Are you a seasoned Corporate Claims Examiner seeking a new career path? Discover our professionally built Corporate Claims Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

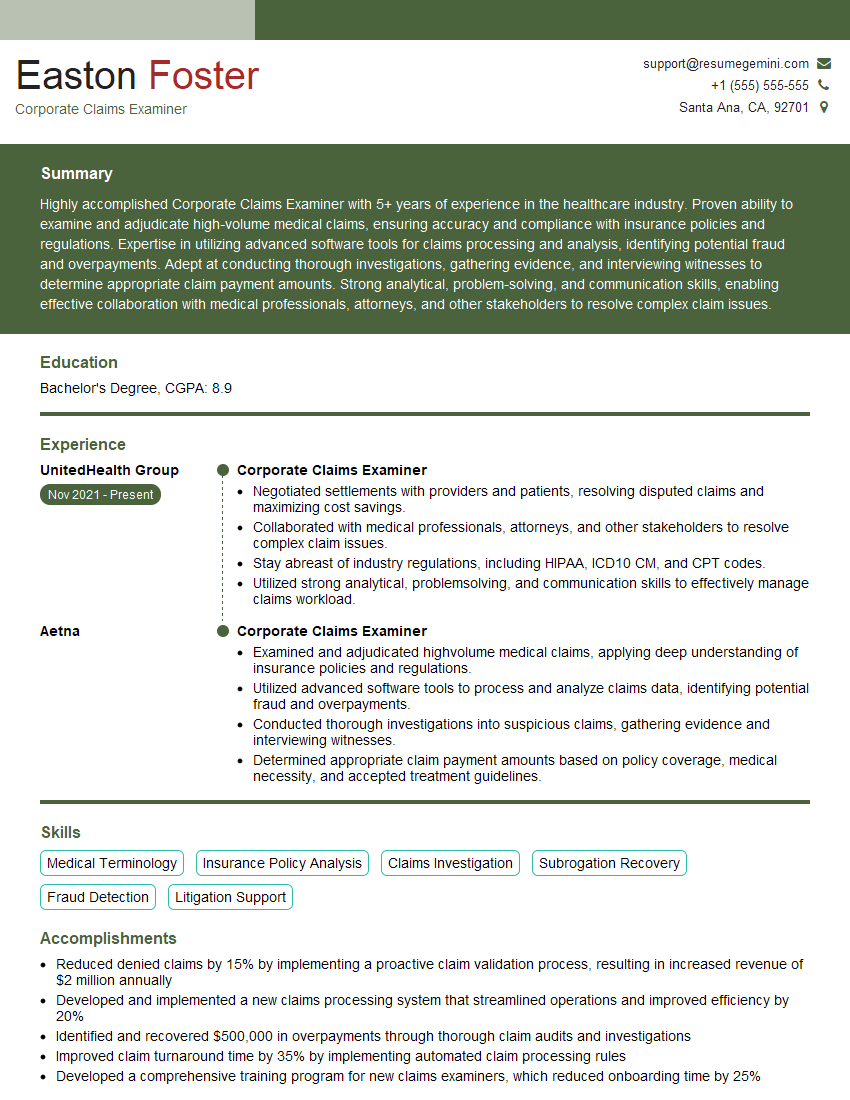

Easton Foster

Corporate Claims Examiner

Summary

Highly accomplished Corporate Claims Examiner with 5+ years of experience in the healthcare industry. Proven ability to examine and adjudicate high-volume medical claims, ensuring accuracy and compliance with insurance policies and regulations. Expertise in utilizing advanced software tools for claims processing and analysis, identifying potential fraud and overpayments. Adept at conducting thorough investigations, gathering evidence, and interviewing witnesses to determine appropriate claim payment amounts. Strong analytical, problem-solving, and communication skills, enabling effective collaboration with medical professionals, attorneys, and other stakeholders to resolve complex claim issues.

Education

Bachelor’s Degree

October 2017

Skills

- Medical Terminology

- Insurance Policy Analysis

- Claims Investigation

- Subrogation Recovery

- Fraud Detection

- Litigation Support

Work Experience

Corporate Claims Examiner

- Negotiated settlements with providers and patients, resolving disputed claims and maximizing cost savings.

- Collaborated with medical professionals, attorneys, and other stakeholders to resolve complex claim issues.

- Stay abreast of industry regulations, including HIPAA, ICD10 CM, and CPT codes.

- Utilized strong analytical, problemsolving, and communication skills to effectively manage claims workload.

Corporate Claims Examiner

- Examined and adjudicated highvolume medical claims, applying deep understanding of insurance policies and regulations.

- Utilized advanced software tools to process and analyze claims data, identifying potential fraud and overpayments.

- Conducted thorough investigations into suspicious claims, gathering evidence and interviewing witnesses.

- Determined appropriate claim payment amounts based on policy coverage, medical necessity, and accepted treatment guidelines.

Accomplishments

- Reduced denied claims by 15% by implementing a proactive claim validation process, resulting in increased revenue of $2 million annually

- Developed and implemented a new claims processing system that streamlined operations and improved efficiency by 20%

- Identified and recovered $500,000 in overpayments through thorough claim audits and investigations

- Improved claim turnaround time by 35% by implementing automated claim processing rules

- Developed a comprehensive training program for new claims examiners, which reduced onboarding time by 25%

Awards

- Corporate Claims Industry Excellence Award for Outstanding Performance in Medical Claim Denials

- Certified Corporate Claims Examiner (CCCE) Credential from the National Association of Independent Insurance Adjusters (NAIIA)

- Presidents Club Award for Exceeding Claims Resolution Targets

- Medical Billing Compliance Professional (MBCP) Certification from the American Health Information Management Association (AHIMA)

Certificates

- Certified Insurance Claims Examiner (CICE)

- Certified Medical Claims Specialist (CMCS)

- Certified Subrogation Recovery Professional (CSRP)

- Certified Insurance Fraud Analyst (CIFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Corporate Claims Examiner

- Highlight your expertise in medical terminology, insurance policy analysis, claims investigation, subrogation recovery, fraud detection, and litigation support.

- Showcase your proficiency in utilizing advanced software tools for claims processing and data analysis.

- Emphasize your strong analytical, problem-solving, and communication skills.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact on the organization.

- Tailor your resume to each job application, highlighting the skills and experience that are most relevant to the specific role.

Essential Experience Highlights for a Strong Corporate Claims Examiner Resume

- Examined and adjudicated high-volume medical claims, applying deep understanding of insurance policies and regulations.

- Utilized advanced software tools to process and analyze claims data, identifying potential fraud and overpayments.

- Conducted thorough investigations into suspicious claims, gathering evidence and interviewing witnesses.

- Determined appropriate claim payment amounts based on policy coverage, medical necessity, and accepted treatment guidelines.

- Negotiated settlements with providers and patients, resolving disputed claims and maximizing cost savings.

- Collaborated with medical professionals, attorneys, and other stakeholders to resolve complex claim issues.

Frequently Asked Questions (FAQ’s) For Corporate Claims Examiner

What are the primary responsibilities of a Corporate Claims Examiner?

Corporate Claims Examiners are responsible for examining and adjudicating medical claims, conducting investigations into suspicious claims, determining appropriate claim payment amounts, negotiating settlements, and collaborating with various stakeholders to resolve complex claim issues.

What skills are essential for success as a Corporate Claims Examiner?

Essential skills for Corporate Claims Examiners include medical terminology, insurance policy analysis, claims investigation, subrogation recovery, fraud detection, litigation support, analytical thinking, problem-solving, and communication.

What is the career path for a Corporate Claims Examiner?

Corporate Claims Examiners can advance to roles such as Claims Manager, Claims Director, and Vice President of Claims, assuming greater responsibilities and leadership positions within the healthcare industry.

What is the job outlook for Corporate Claims Examiners?

The job outlook for Corporate Claims Examiners is expected to grow faster than average due to the increasing complexity of healthcare regulations and the need for qualified professionals to manage and resolve claims.

What is the average salary for a Corporate Claims Examiner?

The average salary for Corporate Claims Examiners varies depending on experience, location, and company size, but typically ranges between $50,000 to $100,000 annually.

What are the benefits of working as a Corporate Claims Examiner?

Benefits of working as a Corporate Claims Examiner include job security, opportunities for career advancement, competitive salaries, and the satisfaction of contributing to the healthcare industry.

What are the challenges of working as a Corporate Claims Examiner?

Challenges of working as a Corporate Claims Examiner include managing high-volume workloads, dealing with complex claims, and navigating the evolving healthcare regulatory landscape.

What is the best way to prepare for a career as a Corporate Claims Examiner?

The best way to prepare for a career as a Corporate Claims Examiner is to obtain a bachelor’s degree in a related field, develop strong analytical and problem-solving skills, and gain experience in the healthcare industry.