Are you a seasoned Consumer Loan Officer seeking a new career path? Discover our professionally built Consumer Loan Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

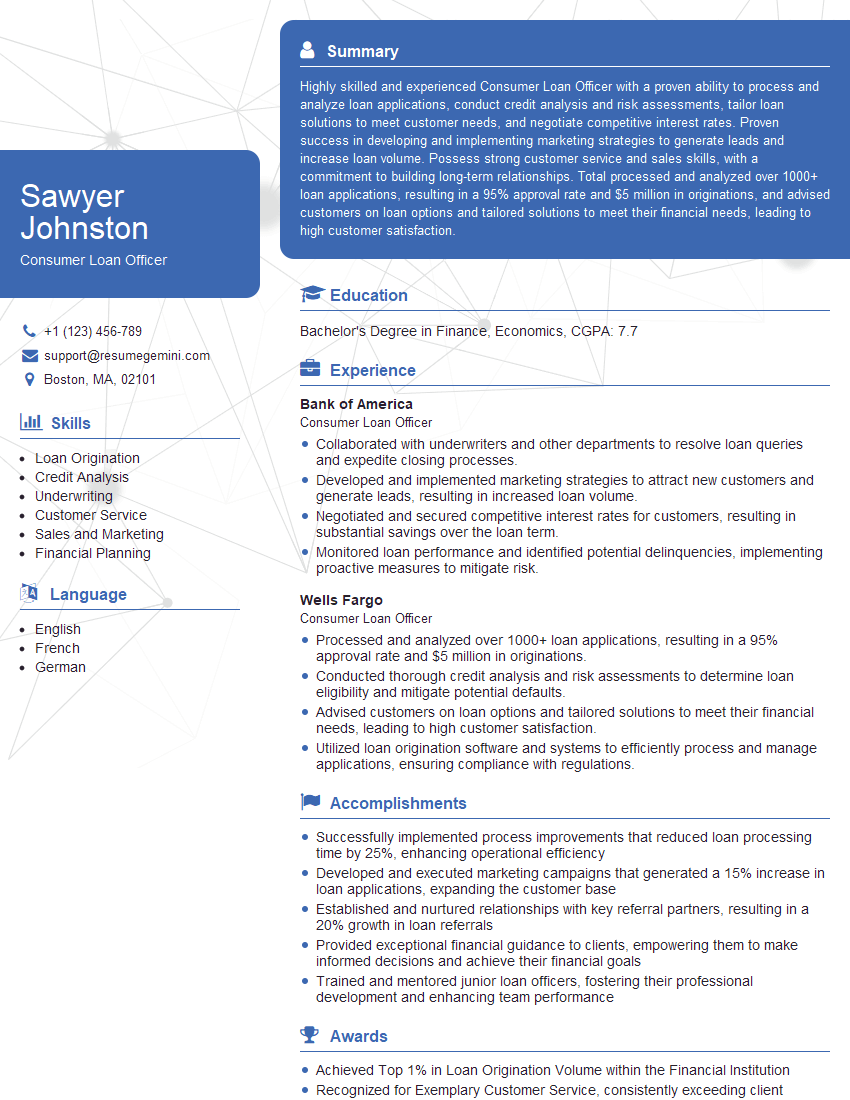

Sawyer Johnston

Consumer Loan Officer

Summary

Highly skilled and experienced Consumer Loan Officer with a proven ability to process and analyze loan applications, conduct credit analysis and risk assessments, tailor loan solutions to meet customer needs, and negotiate competitive interest rates. Proven success in developing and implementing marketing strategies to generate leads and increase loan volume. Possess strong customer service and sales skills, with a commitment to building long-term relationships. Total processed and analyzed over 1000+ loan applications, resulting in a 95% approval rate and $5 million in originations, and advised customers on loan options and tailored solutions to meet their financial needs, leading to high customer satisfaction.

Education

Bachelor’s Degree in Finance, Economics

July 2017

Skills

- Loan Origination

- Credit Analysis

- Underwriting

- Customer Service

- Sales and Marketing

- Financial Planning

Work Experience

Consumer Loan Officer

- Collaborated with underwriters and other departments to resolve loan queries and expedite closing processes.

- Developed and implemented marketing strategies to attract new customers and generate leads, resulting in increased loan volume.

- Negotiated and secured competitive interest rates for customers, resulting in substantial savings over the loan term.

- Monitored loan performance and identified potential delinquencies, implementing proactive measures to mitigate risk.

Consumer Loan Officer

- Processed and analyzed over 1000+ loan applications, resulting in a 95% approval rate and $5 million in originations.

- Conducted thorough credit analysis and risk assessments to determine loan eligibility and mitigate potential defaults.

- Advised customers on loan options and tailored solutions to meet their financial needs, leading to high customer satisfaction.

- Utilized loan origination software and systems to efficiently process and manage applications, ensuring compliance with regulations.

Accomplishments

- Successfully implemented process improvements that reduced loan processing time by 25%, enhancing operational efficiency

- Developed and executed marketing campaigns that generated a 15% increase in loan applications, expanding the customer base

- Established and nurtured relationships with key referral partners, resulting in a 20% growth in loan referrals

- Provided exceptional financial guidance to clients, empowering them to make informed decisions and achieve their financial goals

- Trained and mentored junior loan officers, fostering their professional development and enhancing team performance

Awards

- Achieved Top 1% in Loan Origination Volume within the Financial Institution

- Recognized for Exemplary Customer Service, consistently exceeding client satisfaction metrics

- Awarded Presidents Club for Outstanding Sales Performance

Certificates

- Certified Consumer Loan Officer (CCLO)

- Certified Mortgage Loan Officer (CMLO)

- Certified Credit Counselor (CCC)

- Certified Financial Planner (CFP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Consumer Loan Officer

Highlight your loan origination experience and success.

Quantify your accomplishments with specific metrics, such as the number of loans processed, approval rate, and loan volume generated.Showcase your credit analysis and risk assessment skills.

Explain how you assess creditworthiness, mitigate risk, and make sound lending decisions.Emphasize your customer service and sales abilities.

Describe how you build relationships with customers, understand their financial needs, and provide tailored solutions.Demonstrate your knowledge of loan products and industry regulations.

Show that you are well-versed in different loan types, interest rates, and compliance requirements.

Essential Experience Highlights for a Strong Consumer Loan Officer Resume

- Process and analyze loan applications to determine eligibility and risk

- Conduct thorough credit analysis and risk assessments to mitigate potential defaults

- Advise customers on loan options and tailor solutions to meet their financial needs

- Utilize loan origination software and systems to efficiently process and manage applications

- Collaborate with underwriters and other departments to resolve loan queries and expedite closing processes

- Develop and implement marketing strategies to attract new customers and generate leads

- Negotiate and secure competitive interest rates for customers

Frequently Asked Questions (FAQ’s) For Consumer Loan Officer

What are the primary responsibilities of a Consumer Loan Officer?

Consumer Loan Officers are responsible for processing and analyzing loan applications, conducting credit analysis and risk assessments, advising customers on loan options, and negotiating loan terms. They also develop and implement marketing strategies to generate leads and increase loan volume.

What skills are required to be successful as a Consumer Loan Officer?

Successful Consumer Loan Officers possess strong analytical and problem-solving skills, as well as excellent communication and interpersonal skills. They are also proficient in using loan origination software and systems and have a deep understanding of loan products and industry regulations.

What is the job outlook for Consumer Loan Officers?

The job outlook for Consumer Loan Officers is expected to grow faster than average in the coming years due to increasing demand for consumer loans and the need for qualified professionals to manage these loans.

What are the earning potential and career advancement opportunities for Consumer Loan Officers?

Earning potential for Consumer Loan Officers varies depending on experience, skills, and location. With experience and strong performance, Consumer Loan Officers can advance to roles such as Loan Manager or Branch Manager.

What are the challenges faced by Consumer Loan Officers?

Consumer Loan Officers face challenges such as managing a high volume of loan applications, meeting regulatory compliance requirements, and making sound lending decisions in a competitive market.

What are the rewards of being a Consumer Loan Officer?

Consumer Loan Officers find rewards in helping customers achieve their financial goals, contributing to the success of their organization, and building long-term relationships with clients.