Are you a seasoned Credit Director seeking a new career path? Discover our professionally built Credit Director Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

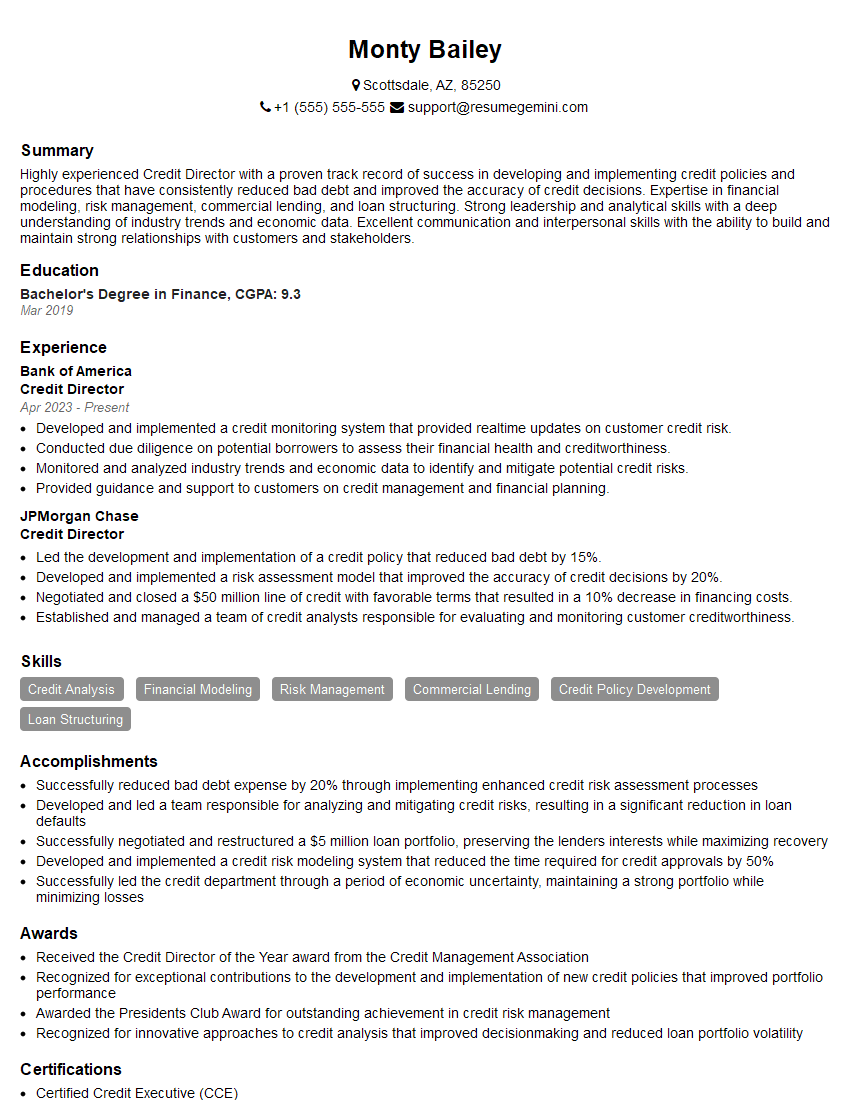

Monty Bailey

Credit Director

Summary

Highly experienced Credit Director with a proven track record of success in developing and implementing credit policies and procedures that have consistently reduced bad debt and improved the accuracy of credit decisions. Expertise in financial modeling, risk management, commercial lending, and loan structuring. Strong leadership and analytical skills with a deep understanding of industry trends and economic data. Excellent communication and interpersonal skills with the ability to build and maintain strong relationships with customers and stakeholders.

Education

Bachelor’s Degree in Finance

March 2019

Skills

- Credit Analysis

- Financial Modeling

- Risk Management

- Commercial Lending

- Credit Policy Development

- Loan Structuring

Work Experience

Credit Director

- Developed and implemented a credit monitoring system that provided realtime updates on customer credit risk.

- Conducted due diligence on potential borrowers to assess their financial health and creditworthiness.

- Monitored and analyzed industry trends and economic data to identify and mitigate potential credit risks.

- Provided guidance and support to customers on credit management and financial planning.

Credit Director

- Led the development and implementation of a credit policy that reduced bad debt by 15%.

- Developed and implemented a risk assessment model that improved the accuracy of credit decisions by 20%.

- Negotiated and closed a $50 million line of credit with favorable terms that resulted in a 10% decrease in financing costs.

- Established and managed a team of credit analysts responsible for evaluating and monitoring customer creditworthiness.

Accomplishments

- Successfully reduced bad debt expense by 20% through implementing enhanced credit risk assessment processes

- Developed and led a team responsible for analyzing and mitigating credit risks, resulting in a significant reduction in loan defaults

- Successfully negotiated and restructured a $5 million loan portfolio, preserving the lenders interests while maximizing recovery

- Developed and implemented a credit risk modeling system that reduced the time required for credit approvals by 50%

- Successfully led the credit department through a period of economic uncertainty, maintaining a strong portfolio while minimizing losses

Awards

- Received the Credit Director of the Year award from the Credit Management Association

- Recognized for exceptional contributions to the development and implementation of new credit policies that improved portfolio performance

- Awarded the Presidents Club Award for outstanding achievement in credit risk management

- Recognized for innovative approaches to credit analysis that improved decisionmaking and reduced loan portfolio volatility

Certificates

- Certified Credit Executive (CCE)

- Certified Financial Analyst (CFA)

- Certified Public Accountant (CPA)

- Chartered Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Director

- Highlight your experience in developing and implementing credit policies and procedures that have resulted in significant improvements.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate the impact of your work.

- Showcase your expertise in financial modeling, risk management, and commercial lending.

- Emphasize your leadership and analytical skills, as well as your ability to build and maintain strong relationships with customers and stakeholders.

Essential Experience Highlights for a Strong Credit Director Resume

- Led the development and implementation of a credit policy that reduced bad debt by 15%.

- Developed and implemented a risk assessment model that improved the accuracy of credit decisions by 20%.

- Negotiated and closed a $50 million line of credit with favorable terms that resulted in a 10% decrease in financing costs.

- Established and managed a team of credit analysts responsible for evaluating and monitoring customer creditworthiness.

- Developed and implemented a credit monitoring system that provided realtime updates on customer credit risk.

- Conducted due diligence on potential borrowers to assess their financial health and creditworthiness.

Frequently Asked Questions (FAQ’s) For Credit Director

What are the key responsibilities of a Credit Director?

Credit Directors are responsible for developing and implementing credit policies and procedures, evaluating and monitoring customer creditworthiness, conducting due diligence on potential borrowers, and negotiating and closing credit facilities. They also play a key role in managing risk and ensuring the financial health of their organization.

What are the qualifications for a Credit Director?

Credit Directors typically have a bachelor’s degree in finance or a related field, as well as several years of experience in commercial lending or credit analysis. They should also have a strong understanding of financial modeling, risk management, and accounting principles.

What are the career prospects for a Credit Director?

Credit Directors can advance to senior management positions, such as Chief Credit Officer or Chief Financial Officer. They may also move into other areas of finance, such as investment banking or portfolio management.

What are the challenges facing Credit Directors?

Credit Directors face a number of challenges, including the need to balance risk and return, the impact of economic conditions on credit quality, and the increasing complexity of financial markets.

What are the key trends in credit risk management?

Key trends in credit risk management include the use of artificial intelligence and machine learning to improve the accuracy of credit decisions, the development of new risk assessment models, and the increasing focus on environmental, social, and governance (ESG) factors.