Are you a seasoned Debt and Budget Counselor seeking a new career path? Discover our professionally built Debt and Budget Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

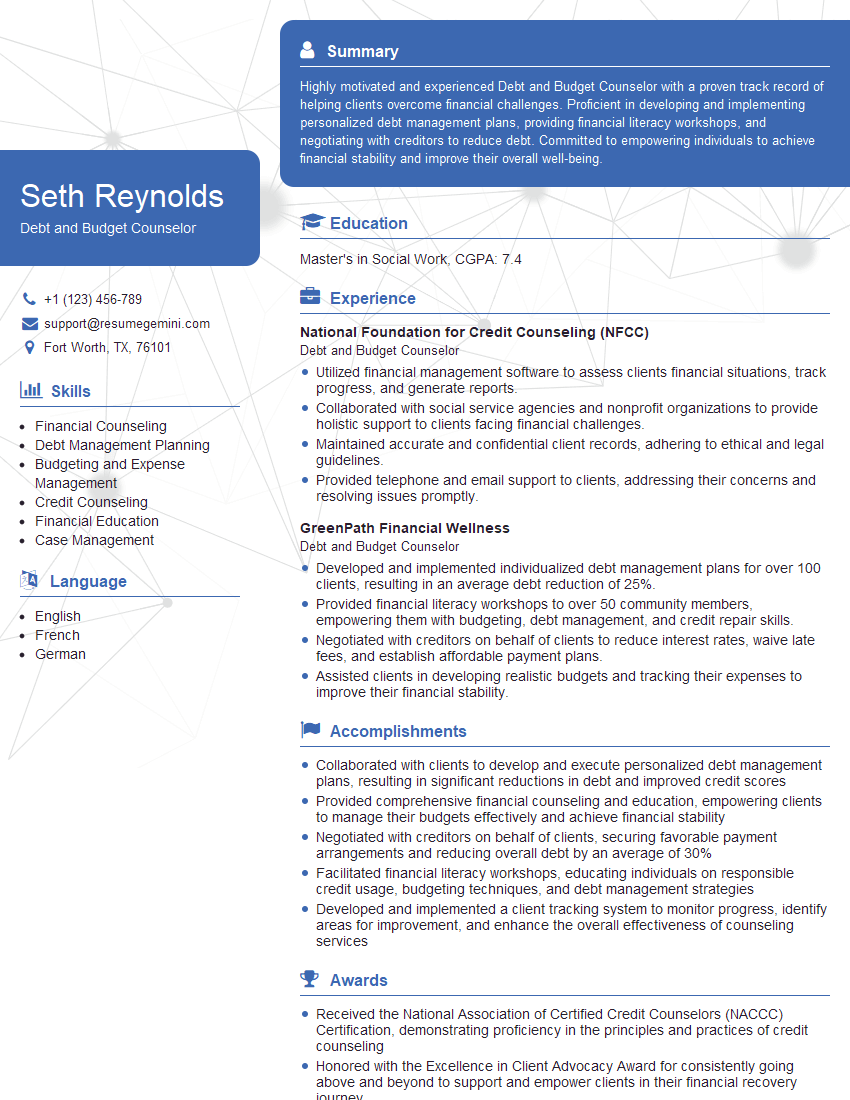

Seth Reynolds

Debt and Budget Counselor

Summary

Highly motivated and experienced Debt and Budget Counselor with a proven track record of helping clients overcome financial challenges. Proficient in developing and implementing personalized debt management plans, providing financial literacy workshops, and negotiating with creditors to reduce debt. Committed to empowering individuals to achieve financial stability and improve their overall well-being.

Education

Master’s in Social Work

February 2019

Skills

- Financial Counseling

- Debt Management Planning

- Budgeting and Expense Management

- Credit Counseling

- Financial Education

- Case Management

Work Experience

Debt and Budget Counselor

- Utilized financial management software to assess clients financial situations, track progress, and generate reports.

- Collaborated with social service agencies and nonprofit organizations to provide holistic support to clients facing financial challenges.

- Maintained accurate and confidential client records, adhering to ethical and legal guidelines.

- Provided telephone and email support to clients, addressing their concerns and resolving issues promptly.

Debt and Budget Counselor

- Developed and implemented individualized debt management plans for over 100 clients, resulting in an average debt reduction of 25%.

- Provided financial literacy workshops to over 50 community members, empowering them with budgeting, debt management, and credit repair skills.

- Negotiated with creditors on behalf of clients to reduce interest rates, waive late fees, and establish affordable payment plans.

- Assisted clients in developing realistic budgets and tracking their expenses to improve their financial stability.

Accomplishments

- Collaborated with clients to develop and execute personalized debt management plans, resulting in significant reductions in debt and improved credit scores

- Provided comprehensive financial counseling and education, empowering clients to manage their budgets effectively and achieve financial stability

- Negotiated with creditors on behalf of clients, securing favorable payment arrangements and reducing overall debt by an average of 30%

- Facilitated financial literacy workshops, educating individuals on responsible credit usage, budgeting techniques, and debt management strategies

- Developed and implemented a client tracking system to monitor progress, identify areas for improvement, and enhance the overall effectiveness of counseling services

Awards

- Received the National Association of Certified Credit Counselors (NACCC) Certification, demonstrating proficiency in the principles and practices of credit counseling

- Honored with the Excellence in Client Advocacy Award for consistently going above and beyond to support and empower clients in their financial recovery journey

- Recognized with the Top 10% Client Satisfaction Award based on exceptional client feedback and positive outcomes achieved

- Certified Debt Relief Specialist, demonstrating expertise in assisting clients with exploring and navigating debt relief options

Certificates

- Certified Financial Planner (CFP)

- Certified Debt Management Professional (CDMP)

- Certified Personal Finance Counselor (CPFC)

- National Financial Capability Certification (NFCC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Debt and Budget Counselor

- Quantify your accomplishments with specific numbers and metrics.

- Highlight your skills in financial counseling, debt management, and budgeting.

- Emphasize your ability to build rapport with clients and provide empathetic support.

- Showcase your knowledge of financial regulations and industry best practices.

- Consider obtaining a certification in debt counseling to demonstrate your expertise.

Essential Experience Highlights for a Strong Debt and Budget Counselor Resume

- Conduct comprehensive financial assessments to determine clients’ financial situation and identify areas of concern.

- Develop and implement individualized debt management plans to help clients reduce debt, improve their credit scores, and achieve financial goals.

- Negotiate with creditors to reduce interest rates, waive late fees, and establish affordable payment plans.

- Provide financial literacy workshops to educate clients on budgeting, debt management, and credit repair.

- Assist clients in developing realistic budgets and tracking their expenses to promote financial discipline and accountability.

- Collaborate with social service agencies and non-profit organizations to provide holistic support to clients facing financial difficulties.

- Maintain accurate and confidential client records in accordance with ethical and legal guidelines.

Frequently Asked Questions (FAQ’s) For Debt and Budget Counselor

What are the primary responsibilities of a Debt and Budget Counselor?

Debt and Budget Counselors help individuals overcome financial challenges by assessing their financial situation, developing personalized debt management plans, providing financial literacy education, and negotiating with creditors to reduce debt.

What qualifications are required to become a Debt and Budget Counselor?

Most Debt and Budget Counselors have a bachelor’s or master’s degree in social work, counseling, or a related field, along with experience in financial counseling or a related area.

What are the career prospects for Debt and Budget Counselors?

Debt and Budget Counselors are in high demand due to the growing need for financial assistance. With experience, they can advance to leadership roles or specialize in areas such as credit counseling or housing counseling.

What is the average salary for a Debt and Budget Counselor?

According to the U.S. Bureau of Labor Statistics, the median annual salary for Budget and Credit Counseling Clerks was $56,260 in May 2021.

What are the key skills required for a Debt and Budget Counselor?

Key skills include strong communication and interpersonal skills, proficiency in financial counseling techniques, knowledge of financial regulations, and the ability to work independently and as part of a team.

What are the benefits of working as a Debt and Budget Counselor?

Debt and Budget Counselors have the opportunity to make a positive impact on the lives of individuals by helping them overcome financial challenges and improve their overall well-being.

How can I find a job as a Debt and Budget Counselor?

You can find job openings for Debt and Budget Counselors through online job boards, staffing agencies, and the websites of non-profit organizations and financial institutions.