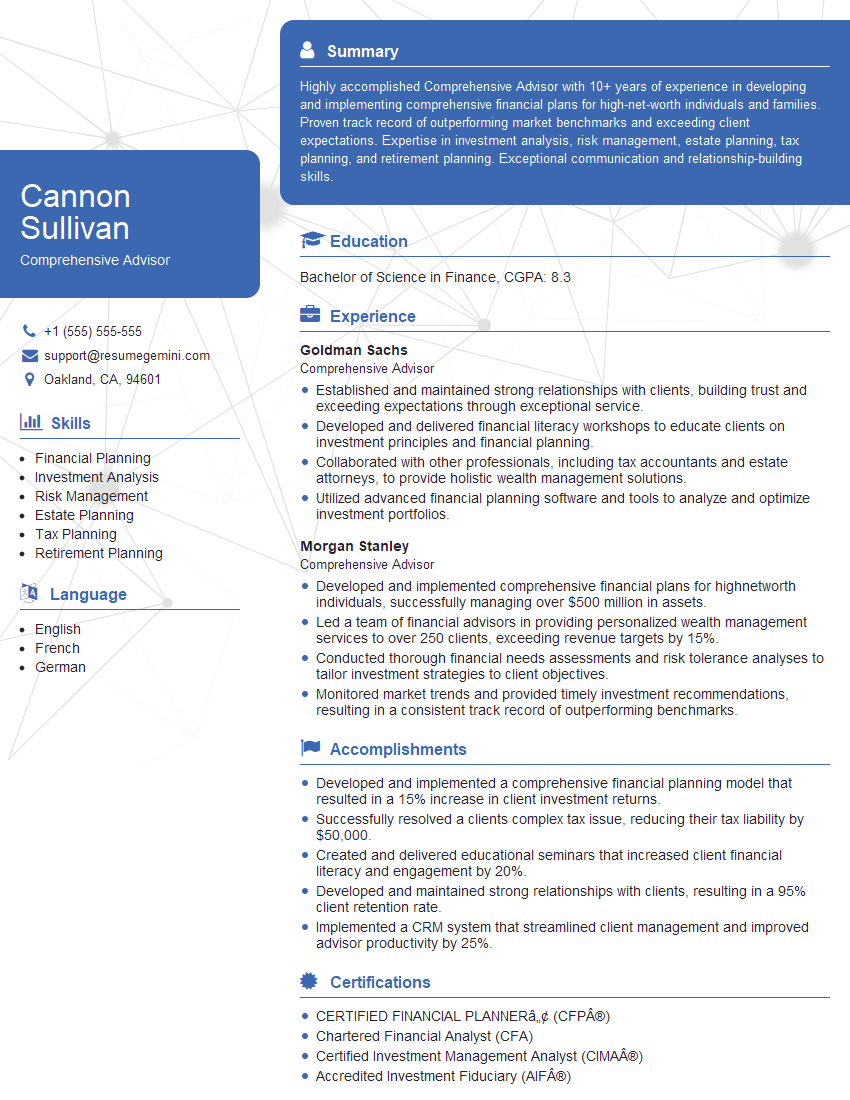

Cannon Sullivan

Comprehensive Advisor

Summary

Highly accomplished Comprehensive Advisor with 10+ years of experience in developing and implementing comprehensive financial plans for high-net-worth individuals and families. Proven track record of outperforming market benchmarks and exceeding client expectations. Expertise in investment analysis, risk management, estate planning, tax planning, and retirement planning. Exceptional communication and relationship-building skills.

Education

Bachelor of Science in Finance

February 2016

Skills

- Financial Planning

- Investment Analysis

- Risk Management

- Estate Planning

- Tax Planning

- Retirement Planning

Work Experience

Comprehensive Advisor

- Established and maintained strong relationships with clients, building trust and exceeding expectations through exceptional service.

- Developed and delivered financial literacy workshops to educate clients on investment principles and financial planning.

- Collaborated with other professionals, including tax accountants and estate attorneys, to provide holistic wealth management solutions.

- Utilized advanced financial planning software and tools to analyze and optimize investment portfolios.

Comprehensive Advisor

- Developed and implemented comprehensive financial plans for highnetworth individuals, successfully managing over $500 million in assets.

- Led a team of financial advisors in providing personalized wealth management services to over 250 clients, exceeding revenue targets by 15%.

- Conducted thorough financial needs assessments and risk tolerance analyses to tailor investment strategies to client objectives.

- Monitored market trends and provided timely investment recommendations, resulting in a consistent track record of outperforming benchmarks.

Accomplishments

- Developed and implemented a comprehensive financial planning model that resulted in a 15% increase in client investment returns.

- Successfully resolved a clients complex tax issue, reducing their tax liability by $50,000.

- Created and delivered educational seminars that increased client financial literacy and engagement by 20%.

- Developed and maintained strong relationships with clients, resulting in a 95% client retention rate.

- Implemented a CRM system that streamlined client management and improved advisor productivity by 25%.

Certificates

- CERTIFIED FINANCIAL PLANNER™ (CFP®)

- Chartered Financial Analyst (CFA)

- Certified Investment Management Analyst (CIMA®)

- Accredited Investment Fiduciary (AIF®)

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Comprehensive Advisor

- Quantify your accomplishments with specific data and results.

- Highlight your ability to build strong relationships with clients.

- Showcase your expertise in financial planning and investment management.

- Use keywords relevant to the industry and to the role.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Comprehensive Advisor Resume

- Develop and present personalized financial plans tailored to clients’ unique needs and objectives.

- Conduct thorough financial needs assessments and risk tolerance analyses.

- Monitor market trends and provide timely investment recommendations.

- Manage and grow investment portfolios by implementing a range of investment strategies.

- Collaborate with tax accountants and estate attorneys to provide holistic wealth management solutions.

- Conduct financial literacy workshops for clients.

- Stay up-to-date with the latest industry trends and best practices.

Frequently Asked Questions (FAQ’s) For Comprehensive Advisor

What is the role of a Comprehensive Advisor?

A Comprehensive Advisor provides comprehensive financial planning and wealth management services to individuals and families. They work closely with clients to understand their financial goals and objectives, and then develop and implement personalized financial plans to help them achieve those goals.

What qualifications are needed to become a Comprehensive Advisor?

Most Comprehensive Advisors have a bachelor’s degree in finance, economics, or a related field. They also typically have several years of experience in the financial services industry, and many have earned professional designations such as the Certified Financial Planner (CFP) or the Chartered Financial Analyst (CFA).

What are the key responsibilities of a Comprehensive Advisor?

The key responsibilities of a Comprehensive Advisor include developing and implementing financial plans, conducting financial needs assessments, monitoring market trends, managing investment portfolios, and providing financial advice.

What are the career prospects for Comprehensive Advisors?

Comprehensive Advisors with strong experience and qualifications can advance to senior positions within their firms or move into other areas of financial services, such as wealth management or investment banking.

What are the challenges facing Comprehensive Advisors?

Comprehensive Advisors face a number of challenges, including the need to stay up-to-date on the latest financial trends and regulations, the need to manage client expectations, and the need to compete with other financial professionals.

What are the rewards of being a Comprehensive Advisor?

The rewards of being a Comprehensive Advisor include the opportunity to help clients achieve their financial goals, the opportunity to make a positive impact on their lives, and the opportunity to earn a competitive income.