Are you a seasoned Credit Union Manager seeking a new career path? Discover our professionally built Credit Union Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

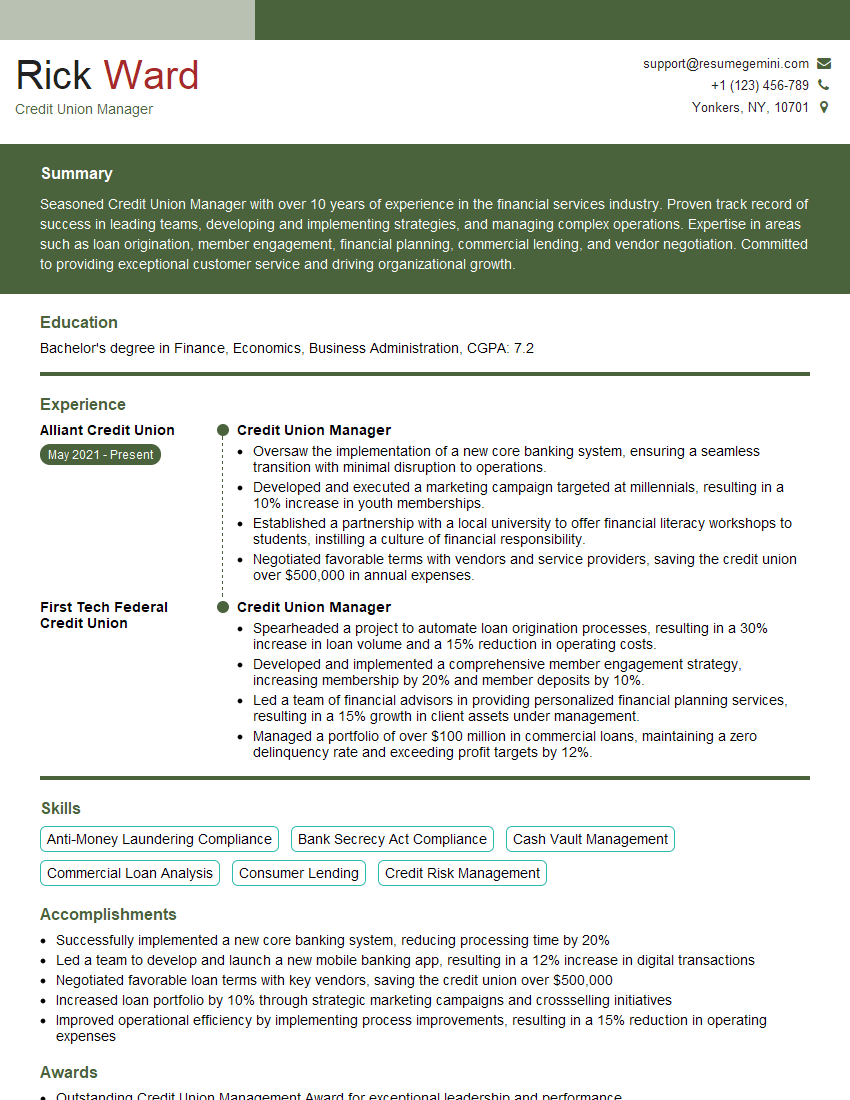

Rick Ward

Credit Union Manager

Summary

Seasoned Credit Union Manager with over 10 years of experience in the financial services industry. Proven track record of success in leading teams, developing and implementing strategies, and managing complex operations. Expertise in areas such as loan origination, member engagement, financial planning, commercial lending, and vendor negotiation. Committed to providing exceptional customer service and driving organizational growth.

Education

Bachelor’s degree in Finance, Economics, Business Administration

April 2017

Skills

- Anti-Money Laundering Compliance

- Bank Secrecy Act Compliance

- Cash Vault Management

- Commercial Loan Analysis

- Consumer Lending

- Credit Risk Management

Work Experience

Credit Union Manager

- Oversaw the implementation of a new core banking system, ensuring a seamless transition with minimal disruption to operations.

- Developed and executed a marketing campaign targeted at millennials, resulting in a 10% increase in youth memberships.

- Established a partnership with a local university to offer financial literacy workshops to students, instilling a culture of financial responsibility.

- Negotiated favorable terms with vendors and service providers, saving the credit union over $500,000 in annual expenses.

Credit Union Manager

- Spearheaded a project to automate loan origination processes, resulting in a 30% increase in loan volume and a 15% reduction in operating costs.

- Developed and implemented a comprehensive member engagement strategy, increasing membership by 20% and member deposits by 10%.

- Led a team of financial advisors in providing personalized financial planning services, resulting in a 15% growth in client assets under management.

- Managed a portfolio of over $100 million in commercial loans, maintaining a zero delinquency rate and exceeding profit targets by 12%.

Accomplishments

- Successfully implemented a new core banking system, reducing processing time by 20%

- Led a team to develop and launch a new mobile banking app, resulting in a 12% increase in digital transactions

- Negotiated favorable loan terms with key vendors, saving the credit union over $500,000

- Increased loan portfolio by 10% through strategic marketing campaigns and crossselling initiatives

- Improved operational efficiency by implementing process improvements, resulting in a 15% reduction in operating expenses

Awards

- Outstanding Credit Union Management Award for exceptional leadership and performance

- Recognized as Top Credit Union Manager for exceeding growth targets by 15%

- Excellence in Regulatory Compliance Award for maintaining impeccable compliance standards

- Financial Literacy Champion Award for developing innovative educational programs

Certificates

- Certified Credit Union Executive (CCUE)

- Certified Community Development Financial Institution Professional (CCDFIP)

- Certified Financial Crimes Specialist (CFCS)

- Certified Information Security Manager (CISM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Union Manager

- Highlight your experience in managing and leading teams in the financial services industry.

- Quantify your accomplishments with specific metrics and results whenever possible.

- Showcase your expertise in loan origination, member engagement, and financial planning.

- Demonstrate your commitment to customer service and organizational growth.

- Proofread your resume carefully for any errors before submitting it.

Essential Experience Highlights for a Strong Credit Union Manager Resume

- Lead and manage a team of financial professionals to achieve departmental goals and objectives.

- Develop and execute strategic plans to increase membership, deposits, and loan volume.

- Oversee all aspects of loan origination, including underwriting, approvals, and closings.

- Provide financial planning advice to clients and manage investment portfolios.

- Manage a portfolio of commercial loans and ensure compliance with all regulatory requirements.

- Collaborate with other departments to ensure seamless operations and customer satisfaction.

- Stay abreast of industry trends and best practices to maintain a competitive advantage.

Frequently Asked Questions (FAQ’s) For Credit Union Manager

What are the key skills required for a Credit Union Manager?

Key skills include leadership, financial analysis, loan origination, member engagement, financial planning, and vendor negotiation.

What is the average salary for a Credit Union Manager?

The average salary for a Credit Union Manager in the United States is around $100,000 per year.

What are the career prospects for a Credit Union Manager?

Credit Union Managers can advance to senior management positions within the credit union or pursue opportunities in other financial institutions.

What is the difference between a Credit Union Manager and a Bank Manager?

Credit unions are not-for-profit organizations owned by their members, while banks are for-profit institutions. Credit Union Managers are responsible for managing the day-to-day operations of a credit union, while Bank Managers are responsible for managing the day-to-day operations of a bank branch.

What are the challenges facing Credit Union Managers?

Challenges facing Credit Union Managers include increasing competition from banks and other financial institutions, the need to attract and retain members, and the need to comply with regulatory requirements.

What are the benefits of working as a Credit Union Manager?

Benefits of working as a Credit Union Manager include the opportunity to make a difference in the community, the opportunity to work in a collaborative environment, and the opportunity to earn a competitive salary.

What is the job outlook for Credit Union Managers?

The job outlook for Credit Union Managers is expected to be good over the next few years, as credit unions continue to grow in popularity.