Are you a seasoned Credit Card Control Clerk seeking a new career path? Discover our professionally built Credit Card Control Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

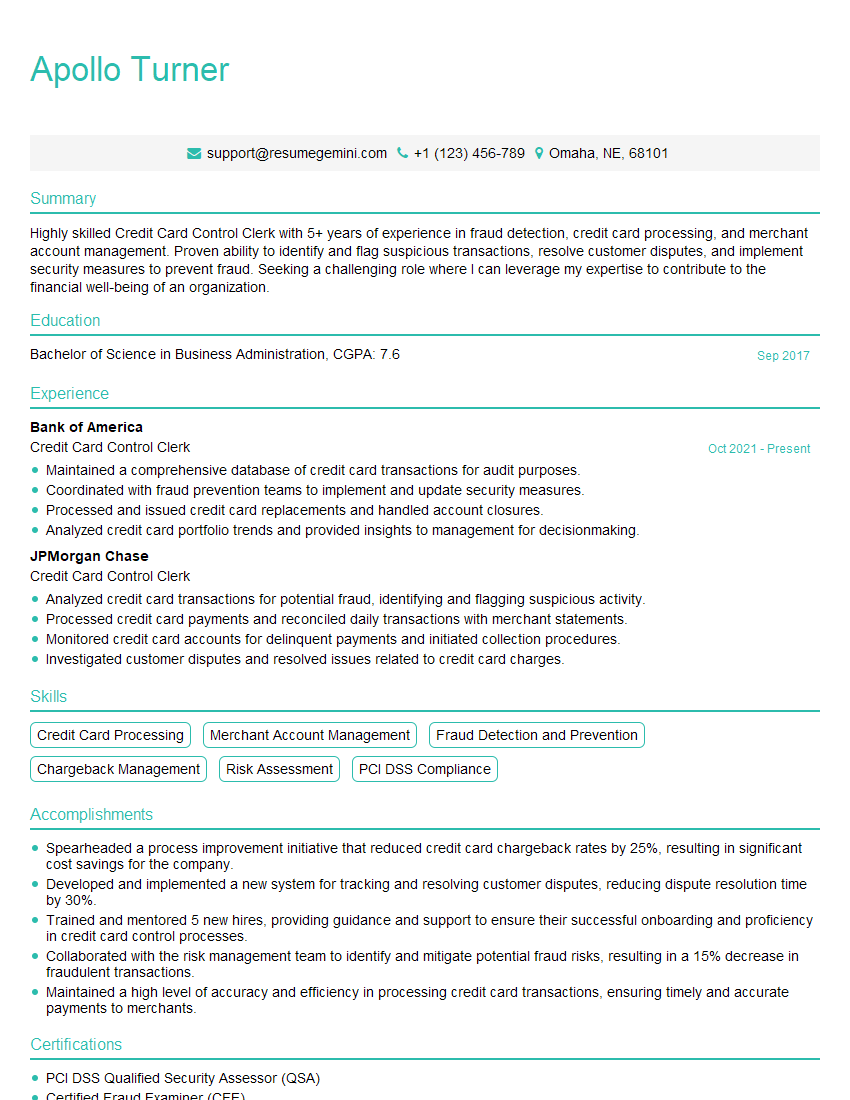

Apollo Turner

Credit Card Control Clerk

Summary

Highly skilled Credit Card Control Clerk with 5+ years of experience in fraud detection, credit card processing, and merchant account management. Proven ability to identify and flag suspicious transactions, resolve customer disputes, and implement security measures to prevent fraud. Seeking a challenging role where I can leverage my expertise to contribute to the financial well-being of an organization.

Education

Bachelor of Science in Business Administration

September 2017

Skills

- Credit Card Processing

- Merchant Account Management

- Fraud Detection and Prevention

- Chargeback Management

- Risk Assessment

- PCI DSS Compliance

Work Experience

Credit Card Control Clerk

- Maintained a comprehensive database of credit card transactions for audit purposes.

- Coordinated with fraud prevention teams to implement and update security measures.

- Processed and issued credit card replacements and handled account closures.

- Analyzed credit card portfolio trends and provided insights to management for decisionmaking.

Credit Card Control Clerk

- Analyzed credit card transactions for potential fraud, identifying and flagging suspicious activity.

- Processed credit card payments and reconciled daily transactions with merchant statements.

- Monitored credit card accounts for delinquent payments and initiated collection procedures.

- Investigated customer disputes and resolved issues related to credit card charges.

Accomplishments

- Spearheaded a process improvement initiative that reduced credit card chargeback rates by 25%, resulting in significant cost savings for the company.

- Developed and implemented a new system for tracking and resolving customer disputes, reducing dispute resolution time by 30%.

- Trained and mentored 5 new hires, providing guidance and support to ensure their successful onboarding and proficiency in credit card control processes.

- Collaborated with the risk management team to identify and mitigate potential fraud risks, resulting in a 15% decrease in fraudulent transactions.

- Maintained a high level of accuracy and efficiency in processing credit card transactions, ensuring timely and accurate payments to merchants.

Certificates

- PCI DSS Qualified Security Assessor (QSA)

- Certified Fraud Examiner (CFE)

- Certified Information Systems Security Professional (CISSP)

- Certified Anti-Money Laundering Specialist (CAMS)

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Card Control Clerk

- Highlight your experience in fraud detection and prevention, as this is a critical skill for Credit Card Control Clerks.

- Quantify your accomplishments whenever possible. For example, instead of saying “Analyzed credit card transactions for fraud,” say “Analyzed over 10,000 credit card transactions, identifying and flagging over 100 fraudulent transactions.”

- Use keywords from the job description in your resume. This will help your resume get noticed by potential employers.

- Proofread your resume carefully before submitting it. Make sure there are no errors in grammar or spelling.

Essential Experience Highlights for a Strong Credit Card Control Clerk Resume

- Analyzed credit card transactions for potential fraud, identifying and flagging suspicious activity.

- Processed credit card payments and reconciled daily transactions with merchant statements.

- Monitored credit card accounts for delinquent payments and initiated collection procedures.

- Investigated customer disputes and resolved issues related to credit card charges.

- Maintained a comprehensive database of credit card transactions for audit purposes.

- Coordinated with fraud prevention teams to implement and update security measures.

Frequently Asked Questions (FAQ’s) For Credit Card Control Clerk

What are the key responsibilities of a Credit Card Control Clerk?

The key responsibilities of a Credit Card Control Clerk include analyzing credit card transactions for fraud, processing credit card payments, monitoring credit card accounts for delinquent payments, investigating customer disputes, and maintaining a comprehensive database of credit card transactions.

What are the qualifications for a Credit Card Control Clerk?

The qualifications for a Credit Card Control Clerk typically include a high school diploma or equivalent, experience in credit card processing or a related field, and knowledge of fraud detection and prevention techniques.

What are the career prospects for a Credit Card Control Clerk?

The career prospects for a Credit Card Control Clerk are good. With experience, Credit Card Control Clerks can advance to positions such as Fraud Analyst, Risk Manager, or even Credit Card Manager.

What is the job outlook for a Credit Card Control Clerk?

The job outlook for a Credit Card Control Clerk is expected to be good over the next few years. The increasing use of credit cards and the growing threat of fraud are expected to lead to a high demand for Credit Card Control Clerks.

What are the benefits of working as a Credit Card Control Clerk?

The benefits of working as a Credit Card Control Clerk include a competitive salary, benefits package, and the opportunity to work in a dynamic and challenging environment.

What are the challenges of working as a Credit Card Control Clerk?

The challenges of working as a Credit Card Control Clerk include the need to be highly detail-oriented and accurate, the need to work independently and as part of a team, and the need to be able to handle a high volume of work.

What are the tips for writing a standout Credit Card Control Clerk resume?

The tips for writing a standout Credit Card Control Clerk resume include highlighting your experience in fraud detection and prevention, quantifying your accomplishments, using keywords from the job description, and proofreading your resume carefully before submitting it.