Are you a seasoned County Tax Assessor seeking a new career path? Discover our professionally built County Tax Assessor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

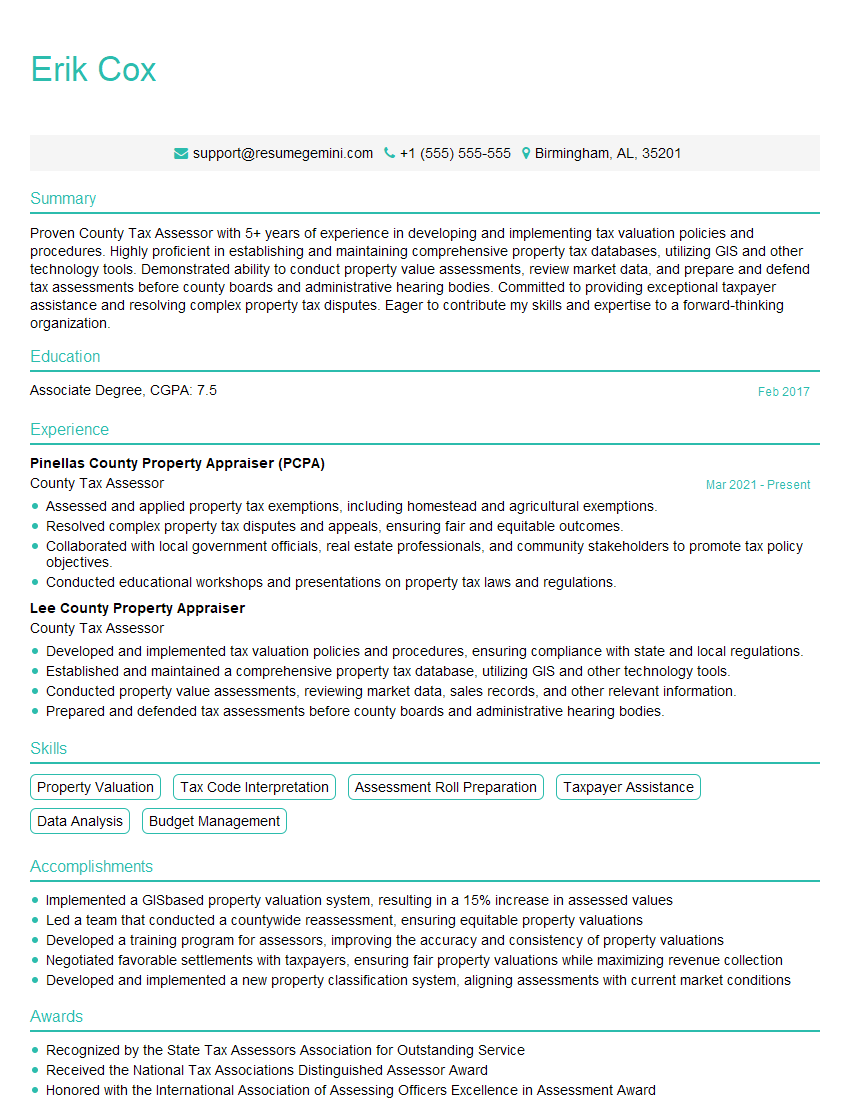

Erik Cox

County Tax Assessor

Summary

Proven County Tax Assessor with 5+ years of experience in developing and implementing tax valuation policies and procedures. Highly proficient in establishing and maintaining comprehensive property tax databases, utilizing GIS and other technology tools. Demonstrated ability to conduct property value assessments, review market data, and prepare and defend tax assessments before county boards and administrative hearing bodies. Committed to providing exceptional taxpayer assistance and resolving complex property tax disputes. Eager to contribute my skills and expertise to a forward-thinking organization.

Education

Associate Degree

February 2017

Skills

- Property Valuation

- Tax Code Interpretation

- Assessment Roll Preparation

- Taxpayer Assistance

- Data Analysis

- Budget Management

Work Experience

County Tax Assessor

- Assessed and applied property tax exemptions, including homestead and agricultural exemptions.

- Resolved complex property tax disputes and appeals, ensuring fair and equitable outcomes.

- Collaborated with local government officials, real estate professionals, and community stakeholders to promote tax policy objectives.

- Conducted educational workshops and presentations on property tax laws and regulations.

County Tax Assessor

- Developed and implemented tax valuation policies and procedures, ensuring compliance with state and local regulations.

- Established and maintained a comprehensive property tax database, utilizing GIS and other technology tools.

- Conducted property value assessments, reviewing market data, sales records, and other relevant information.

- Prepared and defended tax assessments before county boards and administrative hearing bodies.

Accomplishments

- Implemented a GISbased property valuation system, resulting in a 15% increase in assessed values

- Led a team that conducted a countywide reassessment, ensuring equitable property valuations

- Developed a training program for assessors, improving the accuracy and consistency of property valuations

- Negotiated favorable settlements with taxpayers, ensuring fair property valuations while maximizing revenue collection

- Developed and implemented a new property classification system, aligning assessments with current market conditions

Awards

- Recognized by the State Tax Assessors Association for Outstanding Service

- Received the National Tax Associations Distinguished Assessor Award

- Honored with the International Association of Assessing Officers Excellence in Assessment Award

- Presented with the County Commissioners Excellence Award for exceptional contributions to the tax assessment process

Certificates

- Certified Tax Assessor (CTA)

- Certified Mass Appraiser (CMA)

- Certified General Appraiser (CGA)

- Certified Residential Appraiser (CRA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For County Tax Assessor

- Quantify your accomplishments using specific metrics and numbers.

- Highlight your expertise in property valuation and tax code interpretation.

- Demonstrate your proficiency in data analysis and budget management.

- Showcase your commitment to customer service and taxpayer assistance.

Essential Experience Highlights for a Strong County Tax Assessor Resume

- Developed and implemented tax valuation policies and procedures, ensuring compliance with state and local regulations.

- Established and maintained a comprehensive property tax database, utilizing GIS and other technology tools.

- Conducted property value assessments, reviewing market data, sales records, and other relevant information.

- Prepared and defended tax assessments before county boards and administrative hearing bodies.

- Assessed and applied property tax exemptions, including homestead and agricultural exemptions.

- Resolved complex property tax disputes and appeals, ensuring fair and equitable outcomes.

- Collaborated with local government officials, real estate professionals, and community stakeholders to promote tax policy objectives.

Frequently Asked Questions (FAQ’s) For County Tax Assessor

What are the key responsibilities of a County Tax Assessor?

The key responsibilities of a County Tax Assessor include developing and implementing tax valuation policies, establishing and maintaining property tax databases, conducting property value assessments, preparing and defending tax assessments, assessing and applying property tax exemptions, resolving property tax disputes, and collaborating with local government officials and stakeholders.

What qualifications are needed to become a County Tax Assessor?

Most County Tax Assessors hold an Associate Degree in a related field and have several years of experience in property valuation and tax assessment.

What are the career prospects for County Tax Assessors?

County Tax Assessors can advance to leadership positions within the tax assessor’s office, such as Chief Deputy Tax Assessor or Tax Assessor Manager. They may also move into related fields such as real estate appraisal or tax consulting.

What is the salary range for County Tax Assessors?

The salary range for County Tax Assessors varies depending on factors such as experience, location, and the size of the county. According to the U.S. Bureau of Labor Statistics, the median annual salary for Tax Assessors, Collectors, and Revenue Agents was $58,790 in May 2021.

What are the job outlook and employment trends for County Tax Assessors?

The job outlook for County Tax Assessors is expected to be good over the next decade. As property values continue to rise, the demand for qualified tax assessors will increase.

What are some tips for writing a standout County Tax Assessor resume?

To write a standout County Tax Assessor resume, focus on quantifying your accomplishments, highlighting your expertise, demonstrating your commitment to customer service, and tailoring your resume to the specific job you are applying for.

What are some common interview questions for County Tax Assessor positions?

Common interview questions for County Tax Assessor positions include questions about your experience in property valuation, tax assessment, and customer service. You may also be asked about your knowledge of tax laws and regulations, your ability to work independently and as part of a team, and your commitment to ethical conduct.