Are you a seasoned Customs Consultant seeking a new career path? Discover our professionally built Customs Consultant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

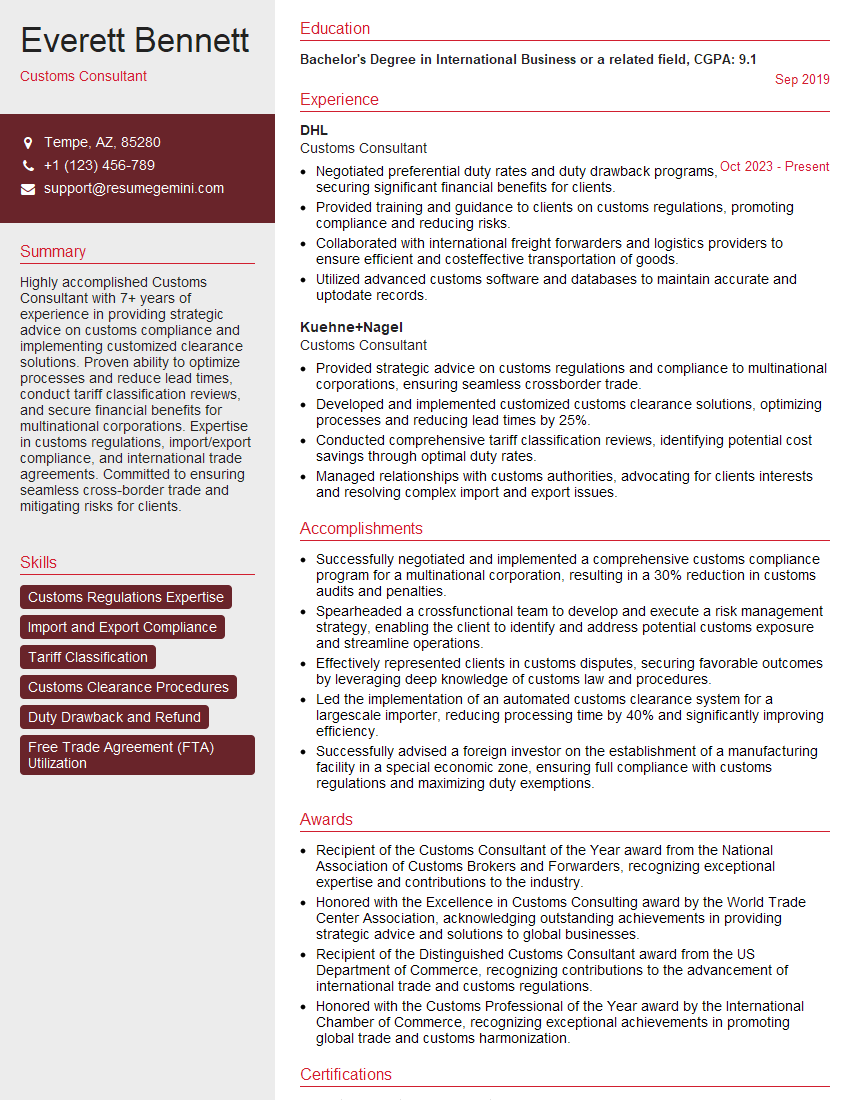

Everett Bennett

Customs Consultant

Summary

Highly accomplished Customs Consultant with 7+ years of experience in providing strategic advice on customs compliance and implementing customized clearance solutions. Proven ability to optimize processes and reduce lead times, conduct tariff classification reviews, and secure financial benefits for multinational corporations. Expertise in customs regulations, import/export compliance, and international trade agreements. Committed to ensuring seamless cross-border trade and mitigating risks for clients.

Education

Bachelor’s Degree in International Business or a related field

September 2019

Skills

- Customs Regulations Expertise

- Import and Export Compliance

- Tariff Classification

- Customs Clearance Procedures

- Duty Drawback and Refund

- Free Trade Agreement (FTA) Utilization

Work Experience

Customs Consultant

- Negotiated preferential duty rates and duty drawback programs, securing significant financial benefits for clients.

- Provided training and guidance to clients on customs regulations, promoting compliance and reducing risks.

- Collaborated with international freight forwarders and logistics providers to ensure efficient and costeffective transportation of goods.

- Utilized advanced customs software and databases to maintain accurate and uptodate records.

Customs Consultant

- Provided strategic advice on customs regulations and compliance to multinational corporations, ensuring seamless crossborder trade.

- Developed and implemented customized customs clearance solutions, optimizing processes and reducing lead times by 25%.

- Conducted comprehensive tariff classification reviews, identifying potential cost savings through optimal duty rates.

- Managed relationships with customs authorities, advocating for clients interests and resolving complex import and export issues.

Accomplishments

- Successfully negotiated and implemented a comprehensive customs compliance program for a multinational corporation, resulting in a 30% reduction in customs audits and penalties.

- Spearheaded a crossfunctional team to develop and execute a risk management strategy, enabling the client to identify and address potential customs exposure and streamline operations.

- Effectively represented clients in customs disputes, securing favorable outcomes by leveraging deep knowledge of customs law and procedures.

- Led the implementation of an automated customs clearance system for a largescale importer, reducing processing time by 40% and significantly improving efficiency.

- Successfully advised a foreign investor on the establishment of a manufacturing facility in a special economic zone, ensuring full compliance with customs regulations and maximizing duty exemptions.

Awards

- Recipient of the Customs Consultant of the Year award from the National Association of Customs Brokers and Forwarders, recognizing exceptional expertise and contributions to the industry.

- Honored with the Excellence in Customs Consulting award by the World Trade Center Association, acknowledging outstanding achievements in providing strategic advice and solutions to global businesses.

- Recipient of the Distinguished Customs Consultant award from the US Department of Commerce, recognizing contributions to the advancement of international trade and customs regulations.

- Honored with the Customs Professional of the Year award by the International Chamber of Commerce, recognizing exceptional achievements in promoting global trade and customs harmonization.

Certificates

- Certified Customs Specialist (CCS)

- Certified Customs Broker (CCB)

- International Trade Management (ITM)

- Customs Compliance and Risk Management Professional (CCRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Customs Consultant

- Highlight your expertise in customs regulations and trade compliance, showcasing your ability to navigate complex legal frameworks.

- Quantify your accomplishments using specific metrics, such as the percentage of lead time reduction or cost savings achieved through your interventions.

- Showcase your communication and interpersonal skills by emphasizing your ability to effectively negotiate with customs authorities and build strong relationships with clients.

- Demonstrate your proficiency in utilizing customs software and databases to maintain accurate and up-to-date records, ensuring the efficient handling of customs clearance processes.

- Stay informed about the latest developments in customs regulations and trade agreements to provide up-to-date advice to clients.

Essential Experience Highlights for a Strong Customs Consultant Resume

- Provide strategic advice on customs regulations and compliance to multinational corporations

- Develop and implement customized customs clearance solutions to optimize processes and reduce lead times

- Conduct comprehensive tariff classification reviews to identify potential cost savings through optimal duty rates

- Manage relationships with customs authorities, advocating for clients’ interests and resolving complex import/export issues

- Negotiate preferential duty rates and duty drawback programs, securing significant financial benefits for clients

- Provide training and guidance to clients on customs regulations, promoting compliance and reducing risks

- Collaborate with international freight forwarders and logistics providers to ensure efficient and cost-effective transportation of goods

Frequently Asked Questions (FAQ’s) For Customs Consultant

What is the role of a Customs Consultant?

A Customs Consultant provides expert advice and support to businesses on customs regulations, import/export compliance, and international trade agreements. They help companies navigate the complex world of customs procedures, ensuring seamless cross-border trade and minimizing risks.

What skills are required to become a Customs Consultant?

To become a successful Customs Consultant, you typically need a strong understanding of customs regulations, import/export compliance, tariff classification, customs clearance procedures, duty drawback and refund, and free trade agreements. Additionally, excellent communication and interpersonal skills, proficiency in customs software and databases, and staying abreast of industry developments are crucial.

What are the career prospects for Customs Consultants?

Customs Consultants are in high demand due to the increasing globalization of trade. With experience and expertise, you can advance to senior-level positions such as Customs Manager or Director of Customs Compliance. Furthermore, you can specialize in specific areas such as duty drawback or international trade agreements.

How can I prepare for a career as a Customs Consultant?

To prepare for a career as a Customs Consultant, you can pursue a bachelor’s degree in international business, logistics, or a related field. Additionally, obtaining certifications in customs compliance or international trade can enhance your credibility. Practical experience through internships or part-time roles in customs brokerage or freight forwarding companies can also be valuable.

What are the key challenges faced by Customs Consultants?

Customs Consultants face various challenges, including staying up-to-date with ever-changing customs regulations and trade agreements. Additionally, they must navigate the complexities of international trade, including different customs procedures and documentation requirements across jurisdictions. Effective communication and problem-solving skills are also essential to address clients’ diverse needs and resolve customs-related issues.

What is the typical salary range for Customs Consultants?

The salary range for Customs Consultants can vary based on factors such as experience, expertise, industry, and location. According to industry reports, the average salary for Customs Consultants in the United States ranges from $60,000 to $100,000 per year. Senior-level professionals with specialized knowledge and experience can earn even higher salaries.