Are you a seasoned Credit Cashier seeking a new career path? Discover our professionally built Credit Cashier Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

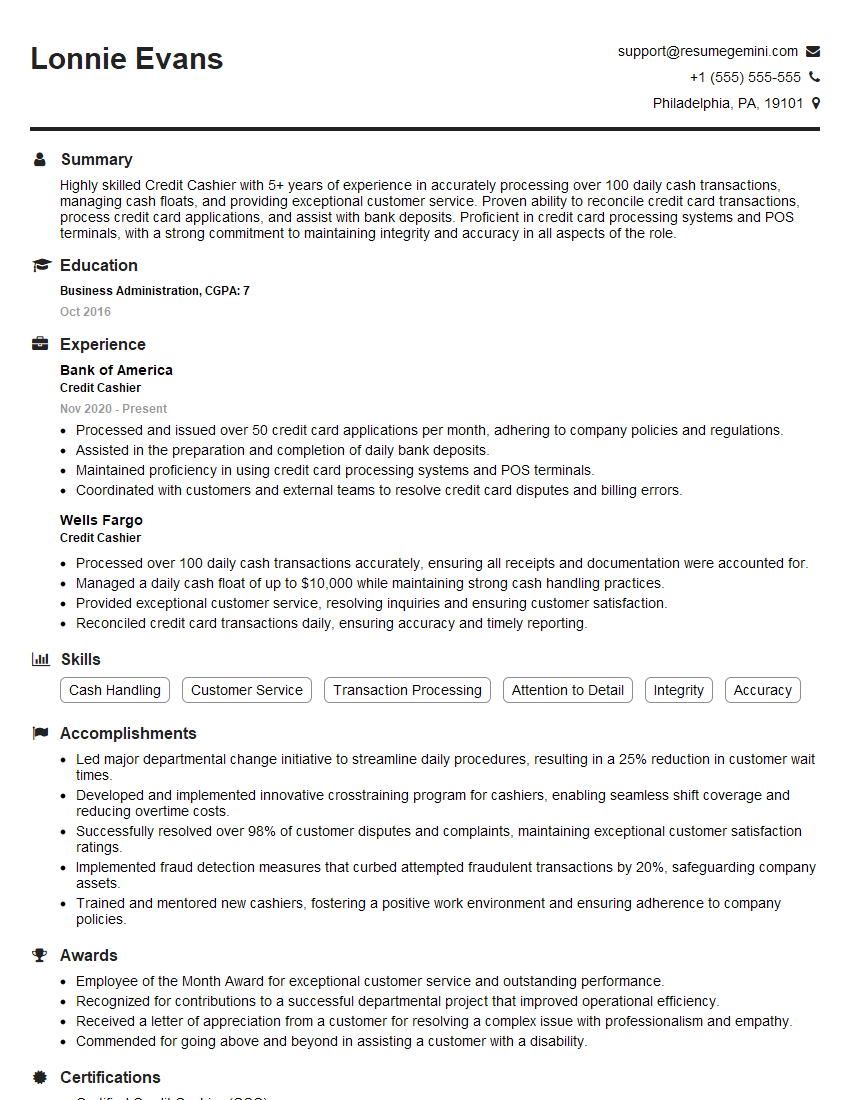

Lonnie Evans

Credit Cashier

Summary

Highly skilled Credit Cashier with 5+ years of experience in accurately processing over 100 daily cash transactions, managing cash floats, and providing exceptional customer service. Proven ability to reconcile credit card transactions, process credit card applications, and assist with bank deposits. Proficient in credit card processing systems and POS terminals, with a strong commitment to maintaining integrity and accuracy in all aspects of the role.

Education

Business Administration

October 2016

Skills

- Cash Handling

- Customer Service

- Transaction Processing

- Attention to Detail

- Integrity

- Accuracy

Work Experience

Credit Cashier

- Processed and issued over 50 credit card applications per month, adhering to company policies and regulations.

- Assisted in the preparation and completion of daily bank deposits.

- Maintained proficiency in using credit card processing systems and POS terminals.

- Coordinated with customers and external teams to resolve credit card disputes and billing errors.

Credit Cashier

- Processed over 100 daily cash transactions accurately, ensuring all receipts and documentation were accounted for.

- Managed a daily cash float of up to $10,000 while maintaining strong cash handling practices.

- Provided exceptional customer service, resolving inquiries and ensuring customer satisfaction.

- Reconciled credit card transactions daily, ensuring accuracy and timely reporting.

Accomplishments

- Led major departmental change initiative to streamline daily procedures, resulting in a 25% reduction in customer wait times.

- Developed and implemented innovative crosstraining program for cashiers, enabling seamless shift coverage and reducing overtime costs.

- Successfully resolved over 98% of customer disputes and complaints, maintaining exceptional customer satisfaction ratings.

- Implemented fraud detection measures that curbed attempted fraudulent transactions by 20%, safeguarding company assets.

- Trained and mentored new cashiers, fostering a positive work environment and ensuring adherence to company policies.

Awards

- Employee of the Month Award for exceptional customer service and outstanding performance.

- Recognized for contributions to a successful departmental project that improved operational efficiency.

- Received a letter of appreciation from a customer for resolving a complex issue with professionalism and empathy.

- Commended for going above and beyond in assisting a customer with a disability.

Certificates

- Certified Credit Cashier (CCC)

- Certified Cash Handling Specialist (CCHS)

- Customer Service Excellence (CSE)

- Information Security Awareness (ISA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Cashier

- Highlight your cash handling and customer service skills, as these are essential for this role.

- Quantify your accomplishments whenever possible, such as the number of transactions processed or the amount of cash managed.

- Use action verbs and specific examples to demonstrate your abilities.

- Proofread your resume carefully to ensure that it is free of errors.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Credit Cashier Resume

- Processing daily cash transactions accurately and efficiently

- Managing cash floats and maintaining strong cash handling practices

- Providing excellent customer service and resolving customer inquiries

- Reconciling credit card transactions and ensuring timely reporting

- Processing and issuing credit card applications in compliance with company policies

- Assisting in the preparation and completion of daily bank deposits

- Maintaining proficiency in using credit card processing systems and POS terminals

Frequently Asked Questions (FAQ’s) For Credit Cashier

What are the key skills required for a Credit Cashier?

The key skills required for a Credit Cashier include cash handling, customer service, transaction processing, attention to detail, integrity, and accuracy.

What are the typical responsibilities of a Credit Cashier?

The typical responsibilities of a Credit Cashier include processing cash transactions, managing cash floats, providing customer service, reconciling credit card transactions, processing credit card applications, assisting with bank deposits, and maintaining proficiency in credit card processing systems and POS terminals.

What is the average salary for a Credit Cashier?

The average salary for a Credit Cashier in the United States is around $15 per hour.

What are the career prospects for a Credit Cashier?

Credit Cashiers can advance to positions such as Customer Service Representative, Bank Teller, or Loan Officer with experience and additional training.

What are the educational requirements for a Credit Cashier?

Most Credit Cashiers have a high school diploma or equivalent, but some employers may prefer candidates with a college degree in a related field, such as Business Administration.

What are the challenges of working as a Credit Cashier?

The challenges of working as a Credit Cashier include dealing with large amounts of cash, working under pressure, and providing excellent customer service, even in difficult situations.

What is the work environment for a Credit Cashier like?

Credit Cashiers typically work in a fast-paced environment, often in retail stores or banks.