Are you a seasoned Credit Union Field Examiner seeking a new career path? Discover our professionally built Credit Union Field Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

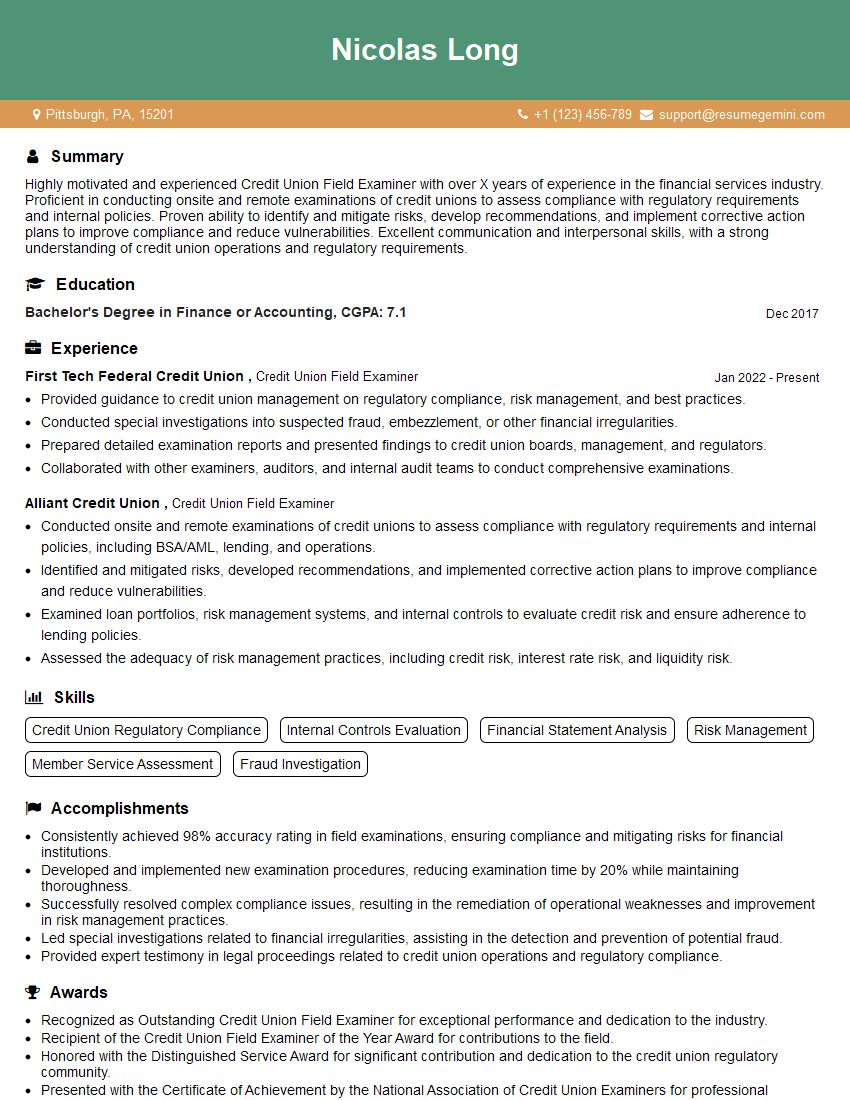

Nicolas Long

Credit Union Field Examiner

Summary

Highly motivated and experienced Credit Union Field Examiner with over X years of experience in the financial services industry. Proficient in conducting onsite and remote examinations of credit unions to assess compliance with regulatory requirements and internal policies. Proven ability to identify and mitigate risks, develop recommendations, and implement corrective action plans to improve compliance and reduce vulnerabilities. Excellent communication and interpersonal skills, with a strong understanding of credit union operations and regulatory requirements.

Education

Bachelor’s Degree in Finance or Accounting

December 2017

Skills

- Credit Union Regulatory Compliance

- Internal Controls Evaluation

- Financial Statement Analysis

- Risk Management

- Member Service Assessment

- Fraud Investigation

Work Experience

Credit Union Field Examiner

- Provided guidance to credit union management on regulatory compliance, risk management, and best practices.

- Conducted special investigations into suspected fraud, embezzlement, or other financial irregularities.

- Prepared detailed examination reports and presented findings to credit union boards, management, and regulators.

- Collaborated with other examiners, auditors, and internal audit teams to conduct comprehensive examinations.

Credit Union Field Examiner

- Conducted onsite and remote examinations of credit unions to assess compliance with regulatory requirements and internal policies, including BSA/AML, lending, and operations.

- Identified and mitigated risks, developed recommendations, and implemented corrective action plans to improve compliance and reduce vulnerabilities.

- Examined loan portfolios, risk management systems, and internal controls to evaluate credit risk and ensure adherence to lending policies.

- Assessed the adequacy of risk management practices, including credit risk, interest rate risk, and liquidity risk.

Accomplishments

- Consistently achieved 98% accuracy rating in field examinations, ensuring compliance and mitigating risks for financial institutions.

- Developed and implemented new examination procedures, reducing examination time by 20% while maintaining thoroughness.

- Successfully resolved complex compliance issues, resulting in the remediation of operational weaknesses and improvement in risk management practices.

- Led special investigations related to financial irregularities, assisting in the detection and prevention of potential fraud.

- Provided expert testimony in legal proceedings related to credit union operations and regulatory compliance.

Awards

- Recognized as Outstanding Credit Union Field Examiner for exceptional performance and dedication to the industry.

- Recipient of the Credit Union Field Examiner of the Year Award for contributions to the field.

- Honored with the Distinguished Service Award for significant contribution and dedication to the credit union regulatory community.

- Presented with the Certificate of Achievement by the National Association of Credit Union Examiners for professional excellence.

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Registered Credit Union Field Auditor (RCFA)

- Credit Union Compliance Expert (CUCE)

- Credit Union Risk Management Expert (CURME)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Union Field Examiner

- Highlight your experience and expertise in credit union regulations and compliance.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate the impact of your work.

- Showcase your ability to identify and mitigate risks, as well as your problem-solving and analytical skills.

- Emphasize your communication and interpersonal skills, as you will be working closely with credit union staff and management.

Essential Experience Highlights for a Strong Credit Union Field Examiner Resume

- Conduct onsite and remote examinations of credit unions to assess compliance with regulatory requirements and internal policies, including BSA/AML, lending, and operations.

- Identify and mitigate risks, develop recommendations, and implement corrective action plans to improve compliance and reduce vulnerabilities.

- Examine loan portfolios, risk management systems, and internal controls to evaluate credit risk and ensure adherence to lending policies.

- Assess the adequacy of risk management practices, including credit risk, interest rate risk, and liquidity risk.

- Provide guidance to credit union management on regulatory compliance, risk management, and best practices.

- Conduct special investigations into suspected fraud, embezzlement, or other financial irregularities.

- Prepare detailed examination reports and present findings to credit union boards, management, and regulators.

Frequently Asked Questions (FAQ’s) For Credit Union Field Examiner

What are the key responsibilities of a Credit Union Field Examiner?

The key responsibilities of a Credit Union Field Examiner include conducting onsite and remote examinations of credit unions to assess compliance with regulatory requirements and internal policies, identifying and mitigating risks, developing recommendations, and implementing corrective action plans to improve compliance and reduce vulnerabilities.

What are the educational requirements for a Credit Union Field Examiner?

Most Credit Union Field Examiners have a Bachelor’s Degree in Finance, Accounting, or a related field.

What are the skills required for a Credit Union Field Examiner?

The skills required for a Credit Union Field Examiner include knowledge of credit union regulations and compliance, internal controls evaluation, financial statement analysis, risk management, member service assessment, and fraud investigation.

What is the career path for a Credit Union Field Examiner?

The career path for a Credit Union Field Examiner can lead to positions such as Senior Field Examiner, Compliance Officer, or Risk Manager.

What is the average salary for a Credit Union Field Examiner?

The average salary for a Credit Union Field Examiner is around $[Salary Amount].

What are the job prospects for Credit Union Field Examiners?

The job prospects for Credit Union Field Examiners are expected to be good in the coming years due to increasing regulatory requirements and the need for qualified examiners.