Are you a seasoned Credit Risk Review Officer seeking a new career path? Discover our professionally built Credit Risk Review Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

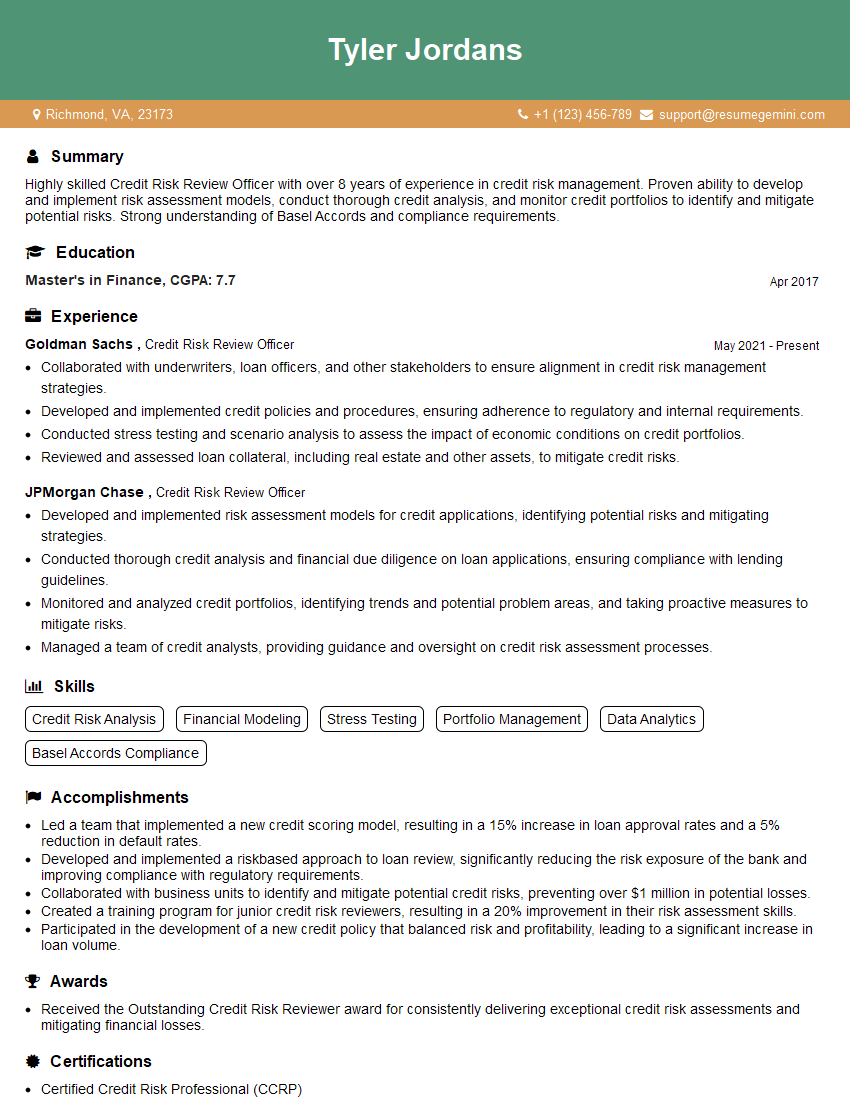

Tyler Jordans

Credit Risk Review Officer

Summary

Highly skilled Credit Risk Review Officer with over 8 years of experience in credit risk management. Proven ability to develop and implement risk assessment models, conduct thorough credit analysis, and monitor credit portfolios to identify and mitigate potential risks. Strong understanding of Basel Accords and compliance requirements.

Education

Master’s in Finance

April 2017

Skills

- Credit Risk Analysis

- Financial Modeling

- Stress Testing

- Portfolio Management

- Data Analytics

- Basel Accords Compliance

Work Experience

Credit Risk Review Officer

- Collaborated with underwriters, loan officers, and other stakeholders to ensure alignment in credit risk management strategies.

- Developed and implemented credit policies and procedures, ensuring adherence to regulatory and internal requirements.

- Conducted stress testing and scenario analysis to assess the impact of economic conditions on credit portfolios.

- Reviewed and assessed loan collateral, including real estate and other assets, to mitigate credit risks.

Credit Risk Review Officer

- Developed and implemented risk assessment models for credit applications, identifying potential risks and mitigating strategies.

- Conducted thorough credit analysis and financial due diligence on loan applications, ensuring compliance with lending guidelines.

- Monitored and analyzed credit portfolios, identifying trends and potential problem areas, and taking proactive measures to mitigate risks.

- Managed a team of credit analysts, providing guidance and oversight on credit risk assessment processes.

Accomplishments

- Led a team that implemented a new credit scoring model, resulting in a 15% increase in loan approval rates and a 5% reduction in default rates.

- Developed and implemented a riskbased approach to loan review, significantly reducing the risk exposure of the bank and improving compliance with regulatory requirements.

- Collaborated with business units to identify and mitigate potential credit risks, preventing over $1 million in potential losses.

- Created a training program for junior credit risk reviewers, resulting in a 20% improvement in their risk assessment skills.

- Participated in the development of a new credit policy that balanced risk and profitability, leading to a significant increase in loan volume.

Awards

- Received the Outstanding Credit Risk Reviewer award for consistently delivering exceptional credit risk assessments and mitigating financial losses.

Certificates

- Certified Credit Risk Professional (CCRP)

- Certified Financial Risk Manager (FRM)

- Certified Risk Manager (CRM)

- Advanced Credit Risk Modeling Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Risk Review Officer

Quantify your accomplishments.

Use numbers and metrics to demonstrate the impact of your work.Highlight your skills in data analysis and modeling.

These skills are essential for credit risk review officers.Showcase your understanding of Basel Accords compliance.

This is a key requirement for credit risk review officers.Emphasize your ability to work independently and as part of a team.

This is an important skill for credit risk review officers.Proofread your resume carefully.

Make sure there are no errors in grammar or spelling.

Essential Experience Highlights for a Strong Credit Risk Review Officer Resume

- Developed and implemented risk assessment models for credit applications, identifying potential risks and mitigating strategies.

- Conducted thorough credit analysis and financial due diligence on loan applications, ensuring compliance with lending guidelines.

- Monitored and analyzed credit portfolios, identifying trends and potential problem areas, and taking proactive measures to mitigate risks.

- Managed a team of credit analysts, providing guidance and oversight on credit risk assessment processes.

- Collaborated with underwriters, loan officers, and other stakeholders to ensure alignment in credit risk management strategies.

- Developed and implemented credit policies and procedures, ensuring adherence to regulatory and internal requirements.

- Conducted stress testing and scenario analysis to assess the impact of economic conditions on credit portfolios.

Frequently Asked Questions (FAQ’s) For Credit Risk Review Officer

What is the role of a Credit Risk Review Officer?

A Credit Risk Review Officer is responsible for assessing and mitigating the credit risk of loan applications and existing ????????? ????????. They develop and implement risk assessment models, conduct financial due diligence, monitor credit portfolios, and work with underwriters and loan officers to ensure that ????????? ????? are managed appropriately.

What are the qualifications for a Credit Risk Review Officer?

A Credit Risk Review Officer typically has a master’s degree in finance or a related field, as well as several years of experience in credit risk management. They should have a strong understanding of Basel Accords compliance and be proficient in data analysis and modeling.

What are the key skills for a Credit Risk Review Officer?

Key skills for a Credit Risk Review Officer include: data analysis and modeling, financial due diligence, Basel Accords compliance, credit risk assessment, and communication.

What is the career path for a Credit Risk Review Officer?

A Credit Risk Review Officer can advance to a variety of leadership roles in credit risk management, such as Credit Risk Manager, Vice President of Credit Risk, or Chief Credit Officer.

What is the salary range for a Credit Risk Review Officer?

The salary range for a Credit Risk Review Officer varies depending on experience, location, and company size. According to Glassdoor, the average salary for a Credit Risk Review Officer in the United States is $105,000 per year.

What are the job prospects for a Credit Risk Review Officer?

The job outlook for Credit Risk Review Officers is expected to grow faster than average in the coming years. This is due to the increasing complexity of the financial markets and the need for businesses to manage their credit risk effectively.

What are some of the challenges that Credit Risk Review Officers face?

Some of the challenges that Credit Risk Review Officers face include: the need to stay up-to-date on the latest regulatory changes, the need to make decisions in a timely manner, and the need to manage the risk of the financial markets.