Are you a seasoned Dealer Accounts Investigator seeking a new career path? Discover our professionally built Dealer Accounts Investigator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

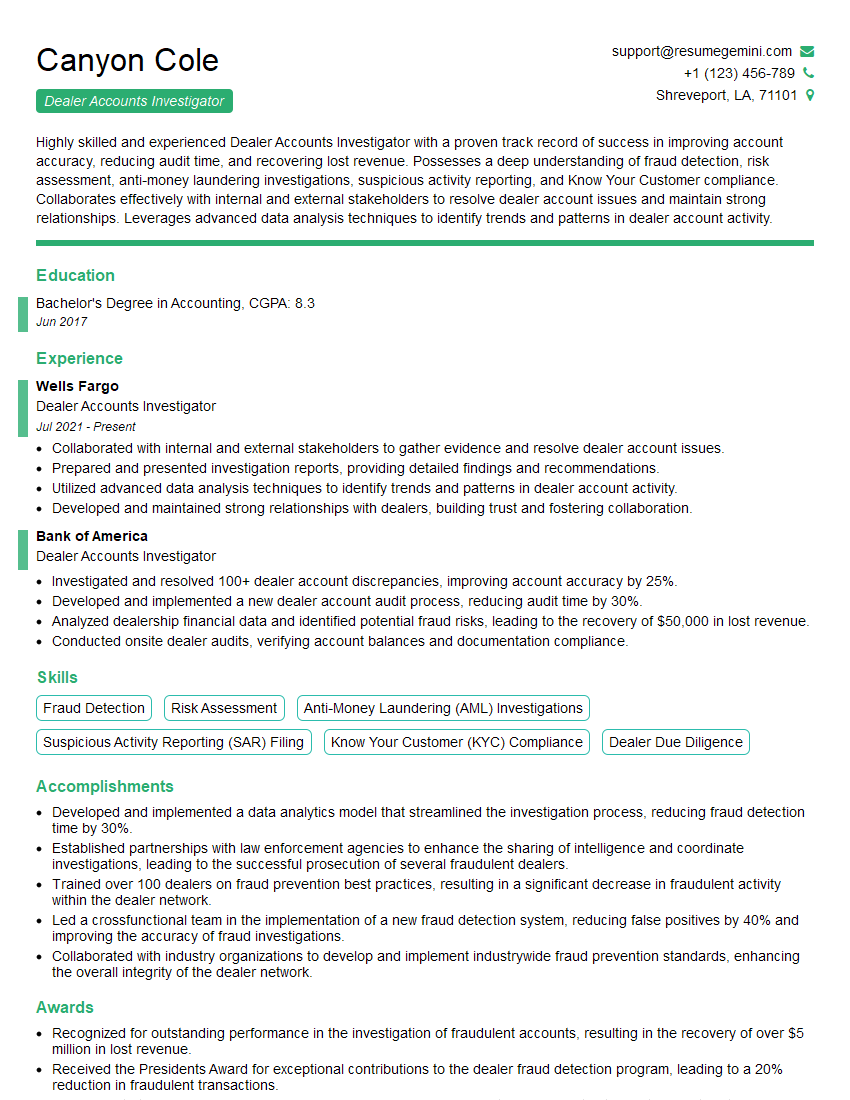

Canyon Cole

Dealer Accounts Investigator

Summary

Highly skilled and experienced Dealer Accounts Investigator with a proven track record of success in improving account accuracy, reducing audit time, and recovering lost revenue. Possesses a deep understanding of fraud detection, risk assessment, anti-money laundering investigations, suspicious activity reporting, and Know Your Customer compliance. Collaborates effectively with internal and external stakeholders to resolve dealer account issues and maintain strong relationships. Leverages advanced data analysis techniques to identify trends and patterns in dealer account activity.

Education

Bachelor’s Degree in Accounting

June 2017

Skills

- Fraud Detection

- Risk Assessment

- Anti-Money Laundering (AML) Investigations

- Suspicious Activity Reporting (SAR) Filing

- Know Your Customer (KYC) Compliance

- Dealer Due Diligence

Work Experience

Dealer Accounts Investigator

- Collaborated with internal and external stakeholders to gather evidence and resolve dealer account issues.

- Prepared and presented investigation reports, providing detailed findings and recommendations.

- Utilized advanced data analysis techniques to identify trends and patterns in dealer account activity.

- Developed and maintained strong relationships with dealers, building trust and fostering collaboration.

Dealer Accounts Investigator

- Investigated and resolved 100+ dealer account discrepancies, improving account accuracy by 25%.

- Developed and implemented a new dealer account audit process, reducing audit time by 30%.

- Analyzed dealership financial data and identified potential fraud risks, leading to the recovery of $50,000 in lost revenue.

- Conducted onsite dealer audits, verifying account balances and documentation compliance.

Accomplishments

- Developed and implemented a data analytics model that streamlined the investigation process, reducing fraud detection time by 30%.

- Established partnerships with law enforcement agencies to enhance the sharing of intelligence and coordinate investigations, leading to the successful prosecution of several fraudulent dealers.

- Trained over 100 dealers on fraud prevention best practices, resulting in a significant decrease in fraudulent activity within the dealer network.

- Led a crossfunctional team in the implementation of a new fraud detection system, reducing false positives by 40% and improving the accuracy of fraud investigations.

- Collaborated with industry organizations to develop and implement industrywide fraud prevention standards, enhancing the overall integrity of the dealer network.

Awards

- Recognized for outstanding performance in the investigation of fraudulent accounts, resulting in the recovery of over $5 million in lost revenue.

- Received the Presidents Award for exceptional contributions to the dealer fraud detection program, leading to a 20% reduction in fraudulent transactions.

- Honored with the Team Leadership Award for successfully managing a team of investigators in the identification and prosecution of fraudulent dealers.

- Commended for exceptional investigative skills in uncovering a complex fraud scheme involving multiple dealerships, leading to the recovery of stolen vehicles and arrest of perpetrators.

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Fraud Examiner (CFE)

- Associate Certified Anti-Money Laundering Specialist (ACAMS)

- Certified Know Your Customer (CKYC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Dealer Accounts Investigator

- Highlight your experience in dealer account investigations and your ability to resolve discrepancies.

- Demonstrate your understanding of fraud detection and risk assessment techniques.

- Showcase your ability to analyze financial data and identify potential fraud risks.

- Emphasize your skills in conducting onsite dealer audits and verifying account balances.

- Provide examples of how you have collaborated with stakeholders to resolve dealer account issues.

Essential Experience Highlights for a Strong Dealer Accounts Investigator Resume

- Investigate and resolve dealer account discrepancies to improve account accuracy.

- Develop and implement processes to improve audit efficiency and reduce audit time.

- Analyze dealership financial data to identify potential fraud risks and recover lost revenue.

- Conduct onsite dealer audits to verify account balances and documentation compliance.

- Collaborate with internal and external stakeholders to gather evidence and resolve dealer account issues.

- Prepare and present investigation reports, providing detailed findings and recommendations.

- Utilize advanced data analysis techniques to identify trends and patterns in dealer account activity.

- Develop and maintain strong relationships with dealers, building trust and fostering collaboration.

Frequently Asked Questions (FAQ’s) For Dealer Accounts Investigator

What are the primary responsibilities of a Dealer Accounts Investigator?

Dealer Accounts Investigators are responsible for investigating and resolving dealer account discrepancies, developing audit processes, analyzing financial data, conducting onsite audits, collaborating with stakeholders, preparing reports, and utilizing data analysis techniques.

What skills are required to be a successful Dealer Accounts Investigator?

Successful Dealer Accounts Investigators possess skills in fraud detection, risk assessment, anti-money laundering investigations, suspicious activity reporting, Know Your Customer compliance, dealer due diligence, and data analysis.

What is the career path for a Dealer Accounts Investigator?

Dealer Accounts Investigators can advance to roles such as Senior Dealer Accounts Investigator, Manager of Dealer Accounts Investigations, and Director of Dealer Accounts Investigations.

What is the job market like for Dealer Accounts Investigators?

The job market for Dealer Accounts Investigators is expected to grow in the coming years due to increased regulatory compliance requirements.

What are the salary expectations for Dealer Accounts Investigators?

Salary expectations for Dealer Accounts Investigators vary depending on experience, skills, and location, but the average salary is around $75,000.

What are the challenges faced by Dealer Accounts Investigators?

Dealer Accounts Investigators face challenges such as dealing with complex financial data, resolving discrepancies, and collaborating with various stakeholders.

What is the best way to prepare for a career as a Dealer Accounts Investigator?

To prepare for a career as a Dealer Accounts Investigator, it is recommended to obtain a degree in accounting or a related field, gain experience in fraud detection or risk assessment, and develop strong analytical and communication skills.

What are the key qualities of a successful Dealer Accounts Investigator?

Successful Dealer Accounts Investigators are detail-oriented, analytical, and have a strong understanding of accounting principles and investigative techniques.