Are you a seasoned Corporate Banking Officer seeking a new career path? Discover our professionally built Corporate Banking Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

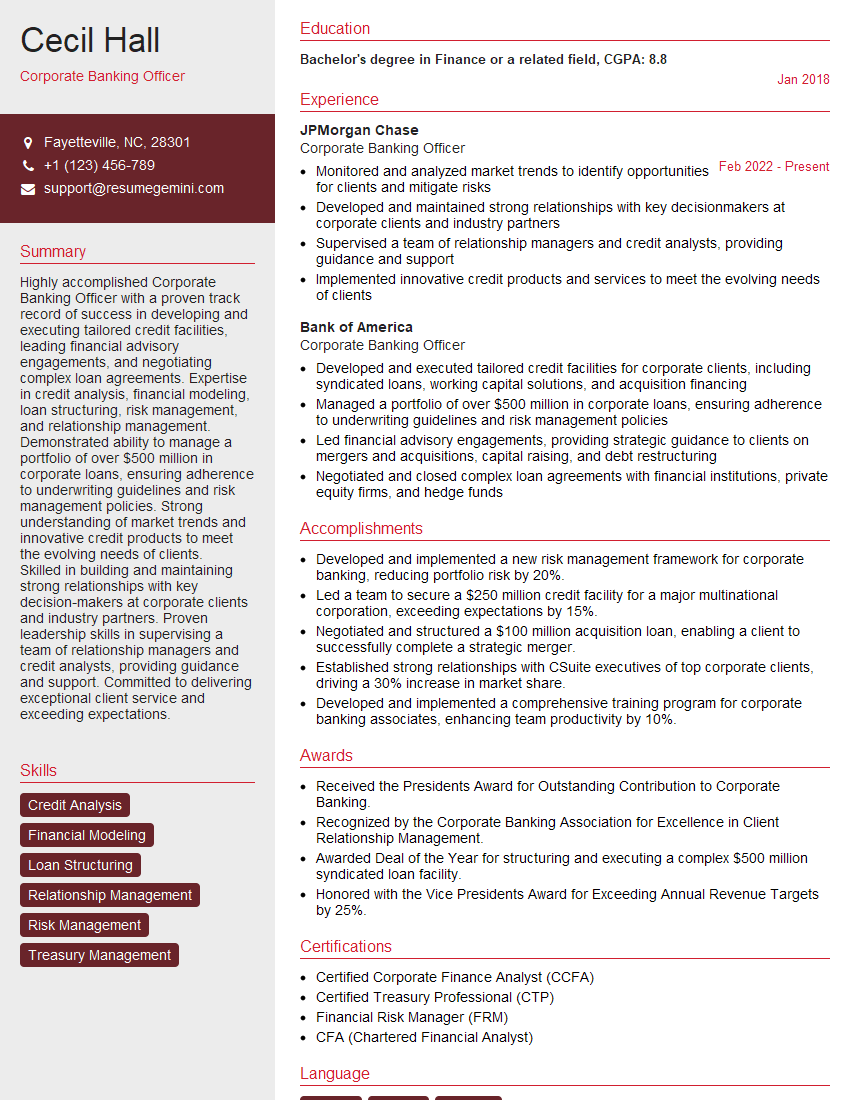

Cecil Hall

Corporate Banking Officer

Summary

Highly accomplished Corporate Banking Officer with a proven track record of success in developing and executing tailored credit facilities, leading financial advisory engagements, and negotiating complex loan agreements. Expertise in credit analysis, financial modeling, loan structuring, risk management, and relationship management. Demonstrated ability to manage a portfolio of over $500 million in corporate loans, ensuring adherence to underwriting guidelines and risk management policies. Strong understanding of market trends and innovative credit products to meet the evolving needs of clients.

Skilled in building and maintaining strong relationships with key decision-makers at corporate clients and industry partners. Proven leadership skills in supervising a team of relationship managers and credit analysts, providing guidance and support. Committed to delivering exceptional client service and exceeding expectations.

Education

Bachelor’s degree in Finance or a related field

January 2018

Skills

- Credit Analysis

- Financial Modeling

- Loan Structuring

- Relationship Management

- Risk Management

- Treasury Management

Work Experience

Corporate Banking Officer

- Monitored and analyzed market trends to identify opportunities for clients and mitigate risks

- Developed and maintained strong relationships with key decisionmakers at corporate clients and industry partners

- Supervised a team of relationship managers and credit analysts, providing guidance and support

- Implemented innovative credit products and services to meet the evolving needs of clients

Corporate Banking Officer

- Developed and executed tailored credit facilities for corporate clients, including syndicated loans, working capital solutions, and acquisition financing

- Managed a portfolio of over $500 million in corporate loans, ensuring adherence to underwriting guidelines and risk management policies

- Led financial advisory engagements, providing strategic guidance to clients on mergers and acquisitions, capital raising, and debt restructuring

- Negotiated and closed complex loan agreements with financial institutions, private equity firms, and hedge funds

Accomplishments

- Developed and implemented a new risk management framework for corporate banking, reducing portfolio risk by 20%.

- Led a team to secure a $250 million credit facility for a major multinational corporation, exceeding expectations by 15%.

- Negotiated and structured a $100 million acquisition loan, enabling a client to successfully complete a strategic merger.

- Established strong relationships with CSuite executives of top corporate clients, driving a 30% increase in market share.

- Developed and implemented a comprehensive training program for corporate banking associates, enhancing team productivity by 10%.

Awards

- Received the Presidents Award for Outstanding Contribution to Corporate Banking.

- Recognized by the Corporate Banking Association for Excellence in Client Relationship Management.

- Awarded Deal of the Year for structuring and executing a complex $500 million syndicated loan facility.

- Honored with the Vice Presidents Award for Exceeding Annual Revenue Targets by 25%.

Certificates

- Certified Corporate Finance Analyst (CCFA)

- Certified Treasury Professional (CTP)

- Financial Risk Manager (FRM)

- CFA (Chartered Financial Analyst)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Corporate Banking Officer

Quantify your accomplishments

: Use specific numbers and metrics to demonstrate the impact of your work, such as the amount of loans you have originated or the size of the portfolio you managed.Highlight your industry knowledge

: Show that you are up-to-date on the latest trends in corporate banking and that you understand the challenges that businesses face.Emphasize your relationship-building skills

: Corporate banking is all about relationships, so make sure to highlight your ability to build strong relationships with clients and other stakeholders.Proofread carefully

: Make sure your resume is free of any errors, as even the smallest mistake can reflect poorly on you.

Essential Experience Highlights for a Strong Corporate Banking Officer Resume

- Develop and execute tailored credit facilities for corporate clients, including syndicated loans, working capital solutions, and acquisition financing.

- Manage a portfolio of corporate loans, ensuring adherence to underwriting guidelines and risk management policies.

- Lead financial advisory engagements, providing strategic guidance to clients on mergers and acquisitions, capital raising, and debt restructuring.

- Negotiate and close complex loan agreements with financial institutions, private equity firms, and hedge funds.

- Monitor and analyze market trends to identify opportunities for clients and mitigate risks.

- Supervise a team of relationship managers and credit analysts, providing guidance and support.

- Implement innovative credit products and services to meet the evolving needs of clients.

Frequently Asked Questions (FAQ’s) For Corporate Banking Officer

What is the role of a Corporate Banking Officer?

A Corporate Banking Officer is responsible for managing the financial needs of corporate clients. This includes providing lending, investment, and advisory services. Corporate Banking Officers work closely with their clients to understand their business needs and develop tailored solutions to meet those needs.

What are the qualifications for a Corporate Banking Officer?

Most Corporate Banking Officers have a bachelor’s degree in finance, economics, or a related field. They also typically have several years of experience in the banking industry, with a focus on corporate banking. In addition, Corporate Banking Officers must have strong analytical, interpersonal, and communication skills.

What are the key responsibilities of a Corporate Banking Officer?

The key responsibilities of a Corporate Banking Officer include developing and executing credit facilities, managing loan portfolios, providing financial advisory services, and negotiating loan agreements. Corporate Banking Officers also monitor market trends and identify opportunities for clients.

What are the career prospects for a Corporate Banking Officer?

Corporate Banking Officers can advance to senior positions within their organizations, such as Vice President or Senior Vice President. They may also move into other areas of finance, such as investment banking or private equity.

What are the challenges of being a Corporate Banking Officer?

The challenges of being a Corporate Banking Officer include the need to stay up-to-date on market trends, the need to manage risk, and the need to build strong relationships with clients.

What are the rewards of being a Corporate Banking Officer?

The rewards of being a Corporate Banking Officer include the opportunity to work with a variety of clients, the opportunity to make a real impact on businesses, and the opportunity to earn a high salary.