Are you a seasoned Credit Products Officer seeking a new career path? Discover our professionally built Credit Products Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

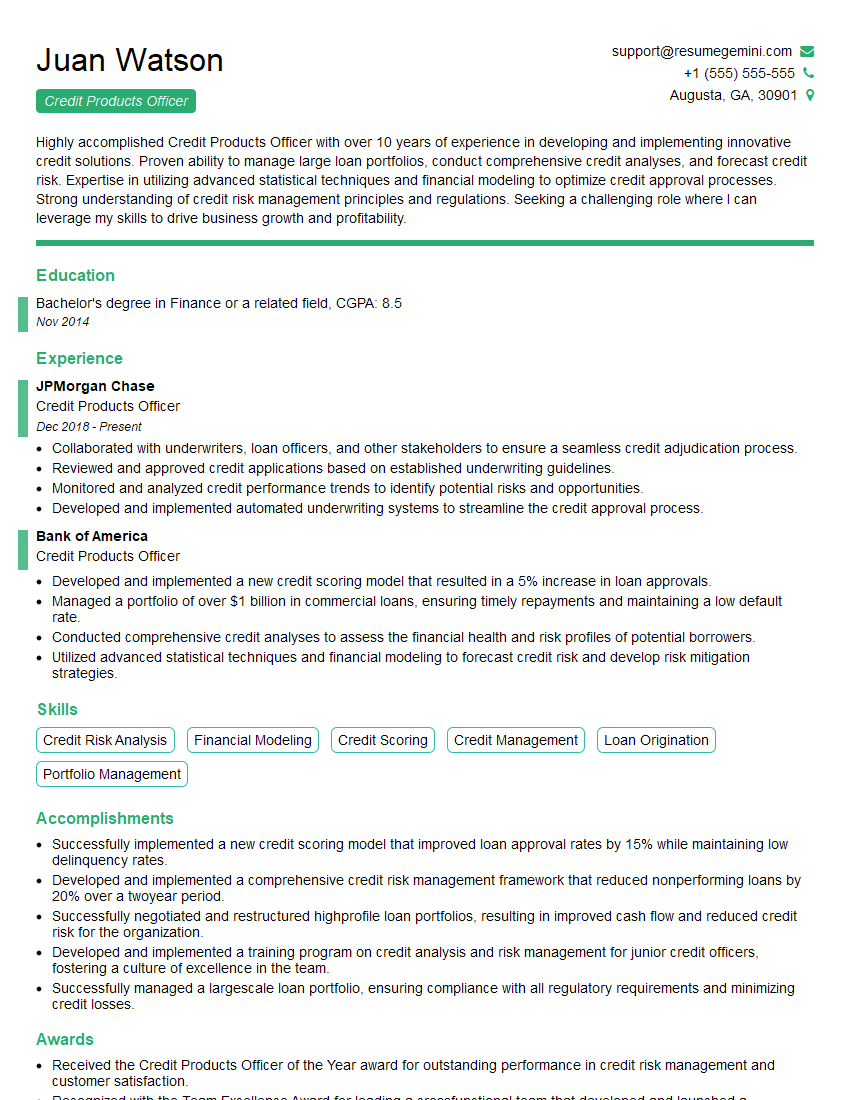

Juan Watson

Credit Products Officer

Summary

Highly accomplished Credit Products Officer with over 10 years of experience in developing and implementing innovative credit solutions. Proven ability to manage large loan portfolios, conduct comprehensive credit analyses, and forecast credit risk. Expertise in utilizing advanced statistical techniques and financial modeling to optimize credit approval processes. Strong understanding of credit risk management principles and regulations. Seeking a challenging role where I can leverage my skills to drive business growth and profitability.

Education

Bachelor’s degree in Finance or a related field

November 2014

Skills

- Credit Risk Analysis

- Financial Modeling

- Credit Scoring

- Credit Management

- Loan Origination

- Portfolio Management

Work Experience

Credit Products Officer

- Collaborated with underwriters, loan officers, and other stakeholders to ensure a seamless credit adjudication process.

- Reviewed and approved credit applications based on established underwriting guidelines.

- Monitored and analyzed credit performance trends to identify potential risks and opportunities.

- Developed and implemented automated underwriting systems to streamline the credit approval process.

Credit Products Officer

- Developed and implemented a new credit scoring model that resulted in a 5% increase in loan approvals.

- Managed a portfolio of over $1 billion in commercial loans, ensuring timely repayments and maintaining a low default rate.

- Conducted comprehensive credit analyses to assess the financial health and risk profiles of potential borrowers.

- Utilized advanced statistical techniques and financial modeling to forecast credit risk and develop risk mitigation strategies.

Accomplishments

- Successfully implemented a new credit scoring model that improved loan approval rates by 15% while maintaining low delinquency rates.

- Developed and implemented a comprehensive credit risk management framework that reduced nonperforming loans by 20% over a twoyear period.

- Successfully negotiated and restructured highprofile loan portfolios, resulting in improved cash flow and reduced credit risk for the organization.

- Developed and implemented a training program on credit analysis and risk management for junior credit officers, fostering a culture of excellence in the team.

- Successfully managed a largescale loan portfolio, ensuring compliance with all regulatory requirements and minimizing credit losses.

Awards

- Received the Credit Products Officer of the Year award for outstanding performance in credit risk management and customer satisfaction.

- Recognized with the Team Excellence Award for leading a crossfunctional team that developed and launched a innovative credit product.

- Received the Top Performer award for consistently exceeding expectations in credit portfolio management and customer service.

- Recognized as a Subject Matter Expert in credit products and risk assessment by industry peers and regulatory bodies.

Certificates

- Certified Credit Risk Analyst (CCRA)

- Certified Financial Risk Manager (CFRM)

- Certified Business Credit Analyst (CBCA)

- Certified Commercial Banker (CCB)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Products Officer

- Quantify your accomplishments and provide specific examples of your success in credit risk management.

- Highlight your expertise in utilizing advanced statistical techniques and financial modeling.

- Demonstrate your understanding of credit risk management principles and regulations.

- Showcase your ability to collaborate effectively with a diverse team of stakeholders.

- Tailor your resume to the specific requirements of the job you are applying for.

Essential Experience Highlights for a Strong Credit Products Officer Resume

- Developed and implemented a new credit scoring model that resulted in a 5% increase in loan approvals.

- Managed a portfolio of over $1 billion in commercial loans, ensuring timely repayments and maintaining a low default rate.

- Conducted comprehensive credit analyses to assess the financial health and risk profiles of potential borrowers.

- Utilized advanced statistical techniques and financial modeling to forecast credit risk and develop risk mitigation strategies.

- Collaborated with underwriters, loan officers, and other stakeholders to ensure a seamless credit adjudication process.

- Reviewed and approved credit applications based on established underwriting guidelines.

- Monitored and analyzed credit performance trends to identify potential risks and opportunities.

Frequently Asked Questions (FAQ’s) For Credit Products Officer

What are the key responsibilities of a Credit Products Officer?

The key responsibilities of a Credit Products Officer include developing and implementing credit scoring models, managing loan portfolios, conducting credit analyses, forecasting credit risk, and collaborating with stakeholders to ensure a seamless credit adjudication process.

What qualifications are required to become a Credit Products Officer?

To become a Credit Products Officer, you typically need a bachelor’s degree in Finance or a related field, as well as several years of experience in credit risk management.

What are the career prospects for Credit Products Officers?

Credit Products Officers can advance to senior roles in credit risk management, such as Credit Risk Manager or Chief Credit Officer. They may also move into other areas of finance, such as investment banking or commercial lending.

What are the challenges faced by Credit Products Officers?

Credit Products Officers face a number of challenges, including the need to keep up with changing regulations, the need to manage risk effectively, and the need to make sound decisions in a timely manner.

What are the key skills required for a Credit Products Officer?

Key skills for a Credit Products Officer include analytical skills, financial modeling skills, risk management skills, and communication skills.

What is the average salary for a Credit Products Officer?

The average salary for a Credit Products Officer varies depending on experience and location, but it is typically in the range of $70,000 to $120,000.

What are the benefits of working as a Credit Products Officer?

Benefits of working as a Credit Products Officer include the opportunity to work in a challenging and rewarding field, the opportunity to make a significant impact on the success of a company, and the opportunity to earn a competitive salary and benefits package.