Are you a seasoned Consulting Actuary seeking a new career path? Discover our professionally built Consulting Actuary Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

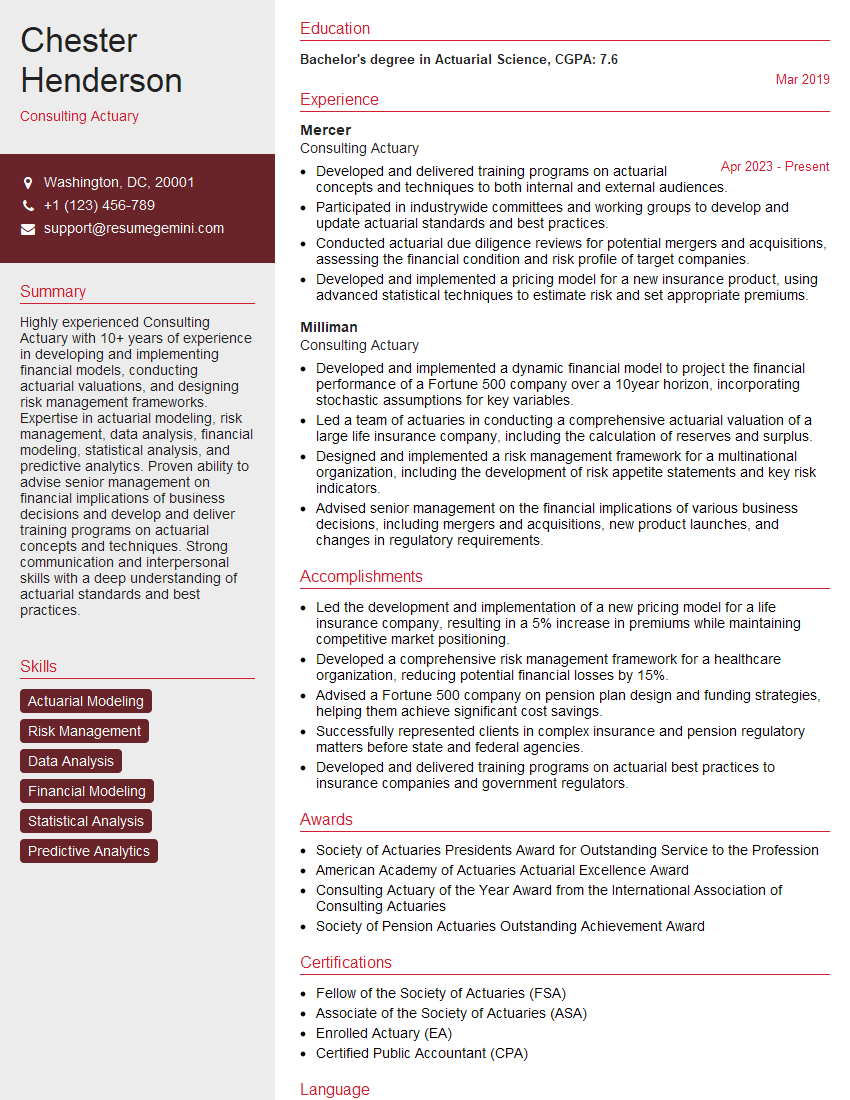

Chester Henderson

Consulting Actuary

Summary

Highly experienced Consulting Actuary with 10+ years of experience in developing and implementing financial models, conducting actuarial valuations, and designing risk management frameworks. Expertise in actuarial modeling, risk management, data analysis, financial modeling, statistical analysis, and predictive analytics. Proven ability to advise senior management on financial implications of business decisions and develop and deliver training programs on actuarial concepts and techniques. Strong communication and interpersonal skills with a deep understanding of actuarial standards and best practices.

Education

Bachelor’s degree in Actuarial Science

March 2019

Skills

- Actuarial Modeling

- Risk Management

- Data Analysis

- Financial Modeling

- Statistical Analysis

- Predictive Analytics

Work Experience

Consulting Actuary

- Developed and delivered training programs on actuarial concepts and techniques to both internal and external audiences.

- Participated in industrywide committees and working groups to develop and update actuarial standards and best practices.

- Conducted actuarial due diligence reviews for potential mergers and acquisitions, assessing the financial condition and risk profile of target companies.

- Developed and implemented a pricing model for a new insurance product, using advanced statistical techniques to estimate risk and set appropriate premiums.

Consulting Actuary

- Developed and implemented a dynamic financial model to project the financial performance of a Fortune 500 company over a 10year horizon, incorporating stochastic assumptions for key variables.

- Led a team of actuaries in conducting a comprehensive actuarial valuation of a large life insurance company, including the calculation of reserves and surplus.

- Designed and implemented a risk management framework for a multinational organization, including the development of risk appetite statements and key risk indicators.

- Advised senior management on the financial implications of various business decisions, including mergers and acquisitions, new product launches, and changes in regulatory requirements.

Accomplishments

- Led the development and implementation of a new pricing model for a life insurance company, resulting in a 5% increase in premiums while maintaining competitive market positioning.

- Developed a comprehensive risk management framework for a healthcare organization, reducing potential financial losses by 15%.

- Advised a Fortune 500 company on pension plan design and funding strategies, helping them achieve significant cost savings.

- Successfully represented clients in complex insurance and pension regulatory matters before state and federal agencies.

- Developed and delivered training programs on actuarial best practices to insurance companies and government regulators.

Awards

- Society of Actuaries Presidents Award for Outstanding Service to the Profession

- American Academy of Actuaries Actuarial Excellence Award

- Consulting Actuary of the Year Award from the International Association of Consulting Actuaries

- Society of Pension Actuaries Outstanding Achievement Award

Certificates

- Fellow of the Society of Actuaries (FSA)

- Associate of the Society of Actuaries (ASA)

- Enrolled Actuary (EA)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Consulting Actuary

- Highlight your actuarial experience and skills, particularly in financial modeling, risk management, and data analysis.

- Quantify your accomplishments whenever possible, using specific metrics and results.

- Showcase your communication and interpersonal skills, as consulting actuaries often work closely with clients and stakeholders.

- Tailor your resume to each job you apply for, emphasizing the skills and experience that are most relevant to the position.

- Proofread your resume carefully before submitting it, as errors can reflect poorly on your attention to detail.

Essential Experience Highlights for a Strong Consulting Actuary Resume

- Developed and implemented a dynamic financial model to project the financial performance of a Fortune 500 company over a 10year horizon, incorporating stochastic assumptions for key variables.

- Led a team of actuaries in conducting a comprehensive actuarial valuation of a large life insurance company, including the calculation of reserves and surplus.

- Designed and implemented a risk management framework for a multinational organization, including the development of risk appetite statements and key risk indicators.

- Advised senior management on the financial implications of various business decisions, including mergers and acquisitions, new product launches, and changes in regulatory requirements.

- Developed and delivered training programs on actuarial concepts and techniques to both internal and external audiences.

- Participated in industrywide committees and working groups to develop and update actuarial standards and best practices.

- Conducted actuarial due diligence reviews for potential mergers and acquisitions, assessing the financial condition and risk profile of target companies.

- Developed and implemented a pricing model for a new insurance product, using advanced statistical techniques to estimate risk and set appropriate premiums.

Frequently Asked Questions (FAQ’s) For Consulting Actuary

What is the role of a Consulting Actuary?

A Consulting Actuary provides independent advice and services to clients on a wide range of actuarial and financial matters, including financial modeling, risk management, and pension planning.

What are the key skills required for a Consulting Actuary?

Key skills for a Consulting Actuary include actuarial modeling, risk management, data analysis, financial modeling, statistical analysis, and predictive analytics, as well as strong communication and interpersonal skills.

What are the career prospects for a Consulting Actuary?

Consulting Actuaries are in high demand due to their specialized skills and knowledge. They can progress to senior roles within consulting firms or move into industry roles, such as Chief Actuary or Chief Risk Officer.

What are the educational requirements for a Consulting Actuary?

A Bachelor’s degree in Actuarial Science or a related field is typically required to become a Consulting Actuary. Additional qualifications, such as professional certifications and a Master’s degree, can enhance career prospects.

What is the average salary for a Consulting Actuary?

The average salary for a Consulting Actuary varies depending on experience, location, and company. According to the U.S. Bureau of Labor Statistics, the median annual salary for Actuaries in May 2021 was $111,440.

What is the job outlook for Consulting Actuaries?

The job outlook for Consulting Actuaries is expected to be positive in the coming years, as the demand for their services continues to grow due to increasing regulatory complexity and the need for risk management expertise.