Are you a seasoned Credit Compliance Officer seeking a new career path? Discover our professionally built Credit Compliance Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

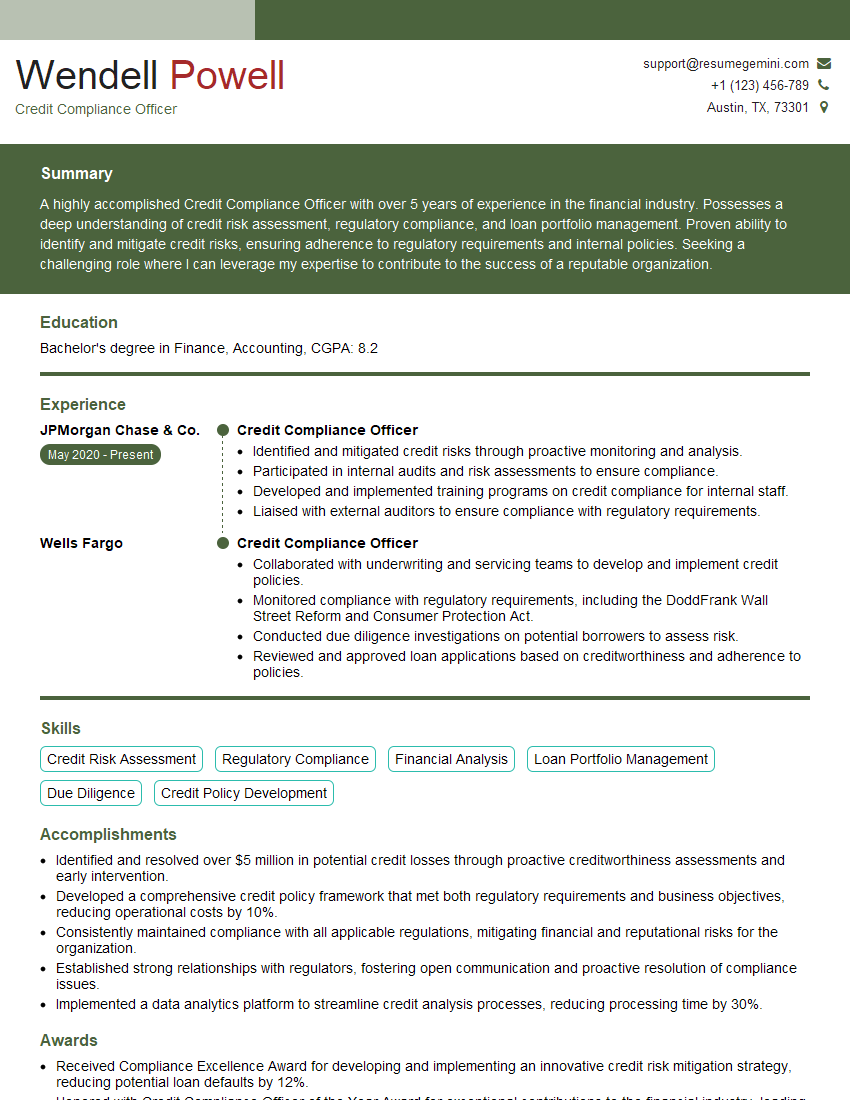

Wendell Powell

Credit Compliance Officer

Summary

A highly accomplished Credit Compliance Officer with over 5 years of experience in the financial industry. Possesses a deep understanding of credit risk assessment, regulatory compliance, and loan portfolio management. Proven ability to identify and mitigate credit risks, ensuring adherence to regulatory requirements and internal policies. Seeking a challenging role where I can leverage my expertise to contribute to the success of a reputable organization.

Education

Bachelor’s degree in Finance, Accounting

April 2016

Skills

- Credit Risk Assessment

- Regulatory Compliance

- Financial Analysis

- Loan Portfolio Management

- Due Diligence

- Credit Policy Development

Work Experience

Credit Compliance Officer

- Identified and mitigated credit risks through proactive monitoring and analysis.

- Participated in internal audits and risk assessments to ensure compliance.

- Developed and implemented training programs on credit compliance for internal staff.

- Liaised with external auditors to ensure compliance with regulatory requirements.

Credit Compliance Officer

- Collaborated with underwriting and servicing teams to develop and implement credit policies.

- Monitored compliance with regulatory requirements, including the DoddFrank Wall Street Reform and Consumer Protection Act.

- Conducted due diligence investigations on potential borrowers to assess risk.

- Reviewed and approved loan applications based on creditworthiness and adherence to policies.

Accomplishments

- Identified and resolved over $5 million in potential credit losses through proactive creditworthiness assessments and early intervention.

- Developed a comprehensive credit policy framework that met both regulatory requirements and business objectives, reducing operational costs by 10%.

- Consistently maintained compliance with all applicable regulations, mitigating financial and reputational risks for the organization.

- Established strong relationships with regulators, fostering open communication and proactive resolution of compliance issues.

- Implemented a data analytics platform to streamline credit analysis processes, reducing processing time by 30%.

Awards

- Received Compliance Excellence Award for developing and implementing an innovative credit risk mitigation strategy, reducing potential loan defaults by 12%.

- Honored with Credit Compliance Officer of the Year Award for exceptional contributions to the financial industry, leading to enhanced regulatory compliance.

- Received Certificate of Excellence for devising and executing a credit monitoring system that significantly improved early warning detection capabilities.

- Recognized for outstanding contributions to the compliance team, resulting in a 40% reduction in regulatory violations.

Certificates

- Certified Credit Compliance Professional (CCCP)

- Certified Regulatory Compliance Manager (CRCM)

- Credit Risk Analyst (CRA)

- Financial Risk Manager (FRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Compliance Officer

- Highlight your experience in credit risk assessment, regulatory compliance, and loan portfolio management.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Showcase your knowledge of the latest regulatory requirements and industry best practices.

- Emphasize your ability to work independently and as part of a team.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Credit Compliance Officer Resume

- Collaborated with underwriting and servicing teams to develop and implement credit policies.

- Monitored compliance with regulatory requirements, including the DoddFrank Wall Street Reform and Consumer Protection Act.

- Conducted due diligence investigations on potential borrowers to assess risk.

- Reviewed and approved loan applications based on creditworthiness and adherence to policies.

- Identified and mitigated credit risks through proactive monitoring and analysis.

- Participated in internal audits and risk assessments to ensure compliance.

- Developed and implemented training programs on credit compliance for internal staff.

Frequently Asked Questions (FAQ’s) For Credit Compliance Officer

What is the role of a Credit Compliance Officer?

A Credit Compliance Officer is responsible for ensuring that a financial institution complies with all applicable laws and regulations related to lending and credit. This includes developing and implementing credit policies, monitoring compliance with those policies, and conducting due diligence on potential borrowers.

What are the key skills required for a Credit Compliance Officer?

Key skills for a Credit Compliance Officer include credit risk assessment, regulatory compliance, financial analysis, loan portfolio management, and due diligence.

What are the career prospects for a Credit Compliance Officer?

Credit Compliance Officers can advance to senior roles within the compliance department, such as Compliance Manager or Chief Compliance Officer. They may also move into other areas of finance, such as risk management or internal audit.

What is the job outlook for Credit Compliance Officers?

The job outlook for Credit Compliance Officers is expected to be good over the next few years. This is due to the increasing complexity of financial regulations and the growing importance of compliance.

What is the average salary for a Credit Compliance Officer?

The average salary for a Credit Compliance Officer in the United States is around $85,000 per year.

What are the educational requirements for a Credit Compliance Officer?

Most Credit Compliance Officers have a bachelor’s degree in finance, accounting, or a related field.

What are the certifications available for Credit Compliance Officers?

There are several certifications available for Credit Compliance Officers, including the Certified Compliance Professional (CCP) and the Certified Anti-Money Laundering Specialist (CAMS).

What are the professional organizations for Credit Compliance Officers?

There are several professional organizations for Credit Compliance Officers, including the American Bankers Association (ABA) and the Association of Certified Anti-Money Laundering Specialists (ACAMS).